GROWTHACES.COM Forex Trading Strategies

Taken Positions:

USD/CAD: short at 1.3195, target 1.2850, profit locked in at 1.3120, risk factor **

AUD/USD: long at 0.7105, target 0.7300, profit locked in at 0.7145, risk factor **

Pending Orders:

AUD/NZD: buy at 1.0690, target 1.0990, stop-loss 1.0570, risk factor **

AUD/JPY: buy at 86.00, target 88.00, stop-loss 85.00, risk factor ***

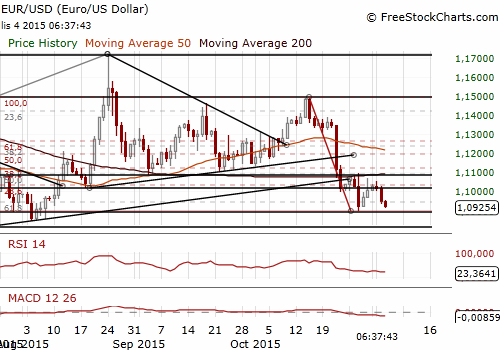

EUR/USD: Draghi Sticks To His Target Of Weaker EUR

- European Central Bank’s President Mario Draghi said: “Even though domestic demand remains resilient, concerns over growth prospects in emerging markets and other external factors are creating downside risks to the outlook for growth and inflation.” He reiterated that the degree of monetary policy accommodation would need to be re-examined at the Governing Council's December meeting. He said: “The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation.”

- We see that Draghi’s target is a weaker EURand he will do anything to get the EUR lower. Weaker EUR was the target of his dovish statement on October 22, when he goaded markets into pricing in easing expectations for December 3. Over the past week or so we have highlighted several key ECB board members that were all quoted well after the October 22 ECB saying much more data would need to be seen before deciding on any extensions to ECB QE or further negative rates. Comments from other ECB policymakers suggest that we may be quite far from additional easing. However, Mario Draghi has not changed his rhetoric despite hawkish shift by the Fed. He is still playing a dangerous game in terms of credibility with the markets.

- Final October Eurozone composite PMI came in at 53.9, weaker than an earlier estimate of 54.0 but above September's four-month low of 53.6. The survey suggests that the Eurozone quarterly growth rate remains constrained at around 0.4%.

- The Commerce Department said yesterday US new orders for manufactured goods declined 1.0% mom after a downwardly revised 2.1% mom drop in August. The manufacturing sector continues to struggle under the weight of a strong USD and deep spending cuts by energy companies. Factory activity is also being constrained by efforts by businesses to reduce an inventory overhang and tepid global demand. But the worst could be over for the sector after a report on Monday showed new orders rose in October for the first time since July.

- The Commerce Department also said orders for non-defense capital goods excluding aircraft, seen as a measure of business confidence and spending plans, slipped 0.1% instead of the 0.3% drop reported last month. This also supports the view that the worst of the manufacturing slump might be over. Shipments of these so-called core capital goods, which are used to calculate business equipment spending in the gross domestic product report, increased 0.5% mom in September as reported last month. Inventories of factory goods fell 0.4% mom after a similar drop in August, also an encouraging sign for the sector. That left the inventories-to-shipments ratio unchanged at a still lofty 1.35.

- The ADP employment report today (13:15 GMT) will be closely watched ahead of Friday's nonfarm payrolls for clues on whether the US is ready for its first hike in nearly a decade.

Significant technical analysis' levels:

Resistance: 1.1006 (10-dma), 1.1073 (high Oct 30), 1.1097 (high Oct 28)

Support: 1.0896 (low Oct 28), 1.0855 (low Aug 7), 1.0847 (low Aug 5)

Source: Growth Aces Profitable Forex Strategies