EUR/USD is steady on Monday, as the pair trades just above the 1.10 level in the European session. The euro plunged about 330 late last week, as the markets reacted sharply to the ECB statement that it was considering further easing measures before the end of 2015. In Monday’s releases, German Ifo Business Climate came in at 108.1 points, very close to the estimate. In the US, the day’s only event is New Home Sales, with the markets expecting the indicator to slip to 546 thousand. We’ll get a look at two market-mover events on Tuesday in the US – Core Durable Goods Orders and CB Consumer Confidence.

It was Black Thursday for the euro, as strong hints that the ECB would take action in December was enough to spark a huge euro selloff. The continental currency dropped about 260 points, closing the day below 1.11 for the first time since mid-August. Further losses on Friday saw the euro dip briefly below the symbolic 1.10 level. The ECB didn’t actually announce new easing measures and held the benchmark rate at 0.05%, but said that a rate cut in December was a possibility, and that a cut to deposit rates (currently at -0.2%) was also discussed. As for quantitative easing (QE), which has been the ECB’s “weapon of choice” to kick-start the Eurozone’s sluggish economy, ECB head Mario Draghi said the program would continue in 2016 or beyond, if needed. Under the current QE program, the ECB is purchasing assets at the rate of EUR 60 billion/month. Any increase in QE levels would send interest rates lower and hence push down on the euro. This was underscored in March of this year, when the euro plunged to 10-year lows after the ECB introduced QE. The markets will now be on alert for further easing measures from the ECB, and any hints in this regard from Draghi or other ECB policymakers could send the euro tumbling yet again.

The German economy has shown some improvement in recent releases. German Ifo Business Climate, a key release, posted another strong reading in September, coming in at 108.1 points, which was very close to the estimate of 108.2 points. As well, October PMIs was generally positive. German Manufacturing PMI softened to 5.16 points, but this still points to expansion and was close to the forecast of 51.8 points. German Services PMI improved to 55.2 points, its best showing since February. This figure easily beat the estimate of 54.0 points. The Eurozone PMIs were a similar story, as the Manufacturing PMI of 52.0 nosed above the forecast of 51.8, while Services PMI came in at 55.2 points, above the estimate of 54.0 points.

US releases looked sharp on Thursday, as Unemployment Claims, a key release, came in at 259 thousand, beating the estimate of 266 thousand. This was slightly higher than the previous reading of 255 thousand, but marked the third straight week that the indicator beat the forecast. The four-week moving average of claims, which reduces the volatility of the weekly jobless reports, is currently at its lowest level since 1973. These figures point to a stronger labor market, but the next big test comes in early November, with the publication of Nonfarm Payrolls. Meanwhile, Existing Housing Sales had a banner September, improving to 5.55 million, crushing the estimate of 5.38 million. We’ll get a look at New Home Sales later on Monday.

Recent US data has not been has strong as hoped, with key numbers sending a mixed message about the health of the economy. This has reduced the likelihood of a rate hike by the Federal Reserve before the end of 2016. The markets remain frustrated about the Fed’s lack of communication with the markets, as FOMC members continue to send out contradictory messages about the Fed’s plans. Still, an improvement in US numbers, especially employment and consumer indicators, could quickly revive speculation about a rate hike and boost the US dollar. Stay tuned for a busy week, as the Federal Reserve issues a policy statement after its monthly meeting. This will be followed by the release of the Advance GDP report, a key event.

EUR/USD Fundamentals

Monday (Oct. 26)

- 9:00 German Ifo Business Climate. Estimate 108.1 points. Actual 108.2 points.

- Tentative German Buba Monthly Report.

- 14:00 US New Home Sales. Estimate 546K.

Upcoming Events

Tuesday (Oct. 26)

- 12:30 US Core Durable Goods Orders.

- 14:00 US CB Consumer Confidence.

*Key releases are highlighted in bold

*All release times are GMT

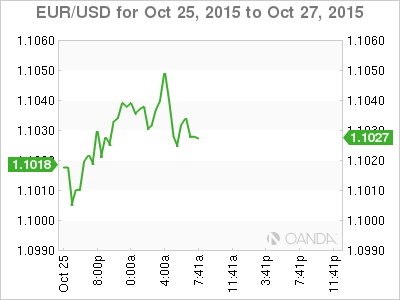

EUR/USD for Monday, October 26, 2015

EUR/USD October 26 at 10:20 GMT

EUR/USD 1.1018 H: 1.1056 L: 1.1015

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0847 | 1.0941 | 1.1017 | 1.1105 | 1.1214 | 1.1296 |

- EUR/USD has shown little movement in the Asian and European sessions.

- On the downside, 1.11017 is under strong pressure and could break during the day. 1.0941 is stronger.

- 1.1105 is an immediate resistance line.

- Current range: 1.1017 to 1.1105

Further levels in both directions:

- Below: 1.1017, 1.0941 and 1.0847

- Above: 1.1105, 1.1214, 1.1296 and 1.1392

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged on Monday. Long positions currently have a solid majority (55%), which points to trader bias in favor of the euro moving higher.