EUR/USD is showing little movement on Thursday, as the pair is trading at 1.1470 in the European session. There are no major releases out of the Eurozone today. It’s another busy day in the US, with the markets keeping a close eye on Unemployment Claims and CPI. We’ll also get a look at manufacturing data, with the markets expecting a second straight decline from the Philly Fed Manufacturing Index. US inflation numbers have not impressed and a weak CPI reading could further dampen expectations of a rate hike in the US before the end of the year.

The Fed minutes last week were a disappointment, as the Fed did not provide any indication of when it might raise rates. So the key question remains – will the Federal Reserve press the trigger and raise rates in 2015? The markets had circled September as a likely candidate for a rate hike, but the Federal Reserve remained on the sidelines yet again. The Fed released the minutes of its September policy meeting last week, and indicated that the Fed does not feel that the timing is appropriate for a rate hike, but provided few clues as to when the Fed might take action. Policymakers cited concerns that the sluggish global economy could affect the US economy.

If the Eurozone economy is to improve, Germany, the bloc’s largest economy, will have to improve. Recent German releases have not been encouraging. German ZEW Economic Sentiment in October was a disaster, as the key indicator fell to just 1.9 points, compared to 12.8 points a month earlier. The markets were braced for a drop, but had expected a stronger release of 6.8 points. This poor release comes on the heels of a disappointing manufacturing and trade balance numbers in August. These dismal numbers should not come as a surprise, keeping in mind that the German economy is heavily dependent on exports, and the country sends a larger proportion of exports to China, compared to other Eurozone countries. The Chinese slowdown shows no sign of improving anytime soon, and investors are nervous that a contraction in the German economy could quickly affect the rest of the bloc and send the fragile Eurozone economy into a tailspin. There was better news from the Eurozone ZEW Economic Sentiment, which slipped to 30.1 points in October, down from 33.3 points but matching the forecast.

EUR/USD Fundamentals

Thursday (Oct. 15)

- Tentative – Spanish 10-Year Bond Auction.

- 12:30 US CPI. Estimate -0.2%.

- 12:30 US Core CPI. Estimate 0.1%.

- 12:30 US Unemployment Claims. Estimate 269K.

- 12:30 US Empire State Manufacturing Index. Estimate -7.3 points.

- 14:00 US Philly Fed Manufacturing Index. Estimate -1.8 points.

- 14:30 Fed FOMC Member William Dudley Speaks.

- 14:30 US Natural Gas Storage. Estimate 92B.

- 15:00 US Crude Oil Inventories. Estimate 2.2M.

- 17:30 US Federal Budget Balance. Estimate 93.8B.

Upcoming Key Events

Friday (Oct. 16)

•9:00 Eurozone Final CPI. Estimate -0.1%.

•14:00 US Preliminary UoM Consumer Sentiment. Estimate 88.8 points.

•14:00 US JOLTS Job Openings. Estimate 5.77M.

*Key releases are highlighted in bold

*All release times are GMT

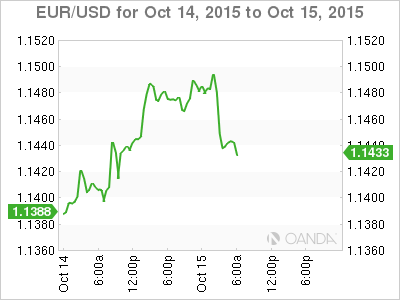

EUR/USD for Thursday, October 15, 2015

EUR/USD October 15 at 9:20 GMT

EUR/USD 1.1443 H: 1.1495 L: 1.1425

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1204 | 1.1296 | 1.1392 | 1.1470 | 1.1658 | 1.1712 |

- EUR/USD was steady in the Asian session and has posted slight losses in European trading.

- 1.1470 is an immediate resistance line.

- 1.1392 remains busy and is a weak support level.

- Current range: 1.1392 to 1.1470

Further levels in both directions:

- Below: 1.1392, 1.1296, 1.1214, 1.1105 and 1.1017

- Above: 1.1470, 1.1658, 1.1712 and 1.1871

OANDA’s Open Positions Ratio

EUR/USD ratio is not showing much movement on Thursday, as long positions retain a majority of the open positions (64%). This points to trader sentiment in favor of the dollar gaining ground against the euro.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.