Weekly

Lower lows and lower highs up until November where we had a technical higher low and just barely a higher high, but not higher than a more significant pivot (1.35).

Price weakened at resistance (on a bearish momentum divergence) after breaking through an overhead trend line and is now in a throwback process to that trend line. A bearish tone on the weekly can change a bit with a move over 1.33, and become even more bullish with a move through 1.35. Weakening may be seen with a breakdown of the underlying trend line which would also put it back under the overhead trend line.

We can also be prepared for the possibility of an inverse Head and Shoulders setting up, with the neckline (black line) taking place through the aforementioned resistance levels. The September 2012 momentum seems to have been digested constructively over these past 4-months.

Daily time frame

Perhaps a head and shoulders pattern. Damage could be done under 1.30. Would like to see the 3/10macd on this time frame at least turn green before getting more bullish (and we anticipate this turning green based on what the faster time frame is doing. Most recent bearish momentum was a reverse divergence (lower momentum low on a higher price high).

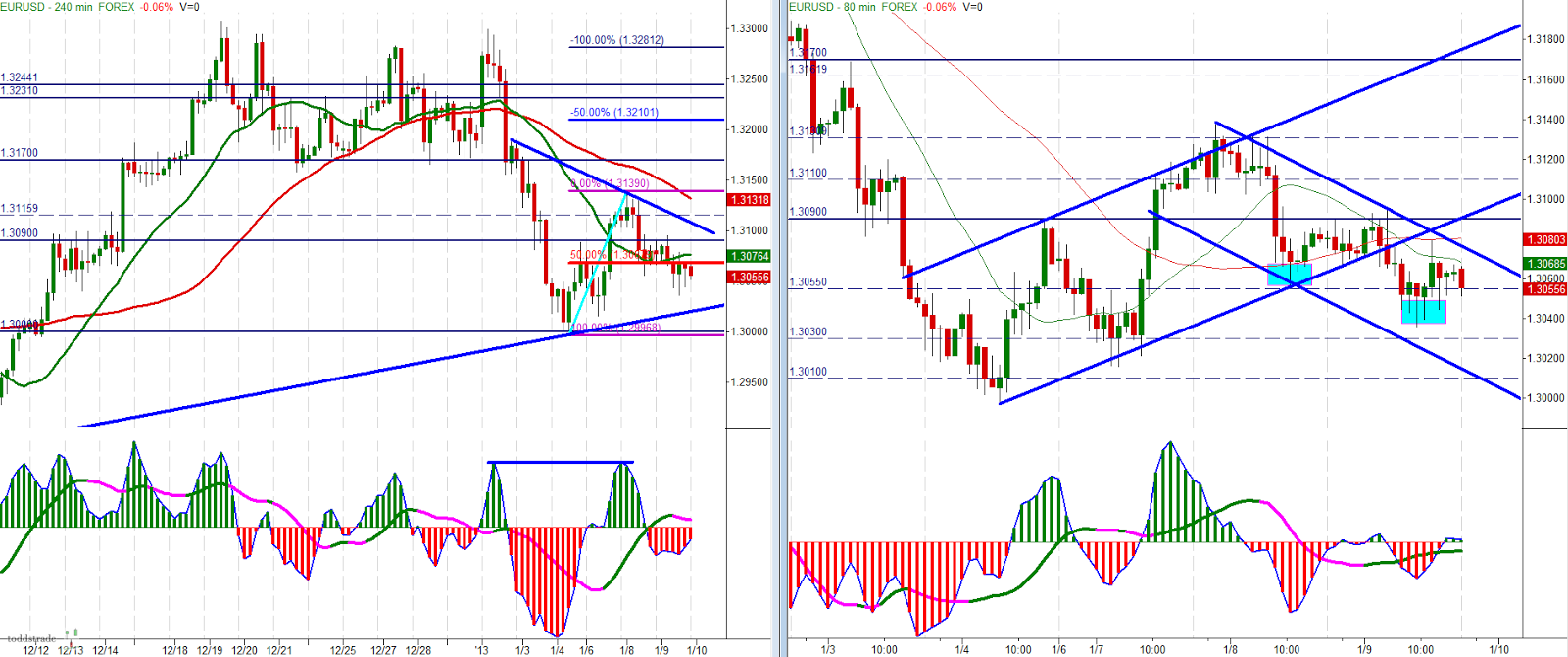

Anticipating the daily chart turning more bullish I'd like to see the 240min 3/10macd fast line turn green, and you can anticipate that happening by looking into an even faster time frame (and looking for fast line pullbacks into the slow line and continuation).

Anticipating the daily chart turning more bearish I'd like to see the 240-min 3/10macd fast line tick down from here, and we could anticipate that happening by looking into the even faster time frame (and looking for a bearish cross of the fast and slow lines).  EUR/USD - 240 Min" title="EUR/USD - 240 Min" width="1600" height="670">

EUR/USD - 240 Min" title="EUR/USD - 240 Min" width="1600" height="670">

At this point I would rather wait to buy after a three-push pattern completes and/or a break above the overhead trend line. I'd possibly look more bearish with the faster time frame having a fast line and slow line crossing with momentum taking out most recent lows (1.304s).