EUR/USD continues to have an uneventful week, as the pair trades at the 1.14 line on Thursday. On the release front, French CPI posted a sharp decline of 1.0%. Eurozone Current Account dipped to EUR 17.8 billion, well below expectations. In the US, there are two key releases on the calendar – Unemployment Claims and the Philly Fed Manufacturing Index. The markets are expecting stronger readings from both indicators.

Is an agreement in sight between Greece and its creditors? Eurozone finance ministers were unable to draft an agreement on Monday, but the finance ministers will try again on Friday. Greece has apparently requested an extension of the bailout, which expires next week. However, the details of the request are not clear, and the parties will likely conduct tough negotiations at the Friday meeting. The stakes are high, since if the bailout does not continue, Greece could be forced to leave the eurozone and abandon the euro.

On Thursday, the ECB takes a step aimed at improving transparency, as the central bank will publish a summary of its policy meeting for the first time. This should make for interesting reading, as the ECB decided to implement its QE program at its previous meeting. The publication of the minutes will bring the ECB in line with other central banks such as the Federal Reserve and the BOJ.

On Wednesday, the Federal Reserve released the minutes of its previous policy meeting. The minutes were decidedly dovish in nature, as Fed policymakers raised concerns that a mid-year rate hike could hurt the economic recovery. The Fed also said it was worried about the impact of global events on the US economy, such as the slowdown in China and the Greek financial crisis. With US inflation at low levels, the Fed is not in any rush to raise rates, so speculation of a mid-year rate may have been premature.

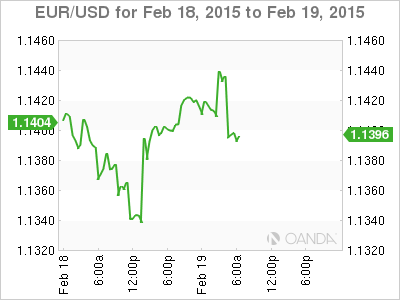

EUR/USD February 19 at 11:50 GMT

EUR/USD 1.1397 H: 1.1449 L: 1.1385

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1154 | 1.1231 | 1.1340 | 1.1426 | 1.1525 | 1.1634 |

- EUR/USD was flat in the Asian session. The pair pushed higher in the European session, testing resistance at 1.1426. However, the euro then gave up these gains.

- 1.1340 remains a weak support line. 1.1231 is stronger.

- On the downside, 1.1426 is under pressure. 1.1525 is stronger.

- Current range: 1.1340 to 1.1426

Further levels in both directions:

- Below: 1.1340, 1.1231, 1.1154, 1.1066 and 1.0909

- Above: 1.1426, 1.1525, 1.1634, 1.1754, 1.1802 and 1.1926

OANDA’s Open Positions Ratio

EUR/USD ratio is almost unchanged on Thursday. This is consistent with the lack of movement we’re seeing from the pair. The ratio has a majority of short positions, indicative of trader bias towards the euro moving lower.

EUR/USD Fundamentals

- 7:45 French CPI. Estimate -0.9%. Actual -1.0%.

- 9:00 Eurozone Current Account. Estimate 23.3B. Actual 17.8B.

- 9:43 Spanish 10-Year Bond Auction. Actual 1.62%.

- 12:30 ECB Monetary Policy Meeting Accounts.

- 13:30 US Unemployment Claims. Estimate 293K.

- 15:00 Eurozone Consumer Confidence. Estimate -8 points.

- 15:00 US Philly Fed Manufacturing Index. Estimate 8.8 points.

- 15:00 US CB Leading Index. Estimate 0.4%.

- 15:30 US Natural Gas Storage. Estimate -110B.

- 16:00 US Crude Oil Inventories. Estimate -1.8M.

- 16:30 German Buba President Jens Weidmann Speaks.