In the last 24 hours the Euro has been continuing to consolidate in a narrow trading range right around 1.2980 whilst bouncing off short term support just below at 1.2960. It has also become evident, especially on the 4 hourly chart below, that the 1.30 level is now providing some resistance and placing pressure on price. The Euro finished last week moving back down through the long term key level of 1.30. It did spend the last couple of weeks trading right around the 1.31 level and finding support and resistance at 1.30 and 1.32 respectively, however the former level has now been broken. In finishing last week below 1.30, it moved to levels not seen in over a month. Over the last month the 1.32 level has become quite significant and has been an obstacle to the Euro moving higher (evident in the right half of the daily chart below). During this time, it has had some times of little movement followed by sharp bursts.

A couple of weeks ago, the Euro exhibited a classic pin bar reversal candlestick pattern which was indicating the significant selling pressure it experienced at any price above the 1.32 level and likely lower prices to follow. This reinforced the significance of the 1.32 level and how it was going to take considerable effort to move through there. On this pin bar, it moved to near 1.325 and to its highest level in more than two months, since the end of February when it was falling heavily from up near 1.34. Just as quickly, it has fallen away and now moved down to the one month low below 1.30. Prior to that, it was quiet and spent the most part of two weeks ago trading within a narrow range between 1.30 and 1.31, which reinforced how significant this two cent range was. In the middle of April the Euro surged up towards 1.32 and ran into a wall of resistance at that level, to then be followed by a sharp fall back towards the then support level at 1.30.

Over the last month the Euro has done well to weather the storm through February and March which saw it fall sharply from around 1.37, although its decline over the last few days may be reversing this good fortune. Despite its strong rally in the first half of April, it was only a few weeks ago that the Euro dropped to its lowest level since the middle of November around 1.2750, so it did very well of late to move back strongly above 1.30, despite its recent lapse. The Euro has spent the best part of the last month consolidating above the key 1.30 and 1.29 levels after its decline throughout February. Over the last couple of weeks, the 1.30 level has been called upon again to prop up price, although it may have reversed roles now as it is providing some resistance to movement higher. Sentiment has completely changed with the Euro and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards levels not seen in over 12 months above 1.37 before falling very sharply to below 1.28 and setting a 14 week low a month ago.

The euro’s slide continues, as the continental currency has lost close to two cents against the dollar since Thursday. The US dollar improved after strong US employment numbers and a positive reading from the US Federal Budget. As well, remarks by ECB member Ignazio Visco that the ECB is considering negative deposit rates hurt the euro, as this would lead to the flow of funds out of the Eurozone. The ECB would be the first major central bank to adopt negative deposit rates. Supporters of the idea argue that it would boost lending to businesses and help increase economic activity in the struggling Eurozone.

EUR/USD May 12 at 22:55 GMT 1.2983 H: 1.2999 L: 1.2941

During the early hours of the Asian trading session on Tuesday, the Euro is continuing to consolidate in a narrow trading range right around 1.2980 whilst bouncing off support just below at 1.2960. Since the start of February, it has fallen sharply from new highs above 1.37, although it has experienced some strong rallies in that time trying to claw back lost ground. Current range: trading right around 1.2970.

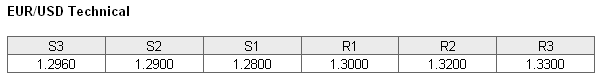

Further levels in both directions:

• Below: 1.2960, 1.2900 and 1.2800.

• Above: 1.3000, 1.32000 and 1.3300.

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has risen sharply in the last couple of days as the Euro has fallen back down below 1.30. The trader sentiment has shifted and is now in favour of long positions.

Economic Releases

- 09:00 EU Industrial production (Mar)

- 09:00 EU ZEW (Economic Sentiment) (May)

- 09:30 AU Treasurer Swan announces Federal Budget for 2013/14 Financial Year

- 12:30 US Import Price Index (Apr)