EUR/USD is showing marginal movement on Wednesday, as the pair trades at 1.0870 in the European session. In economic news, German Consumer Climate posted a strong reading of 9.4 points, within expectations. In the US, the Federal Reserve will release a policy statement and set the benchmark interest rate for January.

The ECB held its monthly policy meeting last week, and opted to maintain current interest rate and quantitative easing levels. ECB President Mario Draghi noted that he reserved the right to “review and reconsider” the ECB’s monetary policy in March. Draghi reiterated this message at last week’s World Economic Forum in Davos, Switzerland. So what does this mean for the markets? In December, the markets were banking on some strong monetary action from the ECB. When this didn’t materialize, the result was huge volatility from the euro. Draghi doesn’t want a repeat of this fiasco, and is sending out the message that although he’s not prepared to make any moves right now, the ECB could increase monetary easing if inflation and growth numbers in the bloc worsen in the next 2 months. Draghi is clearly trying to improve communication with the markets, and upcoming Eurozone and German economic indicators will play a key role as to whether the ECB makes any moves in the March statement.

Wednesday (Jan. 27)

- 2:00 German GfK Consumer Climate. Estimate 9.3 points. Actual 9.4 points

- Tentative – German 30-year Bond Auction

- 10:00 US New Home Sales. Estimate 501K

- 10:30 US Crude Oil Inventories. Estimate 3.8M

- 14:00 FOMC Statement

- 14:00 Federal Funds Rate. Estimate

Upcoming Key Events

Thursday (Jan. 28)

- 8:30 US Core Durable Goods Orders. Estimate 0.0%

- 8:30 US Unemployment Claims. Estimate 281K

*Key events are in bold

*All release times are EST

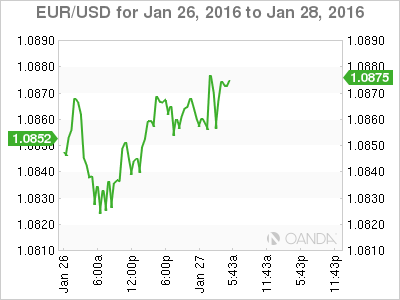

EUR/USD for Wednesday, January 27, 2016

EUR/USD January 27 at 4:45 EST

Open: 1.0862 Low: 1.0850 High: 1.0882 Close: 1.0872

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0659 | 1.0732 | 1.0847 | 1.0941 | 1.1087 | 1.1172 |

- EUR/USD has been flat in the Asian and European sessions

- 1.0847 has switched to a support role. It is a weak line and could see further action during the day.

- There is resistance at 1.0941

- Current range: 1.0847 to 1.0941

Further levels in both directions:

- Below: 1.0847, 1.0732, 1.0659 and 1.0537

- Above: 1.0941, 1.1087 and 1.1172

OANDA’s Open Positions Ratio

EUR/USD ratio is almost unchanged, reflective of the lack of movement from the pair. Currently, short positions have a majority of positions (58%). This points to trader bias towards the pair moving lower.