EUR/USD has started the new trading week in subdued fashion, as the pair trades at 1.0850 in the European session. On the release front, Eurozone and German Manufacturing PMIs were very close to their estimates. In the US, today’s key event is the ISM Manufacturing PMI.

The January Federal Reserve policy statement was cautious in tone, as policymakers noted that there are soft spots in the economy, such as consumer spending and exports. As expected, the Fed did not raise rates from the current level of 0.25% The inflation picture remains problematic, with the Fed saying that inflation levels will remain low, and may not reach the target of 2.0% until 2018.

At the same time, the Fed emphasized that the US labor market remains strong. Will we see another rate hike in March? The Fed probably cannot answer this question just yet, so the markets will have to show some patience. Given the Fed’s continuing concerns about a lack of inflation, it’s hard to foresee another rate hike in March absent a strong improvement in key US indicators.

On the release front, US durable goods reports were dismal in December. Durable Goods dropped 1.2%, while Core Durables plunged 5.1%, its weakest showing since August 2014. These poor numbers underscore ongoing weakness in the US manufacturing sector, which has not improved despite positive economic conditions. There was more disappointing news on the housing front last week, as Pending Home Sales posted a negligible gain of 0.1%, well off the estimate of 1.0%.

Eurozone inflation picked up in December, as Eurozone CPI improved to 0.4%, its strongest gain since September 2014. Core CPI edged up to 1.0%, ahead of the forecast of 0.9%. Despite these stronger numbers, the euro failed to gain any ground as the markets remain pessimistic about the inflation picture. Weak oil prices may be a boon for consumers, but it could send inflation levels into negative territory, and deflation could pose a serious problem.

The ECB is expected to announce major monetary moves at its March meeting, which would mark a significant departure. Analysts expect a reduction of the benchmark rate by 10 basis points, and the QE purchasing program could be raised from 60 billion euros to 80 billion euros/mth. Such a move would likely weaken the euro.

Monday (Feb. 1)

- 3:15 Spanish Manufacturing PMI. Estimate 52.5 points. Actual 55.4 points

- 3:45 Italian Manufacturing PMI. Estimate 54.9 points. Actual 53.2 points

- 3:45 French Manufacturing PMI. Estimate 50.0 points. Actual 50.0 points

- 3:55 German Final Manufacturing PMI. Estimate 52.1 points. Actual 52.3 points

- 4:00 Eurozone Final Manufacturing PMI. Estimate 52.3 points. Actual 52.3 points

- 8:30 US Core PCE Price Index. Estimate 0.1%

- 8:30 US Personal Spending. Estimate 0.1%

- 8:30 US Personal Income. Estimate 0.2%

- 9:45 US Final Manufacturing PMI. Estimate 52.7 points

- 10:00 US ISM Manufacturing PMI. Estimate 48.6 points

- 11:00 ECB President Mario Draghi Speaks

- Tentative – US Loan Officer Survey

*Key events are in bold

*All release times are EST

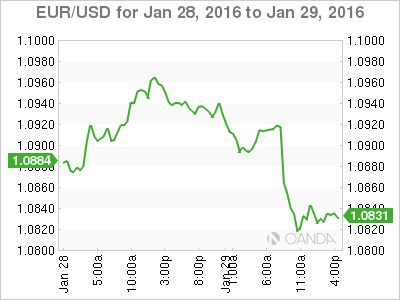

EUR/USD for Monday, February 1, 2016

EUR/USD February 1 at 4:45 EST

Open: 1.0825 Low: 1.0824 High: 1.0857 Close: 1.0851

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0659 | 1.0732 | 1.0847 | 1.0941 | 1.1087 | 1.1172 |

- EUR/USD posted losses late in the Asian session and is choppy in European trade

- 1.0847 continues to provide support

- There is resistance at 1.0941

- Current range: 1.0847 to 1.0941

Further levels in both directions:

- Below: 1.0847, 1.0732, 1.0659 and 1.0537

- Above: 1.0941, 1.1087 and 1.1172

OANDA’s Open Positions Ratio

EUR/USD has shown strong movement towards long positions, as currently there is an even split between long and short positions. This points to a lack of trader bias as to what direction the pair will take next.