JPY crosses were all over the place overnight before and after Kuroda was out discussing the BoJ’s view of bond market volatility. EURUSD needs to fall today or we risk the old 1.3000 magnet syndrome.

BoJ Governor Kuroda was out overnight triggering plenty of volatility in JPY crosses as he maintained that the BoJ will be able to contain bond market volatility with flexible market operations. He underlined that the most important goal is to achieve the 2 percent inflation target. The Nikkei posted new lows overnight below yesterday’s lowest levels, but managed to rally into the close and close above yesterday’s levels. As far as the JPY cross activity – they were all over the map, with USDJPY representative of the action. The pair rallied all the way to above 102.59 and just shy of a perfect 61.8% retracement before selling off steeply to 101.10 again in the wake of Kuroda’s speech and then consolidating about half of that lost ground. Good luck picking entry levels…volatility likely to remain unpredictable in these crosses.

Today and early next week we get a read on whether the JPY short squeeze will continue here or whether this was merely a warning sign to be followed with a bigger move down the road. (Recall the carry trades of 2007 and 2008 for a model of how an unwind can unfold – with cracks showing here and there that show an overpositioned market, but that are immediately pasted over as the rally resumes, only to be followed by a big move that finally unfolds all at once).

EURUSD played headgames with everyone yesterday by entirely failing to follow through lower after the previous day’s enormous reversal on the heels of the Bernanke testimony. I was shocked to see others indicating that this Bernanke testimony was dovish – I thought it quite clearly showed longer term risks on a shift in Fed policy as I indicated in my piece yesterday (http://www.tradingfloor.com/posts/jpy-short-market-moves-blast-past-870677112). Today, EURUSD will take its cue from the German Ifo data, which ticked sharply lower last month. Another disappointing reading would make an extension of the EURUSD comeback a rather tall task – but let’s see.

In the US today, we have the Durable Goods Orders data for April – not a big catalyst usually, but who knows in this rather twitchy atmosphere if it is used for an excuse to move the dollar either way on a Friday of a very nervous week.

Stay careful out there.

Technical observations.

JPY crosses broadly: These have generally retraced in a 61.8% fashion overnight – those highs in Asia are the key resistance for the day and one can look to the bond market as a confirming indicator for establishing tactical short positions if the expectation is that these will correct back lower. I prefer to stand aside, but happy to own some downside volatility, as in recent USDJPY put trade idea. Downside breaks of recent lows could set off waves of further stops.

EURUSD - confusion reigns as reversal meets reversal. 1.2950 looks important as resistance to avoid an all-out reversal back higher and interaction with the 1.3000 level and now there’s a lot of range to chop back through lower toward 1.2800 before we get that head and shoulders neckline in view below.

EURGBP – more wood to chop higher if Euro data is supportive – that’s a big if. Still, the default technical outlook appears supportive if we remain above 0.8500 for a try at 0.8650+.

GBPUSD – consolidation potential toward 1.5130-1.5160, but path looks lower as we are possibly set for a 1.5000 test sooner rather than later and an eventual probe of the sub 1.4900 lows.

EURCHF – some confusion after the choppiness of the last couple of days – outlook similar to that of EURJPY and other JPY crosses until this pair behaves differently. Important support on the day at 1.2480 -1.2500.

USDCHF – a classic bearish reversal yesterday, but this came atop a very large rally, so still looking for support zones rather than selling opportunities. The first big support is 0.9650 followed by the 0.9580 level and a rally through 0.9715/25 would help to relieve the immediate downside pressure.

AUDUSD – tricky after the huge bullish reversal yesterday that was clearly influenced by USDJPY flows. The low was just shy of the big 0.9580 support. Momentum is divergent, but the trend is impressively strong – what to do? I like the pair lower, but tactical entries will remain difficult with such huge volatility. If the 0.9650 level gives way, we may be on to a test of the lows and a go at the massive chart level around 0.9400.

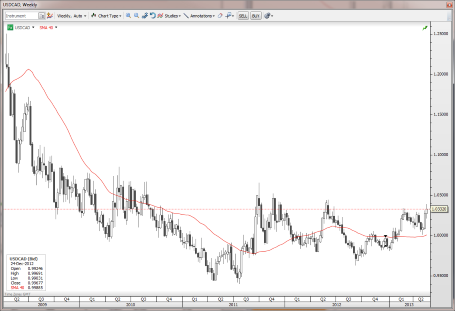

USDCAD – the trend softened up a bit by yesterday’s sell-off. Looking at 1.0300/1.0290 as the important near term support zone for maintaining the rally, which still looks very interesting on the weekly scale.

Chart: USDCAD weekly

The longer term char reminds us of how critical these levels are for USDCAD in the bigger picture. EUR/USD" title="EUR/USD" width="455" height="311">

EUR/USD" title="EUR/USD" width="455" height="311">

EURSEK – support confirmed on weak confidence data this morning as expected over the last couple of days and this one could extend on a break above the 8.65 resistance. Consider USDSEK long ideas if EURUSD reverses back lower.

EURNOK – reversal suggests lower odds of the sell-off continuing. Looking for support to come in around 7.50 now.

Economic Data Highlights

- New Zealand Apr. Trade Balance out at 157M vs. 515M expected and 732M in Mar.

- Germany Jun. GfK Consumer Confidence Survey out at 6.5 vs. 6.2 expected and 6.2 in May.

- Sweden May Consumer Confidence out at 3.6 vs. 6.5 expected and 5.2 in Apr.

- Sweden May Manufacturing Confidence out at -15 vs. -8 expected and -9 in Apr.

- Germany May Ifo Survey (0800)

- Euro Zone ECB’s Weidmann to Speak (1000)

- US Apr. Durable Goods Orders (1230)

- Japan BoJ Governor Kuroda to Speak (Sun 0450)

- Bank of Japan April 26 Meeting Minutes (Sun 2350)