The sparkling euro climbed to 1.1777 on Thursday, its highest level since January 2015. On Friday, EUR/USD has inched higher, as the pair is trading at the 1.17 line, up 0.23% on the day. On the release front, German Preliminary CPI is expected to remain unchanged at 0.2%. Later in the day, the US releases Advance GDP, with the estimate standing at 2.5%. If GDP surprises, we can expect movement from the euro. We’ll also get a look at UoM Consumer Sentiment, with is expected to dip to 93.2 points.

The German consumer remains optimistic about the economy, and economic barometers certainly bear out the positive sentiment. With German exports in high demand, the manufacturing sector is strong. GfK German Consumer Climate strengthened for a fourth straight month, improving to 10.8 in the July report. This edged above the estimate of 10.7 points. Importantly, strong consumer confidence has translated into increased consumer spending, a key driver of economic growth. However, the fly in the ointment remains inflation, which is stuck at low levels. The lack of inflation is a pressing concern for ECB policymakers, and there is little chance that the bank will end its quantitative easing program before December, if inflation levels don’t move upwards.

The Federal Reserve maintained the benchmark rate at 1.25% on Wednesday. The highly-anticipated rate statement was cautiously optimistic in tone, saying that the economy was growing at a moderate pace and that the labor market remained strong. The statement made note of low inflation, but said that the Fed expected the economy to continue to expand. Another key issue on the Fed’s plate is the $4.2 trillion balance sheet. The rate statement said that the Fed plans to taper asset purchases “relatively soon”, which is a likely nod at September as the start date. This would involve the Fed tapering its purchases of Treasury bonds and mortgage securities, with an initial taper likely of $10 billion/month. Although the Fed continues to talk about another rate hike in 2017, investors remain skeptical. The rate statement did not change many minds, as the odds of rate increase in December stand at 47%, according to the CME Group (NASDAQ:CME).

EUR/USD Fundamentals

Friday (July 28)

- 1:30 French Flash GDP. Estimate 0.5%. Actual 0.5%

- All Day – Germany Preliminary CPI. Estimate 0.2%

- 2:45 French Consumer Spending. Estimate -0.3%. Actual -0.8%

- 2:45 French Preliminary CPI. Estimate -0.4%. Actual -0.3%

- 3:00 Spanish Flash CPI. Estimate 1.5%. Actual 1.5%

- 3:00 Spanish Flash GDP. Estimate 0.9%. Actual 0.9%

- Tentative – Italian 10-y Bond Auction

- 8:30 US Advance GDP. Estimate 2.5%

- 8:30 US Advance GDP Price Index. Estimate 1.3%

- 8:30 US Employment Cost Index. Estimate 0.6%

- 10:00 Revised UoM Consumer Sentiment. Estimate 93.2

- 10:00 Revised UoM Inflation Expectations

- 13:20 US FOMC Member Neel Kashkari Speaks

*All release times are GMT

*Key events are in bold

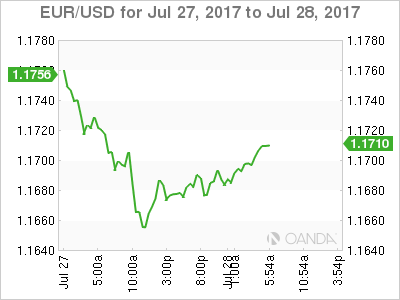

EUR/USD for Friday, July 28, 2017

EUR/USD Friday, July 28 at 5:30 EDT

Open: 1.1677 High: 1.1717 Low: 1.1671 Close: 1.1706

EUR/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1465 | 1.1534 | 1.1616 | 1.1712 | 1.1876 | 1.1996 |

EUR/USD showed little movement in the Asian session. The pair has posted slight gains in the European session

- 1.1616 has some breathing in support

- 1.1712 was tested earlier in resistance and is a weak line. It could break in Friday session

Further levels in both directions:

- Below: 1.1616, 1.1534, 1.1465 and 1.1366

- Above: 1.1712, 1.1876 and 1.1996

- Current range: 1.1616 to 1.1712

OANDA’s Open Positions Ratio

EUR/USD ratio is showing long positions with a majority (63%). This is indicative of EUR/USD continuing to move downwards.