Investing.com’s stocks of the week

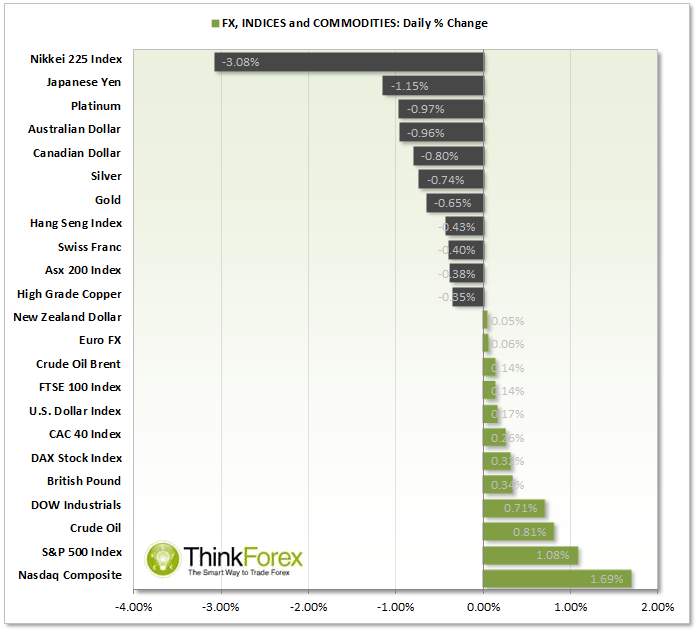

Market Snapshot:

AUD: New motor vehicles sales came in less at 1.7% vs 2.1% expected and is a reflection of consumer confidence.

CAD: Clearly still bearish but retracing slight against most majors. Trading at new lows against CHF

CHF: Retail sales are up later forecast at 2.3%, well above the previous month of 1.2%. The Swiss Franc has not had a great week, particularly in light of US Core Retails sales so we need a reading above forecast for it to be of any significance.

EUR: Trade Balance is forecast at 16.7bn with a higher reading generally being good for the Euro and measures the difference between imported and exported goods.

GBP: Recovering from recent losses and capitalising on AUD and NZD weakness.

NZD: Retracing after a positive bullish start to the year. NZDJPY broke to 12-month highs this week and currently retracing during Asia session.

USD: Looking strong against the majors with USDCAD back at record highs.

ECONOMY: The global economy appears it may be approaching a 'productivity crisis' as emerging economies and

For the first time since 2009 US Congress has agreed upon a spending deal to prevent another government shutdown.

INDICES: US Equities and Europe posted largest single day gains this year after positive Core Retail sales form the US.

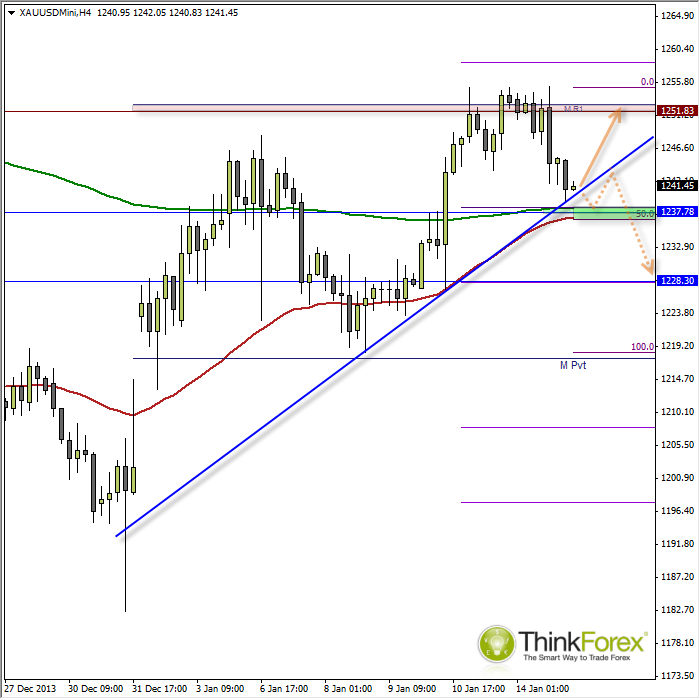

GOLD: Good support around 1237 - Another attempt to go higher?

Gold continued to push higher after the markets became risk averse but the precious yellow metal met its match around the 1250 resistance zone. We can see similar patterns across other metals markets as Copper, Silver and Platinum have all sold off from their yearly highs. However this is too soon to see if this is merely an initial retracement or the part of something much more significant.

Momentum on Platinum is particularly bullish and Gold is approaching a level of support I would expect to hold. The 200eMA (or 50eMA on the daily) along with the rising trendline and 50% Fibonacci may well be enough to hold temporarily at least, but my bias is for another attempt to get back up to the 1250.

How price reacts as it approaches this level may provide further clues. If we lose momentum before we get there then we could well begin to witness a 'lower high' being formed, which if fulfilled would open up the chances for the trendline to break and for bearish momentum to pick up pace.

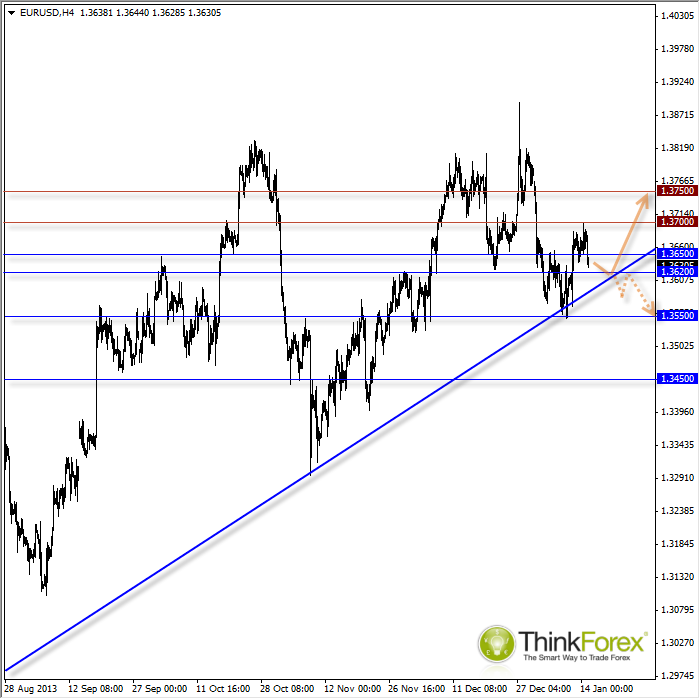

EUR/USD: Approaching primary trendline - fine line between bullish and bearish

Please view yesterday's report for a closer look at EURUSD. We have broken below the initial support zone and could well retrace towards the primary trendline. If we each it I would at the very least expect some volatility around this area with my bias being for another leg higher.

However more pips may be available if the trendline breaks as this would require a strong level of support to give way, which usually catches many out and fuels the fire for a larger subsequent move. EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="700" height="699">

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="700" height="699">