The Euro did well to finish last week by moving back up through the 1.29 level after experiencing a wild ride in that time by surging higher to the resistance level at 1.30 before falling sharply back down towards the long term support level at 1.28, only to be followed by another surge higher back above 1.29. This followed a couple of days earlier last week where the Euro was able to finally show some resilience and rally higher to regain some lost ground moving back to above 1.29. Over the couple of weeks prior to last week, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level has been called upon over the last week to provide additional support. A couple of weeks ago the Euro traded ever so slightly below 1.2800 and this level represented the lowest levels it had traded to since early April.

It has become evident over the last week that the 1.30 level is now providing some resistance and placing pressure on price. Over the last month the 1.32 level has become quite significant and has been an obstacle to the Euro moving higher (evident in the right half of the daily chart below). During this time, it has had some periods of little movement followed by sharp bursts. At the beginning of May the Euro exhibited a classic pin bar reversal candlestick pattern which was indicating the significant selling pressure it experienced at any price above the 1.32 level and likely lower prices to follow. This reinforced the significance of the 1.32 level and how it was going to take considerable effort to move through there. On this pin bar, it moved to near 1.325 and to its highest level in more than two months, since the end of February when it was falling heavily from up near 1.34. Just as quickly, it fell away and moved down to the six week low below 1.28. Prior to that, it was quiet and spent the most part of two weeks ago trading within a narrow range between 1.30 and 1.31, which reinforced how significant this two cent range was.

Over the last month the Euro has done well to weather the storm through February and March which saw it fall sharply from around 1.37, although its decline over the last few weeks may be reversing this good fortune. Despite its strong rally in the first half of April, it was only a few weeks ago that the Euro dropped to its lowest level since the middle of November around 1.2750, so it did very well of late to move back strongly above 1.30, despite its recent lapse. The Euro has spent the best part of the last month consolidating above the key 1.30 and 1.29 levels after its decline throughout February. Sentiment has completely changed with the Euro and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards levels not seen in over 12 months above 1.37 before falling very sharply to below 1.28 and setting a 14 week low a month ago.

The EUR/USD had a roller coaster ride. Last week Fed member comments regarding a near end of the US QE program sapped strength away from the EUR. This week Fed Chairman Ben Bernanke warned against ending the program too soon, as it might hurt more than help. The comments and a surprisingly strong German IFO Business Climate figure drove the EUR/USD above the 1.29 level.

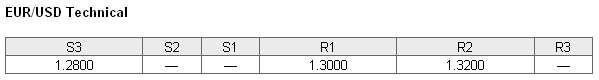

EUR/USD May 27 at 00:25 GMT 1.2938 H: 1.2944 L: 1.2931 EUR/USD Technical" title="EUR/USD Technical" width="599" height="80">

EUR/USD Technical" title="EUR/USD Technical" width="599" height="80">

During the early hours of the Asian trading session on Monday, the Euro is trading within a narrow range around 1.2940 after starting the week pushing up a little from 1.29. Since the start of February, it has fallen sharply from new highs above 1.37, although it has experienced some strong rallies in that time trying to claw back lost ground. Current range: trading right around 1.2940.

Further levels in both directions:

• Below: 1.2800.

• Above: 1.3000, and 1.32000

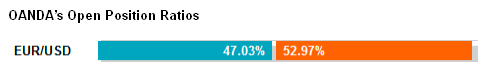

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has moved lower as the Euro has rallied a little to over 1.29. The trader sentiment shifts to in favour of short positions.

Economic Releases

- 06:00 DE Retail Sales (27th-31st) (Apr)

- 07:30 NL Producer Confi dence (May)

- 07:30 SE Retail sales (Apr)

- 08:00 NO Unemployment (AKU/LFS) (Mar)