The euro continued to move higher against the US dollar on Thursday. EUR/USD climbed around one cent, capitalizing on a string of weak US releases. The pair is trading slightly above the 1.30 level in Friday’s European session. We can expect the pair to be active on Friday, with a host of releases from the Eurozone and the US. In economic news, the Eurozone posted some weak numbers, as German Retail Sales declined and the Italian and Eurozone Unemployment Rate hit new record highs. In the US, today’s highlights include inflation and consumer confidence releases.

Any hopes for a string of positive US releases evaporated on Thursday, with three key releases missing their estimates. Preliminary GDP improved to 2.4%, but missed the estimate of 2.5% Unemployment Claims shot up to 350 thousand, well above the estimate of 342 thousand. Pending Home Sales gained just 0.3%, well below the forecast of a 1.3% gain. These numbers point to weakness in the US economy, and raises questions about the extent of the US recovery. The US dollar was broadly lower courtesy of the bad news, and the euro gained about one cent on the day, pushed above the 1.30 level. The euro has enjoyed a late-week rally, climbing about 150 points since Wednesday.

Germany, dubbed the “locomotive of Europe”, has been having its problems, as economic releases continue to disappoint the markets. This is leading to rising concern about the health of the German economy. There was mixed news on Wednesday as Unemployment Change was awful. The key indicator shot up to 21 thousand, blowing past the estimate of 4 thousand. This was the indicator’s worst reading since June 2008. There was better news on the inflation front, as Preliminary CPI rebounded nicely and posted a 0.4% gain, beating the forecast of 0.2%. The week ended on a sour note as Retail Sales slumped, declining 0.4%. This was well below the estimate of 0.1%, and marked a four-month low. Where is the German economy headed? The Eurozone will find it more than difficult to get back on track if the German locomotive is not steaming in the right direction. Meanwhile, the employment picture in the Eurozone is going from bad to worse, with the Eurozone Unemployment Rate hitting 1.22%, while the quarterly Italian Unemployment Rate jumped to 11.9%.

Will the ECB implement negative interest rates? Recently, ECB Mario Draghi and other policymakers have expressed a willingness to consider the idea. At present, the ECB’s deposit rate stands at zero. If the ECB does opt to lower rates, it would be the first major central bank to adopt negative interest rates. On Monday, ECB Executive Board member Joerg Asmussen said that the ECB will continue its expansive monetary policy in order to boost the Eurozone economy, but urged caution on the question of negative rates. Asmussen warned that the ECB can’t simply fix uncompetitive economies by changing its monetary policy, such as the adopting negative interest rates. A move in this direction would likely hurt the euro, as investors would move funds out of the Eurozone in search of better rates of return.

In the US, the Federal Reserve hasn’t made any changes to the current round of quantitative easing, which stands at $85 billion in asset purchases each month. Fed policymakers, including Fed Chair Bernanke, have not been shy about dropping clues that QE could be altered or even terminated in the next few months. The currency markets have reacted sharply to such talk, and much of the volatility we are seeing in the currency markets is a reflection of market uncertainty as to what the Fed plans to do. Talk of an end to QE has given a boost to the dollar, and we can expect the currency markets to continue to be very sensitive to further talk of tapering QE.

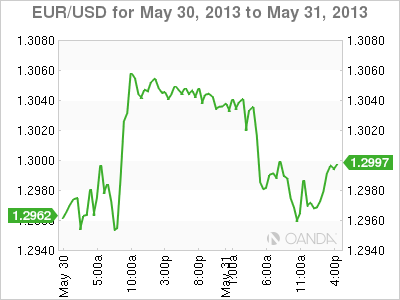

EUR/USD May 31 at 8:50 GMT

EUR/USD 1.3012 H: 1.3049 L: 1.3008 EUR/USD Technical" title="EUR/USD Technical" width="597" height="83">

EUR/USD Technical" title="EUR/USD Technical" width="597" height="83">

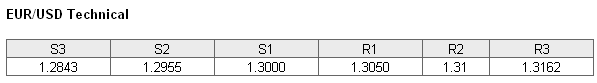

EUR/USD has settled down on Friday, after strong gains yesterday. On the downside, the pair is testing the 1.3000 line. This line could see further activity if the dollar shows any strength. The next line of support is at 1.2955. On the upside, 1.3050 is providing support. There is stronger resistance at the round number of 1.31.

- Current range: 1.3000 to 1.3050

- Below: 1.2955, 1.2843, 1.2753, 1.2689, 1.2589 and 1.2500

- Above: 1.3000, 1.3050, 1.3100, 1.3162 and 1.3271

EUR/USD ratio has shifted directions and is pointing to movement towards short positions. This is likely a result of long positions continuing to be covered, as the pair rallies upwards. If the euro continues to gain ground, we can expect this movement in the ratio to continue.

The euro has looked very sharp against the dollar, gaining about 150 points since Wednesday. We can expect more movement from the pair on Friday, as the Eurozone and the US releasing numerous events.

EUR/USD Fundamentals

- 6:00 German Retail Sales. Estimate 0.3%. Actual -0.4%.

- 6:45 French Consumer Spending. Estimate -0.5%. Actual -0.3%.

- 8:00 Italian Quarterly Unemployment Rate. Estimate 11.2%. Actual 11.9%.

- 8:00 Italian Monthly Unemployment Rate. Estimate 11.6%. Actual 12.0%

- All Day: OPEC Meetings.

- 9:00 Eurozone CPI Flash Estimate. Exp. 1.4%. Actual 1.4%.

- 9:00 Eurozone Unemployment Rate. Estimate 12.2%. Actual 12.2%.

- 9:00 Italian Preliminary CPI. Estimate 0.1%. Actual 0.1%.

- 12:30 US Core PCE Price Index. Estimate 0.1%.

- 12:30 US Personal Spending. Estimate 0.2%.

- 12:30 US Personal Income. Estimate 0.2%.

- 13:45 US Chicago PMI. Estimate 50.3 points.

- 13:55 US Revised UoM Consumer Sentiment. Estimate 84.1 points.

- 13:55 US Revised UoM Inflation Expectations.

- 15:00 US Crude Oil Inventories. Estimate -0.8M.