GROWTHACES.COM Forex Trading Strategies

Taken Positions

AUD/USD: long at 0.7865, target 0.8080, stop-loss moved to 0.7865, risk factor **

EUR/GBP: long at 0.7240, target 0.7480, stop-loss 0.7195, risk factor **

EUR/JPY: long at 134.20, target 136.70, stop-loss 132.95, risk factor **

Pending Orders

EUR/USD: buy at 1.1080, if filled - target 1.1450, stop-loss 1.1020, risk factor **

GBP/USD: buy at 1.5320, if filled - target 1.5570, stop-loss 1.5195, risk factor **

USD/CHF: sell at 0.9375, if filled - target 0.9000, stop-loss 0.9445, risk factor **

USD/CAD: sell at 1.2170, if filled - target 1.1950, stop-loss 1.2280, risk factor ***

EUR/CAD: buy at 1.3430, if filled - target 1.3825, stop-loss 1.3330, risk factor **

GBP/JPY: buy at 183.50, if filled – target 186.50, stop-loss 182.30, risk factor **

CHF/JPY: buy at 127.80, if filled - target 133.00, stop-loss 126.80, risk factor **

AUD/NZD: buy at 1.0500, if filled – target 1.0780, stop-loss 1.0400, risk factor ***

AUD/JPY: buy at 94.20, if filled – target 97.00, stop-loss 93.40, risk factor ***

EUR/USD: Eurozone Finance Ministers Meet With Greece Today

(stop-loss hit, buy again at 1.1080)

- The Eurogroup of Eurozone finance ministers meets in Brussels today with Greece under pressure to reach a cash-for-reforms deal as it faces a EUR 750 million payment to the International Monetary Fund on Tuesday. French Finance Minister Michel Sapin said the meeting of finance ministers would be important but not decisive. He added a few more days or weeks were needed to reach a deal. He said he had no doubt on the political will on both sides and no worries over whether a deal would be reached eventually.

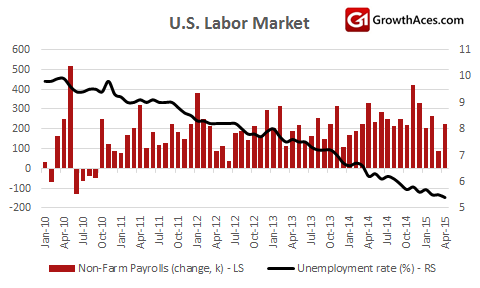

- Friday’s data showed U.S. employers added 223k jobs in April. There was a broad-based acceleration in job growth in April, with the exception of the mining sector, where a plunge in crude oil prices has undercut energy production.

- March's already-tepid job gain was revised sharply lower, to just 85k from 126k. In the past three months, employers have added 191k positions, a decent gain but down from last year's average of 260k. Unemployment rate fell to 5.4% from 5.5% in March. That is the lowest level since May 2008. Average hourly wages in April rose just 2.2% yoy.

- The U.S. non-farm payrolls numbers showed a rebound in April, but a significant downward revision to the March figure, and weaker-than expected wage growth supported bets that the Fed will not begin hiking later rather than sooner.

- The EUR/USD slipped on Monday, as many investors took a pessimistic view of the latest round of Eurozone talks on a cash-for-reform deal for Greece. Our long EUR/USD position hit the stop-loss level at 1.1135.

- In our opinion EUR weakness is temporary and there is a scope for further gains to the 1.1534, high on February 3 in the medium term. We expect the EUR/USD to come back to gains, but at a slower pace than it has been observed recently. We have placed our buy order at 1.1080, above the very strong support area near 1.1050.

Significant technical analysis' levels:

Resistance: 1.1206 (session high May 11), 1.1228 (100-dma), 1.1290 (high May 8)

Support: 1.1133 (session low May 11), 1.1100 (psychological level), 1.1067 (low May 5)

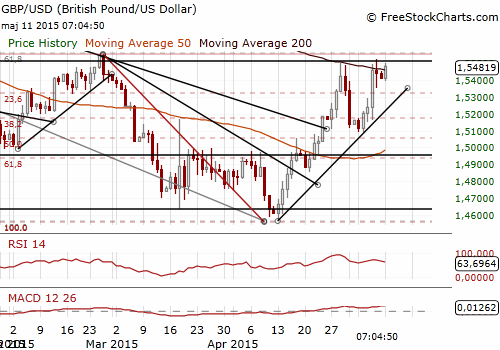

GBP/USD: Bank Of England Keeps Rates Steady

(buy at 1.5320)

- The Bank of England kept interest rates steady at a record-low 0.5% on Monday. The bank issued no statement but Governor Mark Carney will explain more on Wednesday, when he presents a quarterly update to the central bank's forecasts for growth and inflation.

- In February the BoE forecast it would take around two years for inflation to return to target, while growth would continue at an above-average pace of just under 3%, as the country makes up ground lost during the financial crisis. Since then, growth in the first three months of this year has come in weaker than the Bank expected at just 0.3%. The BoE is likely to cut its growth forecasts on Wednesday. On the other hand, BoE inflation report may point to higher CPI path. After all, oil price is now more than 15% higher since the previous inflation report was published.

- UK wages and jobless data are also due this week.

- We are hunting for lower levels to get long again on the GBP/USD. In our opinion the GBP/USD may rise to 1.5570 (38.2% of 1.7192-1.4567) soon. We maintain our buy order at 1.5320.

Significant technical analysis' levels:

Resistance: 1.5500 (psychological level), 1.5523 (high May 8), 1.5554 (high Feb 26)

Support: 1.5362 (hourly low May 8), 1.5294 (10-dma), 1.5240 (low May 8)

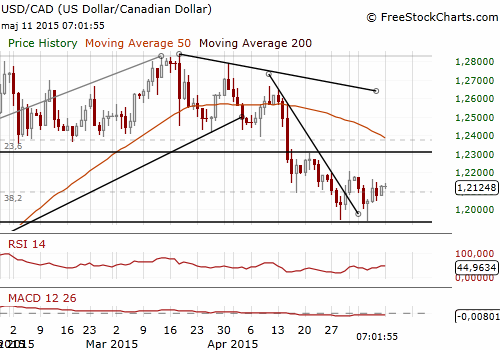

USD/CAD: The Loonie Has Potential To Rise In The Medium Term

(sell at 1.2170)

- Canada's economy shed a higher-than-expected 19.7k jobs in April. The unemployment rate remained unchanged at 6.8% in April.

- The employment number is stronger than the headline would suggest with solid gains in higher quality full-time employment of 46.9k jobs (previously -28.2k), while part-time employment lost 66.5k jobs (previously 56.8k). The participation rate was a tick lower at 65.8% from 65.9% in March. Annual hourly wage growth in April increased by 2.4%.

- There were fewer people working in construction, retail and wholesale trade, as well as in information, culture and recreation in April. At the same time, there were more people working in business, building and other support services as well as in manufacturing.

- Immediately after the U.S. and Canadian jobs data was released the loonie rallied to a session high of 1.2046 before retreating to a session low of 1.2145.

- The CAD has been one of the best performing currencies since beginning of April. The optimism about economic growth recently expressed by the Bank of Canada was also confirmed by an increased Ivey PMI last week. In our opinion the CAD has the upside potential that will emerge in the medium to longer term and gradually increasing oil prices should help the loonie. We maintain our sell order on the USD/CAD at 1.2170.

Significant technical analysis' levels:

Resistance: 1.2145 (high May 8), 1.2164 (high May 7), 1.2180 (high May 4)

Support: 1.2046 (low May 8), 1.2033 (low May 7), 1.1940 (low May 6)

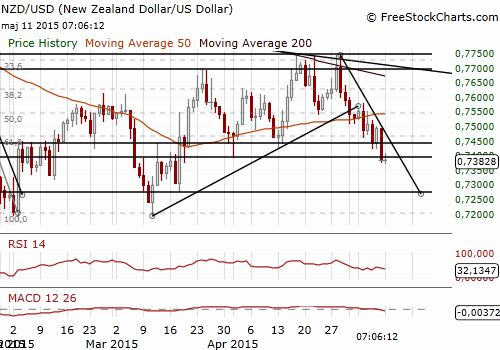

NZD/USD: The Odds For RBNZ Cut Are Rising

(we stay sideways)

- Statistics New Zealand announced that electronic retail card sales fell 0.7% April, the first decline in nine months, due to lower vehicle and durable goods sales. The fall was driven by a 6.3% drop in vehicle sales, their first decrease since September, while durables, including furniture, hardware and appliances, were down 1.2%.

- The NZD skidded to multi-week lows on weak sales data and growing speculation of an interest rate cut in coming months.

- The NZD was hit also by China a rate cut in China. The People's Bank of China said it was lowering its benchmark, one-year lending rate by 25 bps to 5.1% from May 11. The market is reading the China rate cut as further belated confirmation of weakness in the economy.

- We do not get any major macroeconomic releases this week. The bias remains for kiwi weakness. The odds for a rate cut by the RBNZ are rising. We stay sideways on the NZD/USD, but are looking to get long on the AUD/NZD.

Significant technical analysis' levels:

Resistance: 1.2145 (high May 8), 1.2164 (high May 7), 1.2180 (high May 4)

Support: 0.7372 (session low May 11), 0.7276 (low Mar 18), 0.7192 (low Mar 11)

Source: Growth Aces Forex Trading Strategies