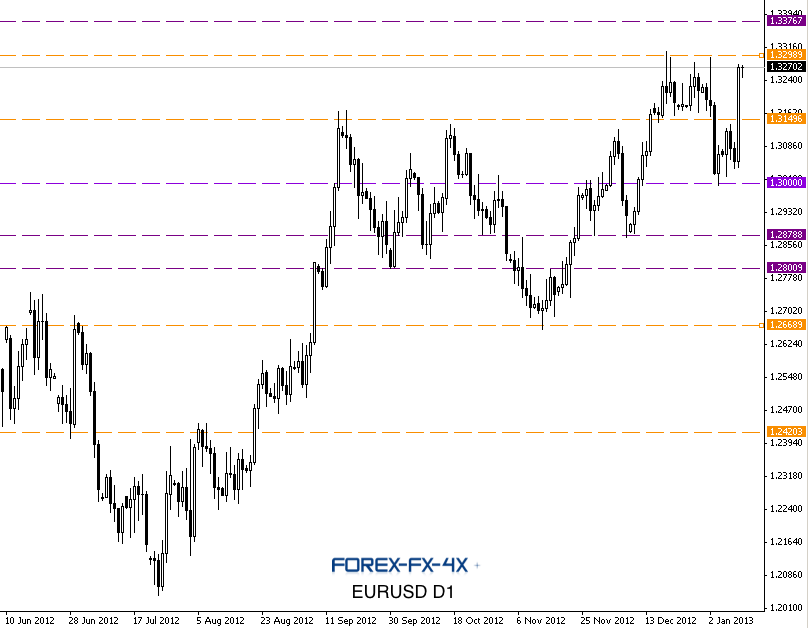

- The EUR/USD currency pair is once again threatening recent range resistance highs around 1.3300, after the ECB (European Central Bank) held its key rate at the record low 0.75% level. Yesterday’s move brought significant volatility and the daily range was over 240 pips – 3 times the 60 day average.

- The 1.3150 area has proved to be a price pivot zone and is eyed as potential support on any initial move lower. This technical area last acted as resistance earlier this week.

- To the upside – a cluster of daily highs from March/April is located around 1.3380 and and could potentially provide resistance on any sustained break above range resistance.

- The 1.3485 29/2/12 prominent swing high point is just under a 50% corrective retrace and the 1.3500 psychological round number. This a key confluence area and technical point of interest on any extended upside.

- In related markets we note that cable has found support at the 1.6000 /ascending trend line area and is now consolidating around 1.6150. This has the EURGBP cross likewise threatening range resistance highs around 0.8240 on a broad based EUR strength scenario.

- The USDJPY is trading around 89.00 as the Japanese yen has broadly under performed, reaching the weakest level seen against the US dollar since June 2010.

EUR/USD D1" title="EUR/USD D1" width="809" height="628">

EUR/USD D1" title="EUR/USD D1" width="809" height="628">Disclaimer:The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post