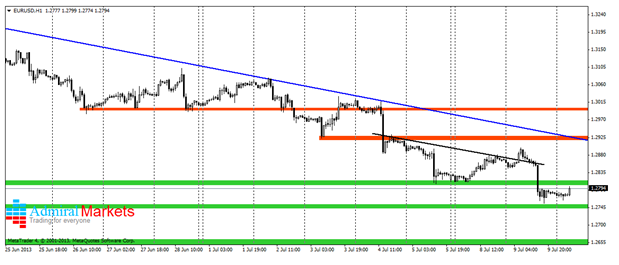

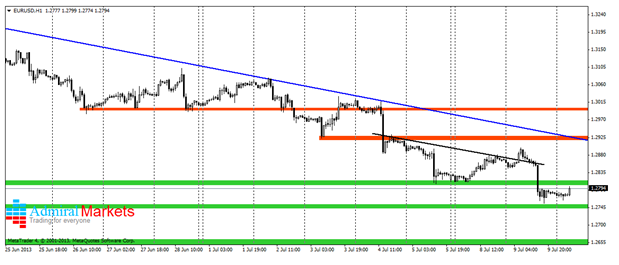

Bulls on EUR/USD missed their chance at the beginning of the European session yesterday. The price formed an inverted head and shoulders formation and buyers managed to break the black neck line. As we can see on the chart the breakout was false and after a few pips up, the price went down quite heavily. At the end of the European session sellers managed to push prices below recent supports, which can be considered as a major sell signal. 1.2810 currently is the closest resistance.

EUR/USD" title="EUR/USD" width="619" height="265" />

EUR/USD" title="EUR/USD" width="619" height="265" />

The price is above some very important support levels at the moment that have a historical significance. The first one is 1.2750 – the low from the end of March and the beginning of April. The second one is 1.2650 – the low from November 2011.

As a good chance for a bullish reversal was wasted, the only signal that is left on this pair is to stick to the short positions. Although strong historical supports can help bulls to at least stop the downswings for a couple of days.

EUR/USD" title="EUR/USD" width="619" height="265" />

EUR/USD" title="EUR/USD" width="619" height="265" />The price is above some very important support levels at the moment that have a historical significance. The first one is 1.2750 – the low from the end of March and the beginning of April. The second one is 1.2650 – the low from November 2011.

As a good chance for a bullish reversal was wasted, the only signal that is left on this pair is to stick to the short positions. Although strong historical supports can help bulls to at least stop the downswings for a couple of days.