GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1325, target 1.1550, stop-loss 1.1205, risk factor *

USD/CAD: short at 1.2270, target 1.2100, stop-loss 1.2370, risk factor **

EUR/GBP: long at 0.7150, target 0.7400, stop-loss 0.7080, risk factor ***

EUR/CHF: long at 1.0440, target 1.0680, stop-loss 1.0380, risk factor *

EUR/JPY: long at 139.50, target 142.00, stop-loss 137.80, risk factor *

EUR/CAD: long at 1.3895, target1.4150, stop-loss 1.3770, risk factor **

GBP/JPY: long at 195.25, target 197.30, stop-loss 194.00, risk factor *

CHF/JPY: long at 133.65, target 136.00, stop-loss 132.10, risk factor **

Pending Orders

AUD/NZD: sell at 1.1300, target 1.1100, stop-loss 1.1400, risk factor ***

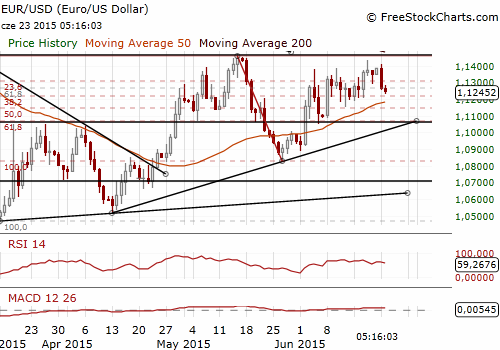

EUR/USD Under Pressure On Greek Neverending Story And Despite Strong Eurozone PMIs

(long under threat)

- Eurozone ministers on Monday welcomed new reform proposals from Greece as a possible basis for an agreement. The Greek proposals included higher taxes and welfare charges and steps to curtail early retirement, but not the nominal pension and wage cuts first sought by lenders. Leftist Prime Minister Alexis Tsipras, elected in January on a promise to end austerity measures, also appeared to have avoided raising value added tax on electricity or loosening job protection laws. Tsipras said the ball was back in the creditors' court.

- European Council President Donald Tusk, who chaired an emergency summit of leaders of the Eurozone, called the Greek proposals “a positive step forward”. He said the aim was to have the Eurogroup finance ministers approve a cash-for-reform package on Wednesday evening and put it to Eurozone leaders for final endorsement on Thursday morning.

- European Commission President Jean-Claude Juncker told a late-night news conference: "I am convinced that we will come to a final agreement in the course of this week”. Juncker said he had proposed EUR 35 billion programme for growth-enhancing measures in Greece up to 2020.

- U.S. Treasury Secretary Jack Lew urged Tsipras in a phone call to make a “serious move” at reaching a deal with Athens' creditors to avert “immediate hardship for Greece and uncertainties for Europe and the global economy”. He also telephoned the IMF's managing director Christine Lagarde to underline that all sides in the talks must come to a rapid agreement.

- Investors are disappointed after Eurozone finance ministers failed to reach an agreement yesterday. We got long yesterday as we expected Greece deal but the EUR is under selling pressure now and our long is getting closer to the stop-loss level. The EUR's drop also partly reflected resurgence in the USD, which was aided by upbeat housing data and a jump in Treasury yields.

- The National Association of Realtors said existing home sales increased 5.1% to an annual rate of 5.35 million units, the highest level since November 2009. That put sales this year on track for their strongest gain since 2007. The Realtors group revised April's sales pace up to 5.09 million units from the previously reported 5.04 million units. House prices this year could exceed the peak set in 2006, the Realtors group said. The data support our view that the Fed will raise rates as soon as in September. US new home sales data will be released later today (14:00 GMT).

- Today’s Eurozone PMI data did not help our long position, although the reading was above expectations. PMI composite rose to 54.1 in June from 53.6 in the previous month. It was the highest reading since May 2011. Growth picked up speed in both services and manufacturing at the end of the second quarter.

- PMI survey also indicated that employment and new orders had likewise risen at the strongest rates for four years over the second quarter as a whole, although growth slowed in both cases in June.

- PMI showed that average selling prices for goods and services continued to fall, but the decline was once again only marginal and one of the smallest seen over the past three years.

- The PMI is signalling GDP growth of 0.4% for the Eurozone as a whole in the second quarter. The upturn is seen in the largest economies - robust GDP growth in Germany and the best quarter for almost four years in France.

Significant technical analysis' levels:

Resistance: 1.1324 (hourly high Jun 23), 1.1347 (session high Jun 23), 1.1400 (psychological level)

Support: 1.1206 (low Jun 17), 1.1200 (psychological level), 1.1189 (low Jun 15)

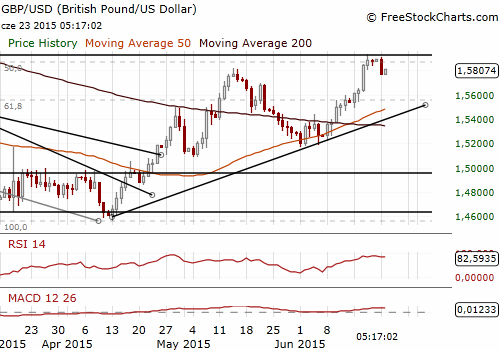

GBP/USD: We Are Getting Closer To Rate Hikes Also In The United Kingdom

(stop-loss hit)

- Bank of England Deputy Governor Minouche Shafik said the latest British wage data were very encouraging and suggested the most important driver of domestically generated inflation was starting to pick up. Last week's official data showed average weekly earnings including bonuses rose 2.7% in the three months to April compared with a year ago, the strongest increase since the summer of 2011.

- BoE Deputy Governor Jon Cunliffe said Britain's reserve of spare labour is running out, which should help to boost poor British productivity growth as companies focus increasingly on less labour-intensive forms of production. He said the Monetary Policy Committee would find itself under greater pressure to act to control price pressures if wage growth continues to pick up without a commensurate improvement in productivity. Data last week showed British workers' pay grew at its fastest rate in nearly four years in the three months to April, prompting rate-setter Kristin Forbes to a say an interest rate hike was coming in the “not-too-distant future”. Cunliffe repeated the BoE's guidance that interest rates were likely to rise from their present record low of 0.5%, albeit gradually and to a level below their pre-crisis average.

- The comments from BoE policymakers suggest that the central bank is getting closer to rate hikes. In our opinion the first rate hike will take place in the first quarter 2015. Hawkish comments from the BoE should help the GBP bulls, but rather in the medium term. Today the GBP is under selling pressure because of lack of Greece deal and our long GBP/USD hit the stop-loss level at 1.5770. The GBP/USD may be pushed down further in case of better-than-expected US data today. That is why we do not plan to get long again at current levels. It would not be a good idea also taking into account our risk exposure on the GBP pairs, as we are still GBP/JPY long.

Significant technical analysis' levels:

Resistance: 1.5831 (session high Jun 23), 1.5910 (high Jun 22), 1.5930 (high Jun 18)

Support: 1.5765 (session low Jun 23), 1.5700 (psychological level), 1.5627 (low Jun 17)

Source: Growth Aces Forex Trading Strategies