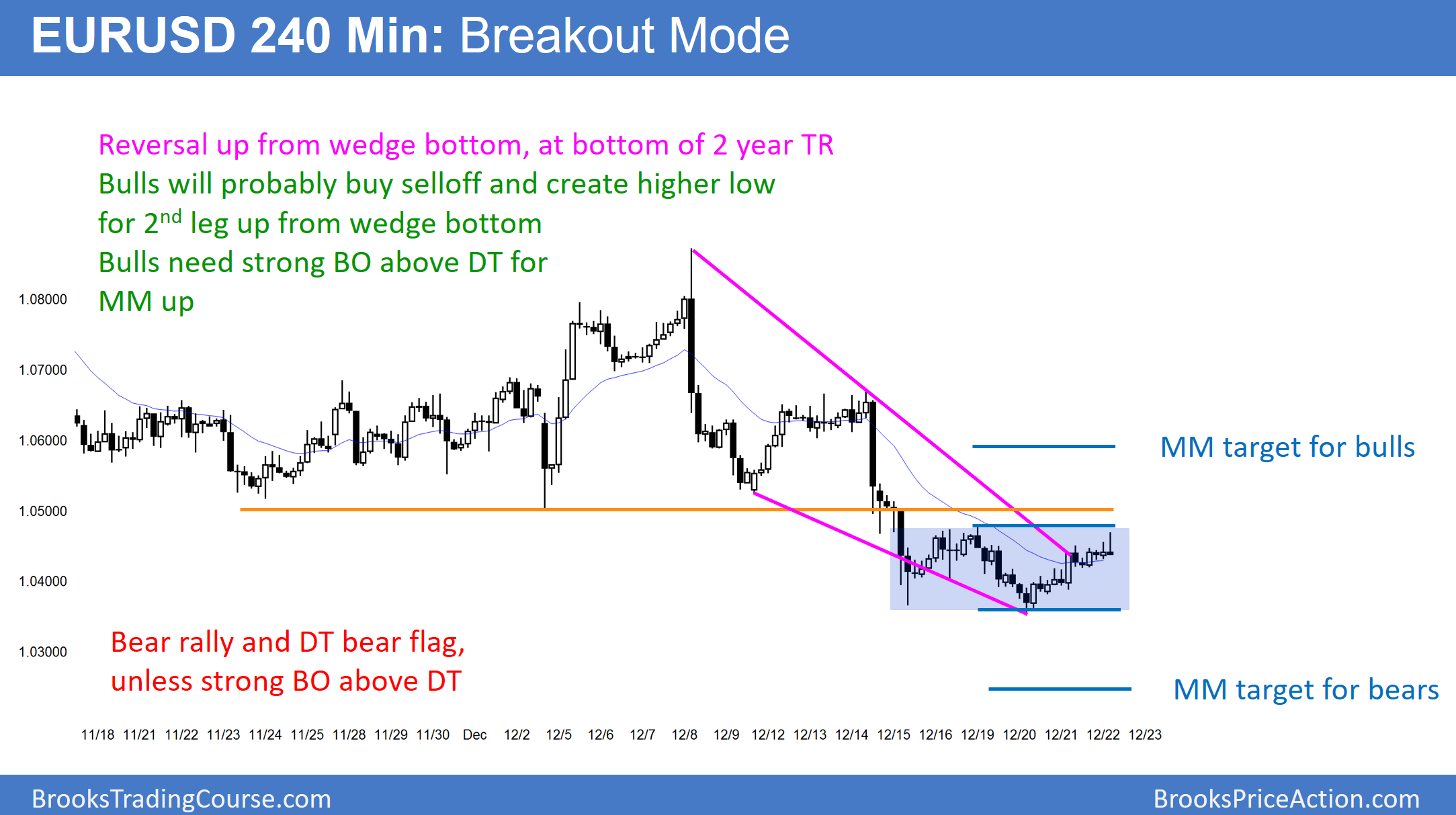

The EUR/USD 240-minute chart had a weak rally to last week’s lower high. This is a double top (DT) bear flag and the bears expect a measured move (MM) down. The bulls expect a higher low (HL) after the wedge bottom, and then a measured move up.

While the EUR/USD rallied 100 pips over the past 2 days, it is still in a bear trend on the daily chart. The bulls want the wedge bottom on the 240-minute chart to lead to a 2nd leg up after the 1st pullback. Yet, they need a strong breakout above major lower highs before traders will believe that the bear trend has successfully converted into a trading range. Until then, it is easier to make money selling rallies, or scalping for 10 pips on the 5-minute chart.

Overnight EUR/USD

The EUR/USD had a weak rally last night. Yet, it turned down from last week’s high. As a result, there is a double top bears flag on the 240-minute chart. Since there was a wedge bottom 2 days ago, the odds are that the bulls will buy the selloff. Therefore, they will probably get a higher low. However, they then need a breakout above the double top. Without it, the trading range will evolve into a triangle. Since the trend is strongly down on the daily chart, that would still be a bear flag.

Because the legs up and down have lacked consecutive big trend bars up or down, the odds are that the trading range price action will continue today. Day traders will therefore look for 10 pip scalps while waiting for a strong breakout.