The Euro has reversed and surged higher in the last 24 hours pushing through the resistance at 1.33 again and in recent hours, consolidating right around 1.3350. This is after it spent most of the last week drifting lower from the resistance level at 1.34 back towards the previous resistance level of 1.33. This level provided very little support for the Euro as it continued to move down strongly towards 1.3230 before consolidating recently above the support level at 1.3250. Earlier last week it was able to push up through the 1.33 resistance level and continue on to touch 1.34 and reach a seven week high before easing back late last week. Prior to last week, for a couple of weeks the Euro established and traded within a narrow range between two key levels of 1.32 and 1.33 as it continued to place pressure on the latter. Over the last couple of weeks as the resistance level at 1.33 has stood firm, the Euro has found solid support right around 1.3250 as well. A couple of weeks ago it surged higher to reach a new one month high just shy of 1.3350 however it continued to meet stiff resistance at 1.33 during this period. In the week prior to the recent consolidation period between 1.32 and 1.33, the Euro enjoyed a healthy and steady rally towards the resistance level at 1.32 and finally made its way through culminating in its recent push higher.

About a month ago the Euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there. It has been some time since the Euro has experienced a 24 hour period with as much range as the period almost a month ago when it surged higher from from below 1.28 up to above 1.32. Prior to that jump, the Euro had been in a very solid medium term down trend after succumbing to the resistance at 1.29 and moving down below the key long term level of 1.28. This resulted in it trading at a multi-year low near 1.2750. After reaching a four month high above 1.34 about seven weeks ago, the EUR/USD was in the midst of a very solid medium term down trend which has seen it fall sharply.

It was only a month or so ago that the 1.30 level was standing up and proving itself to be a brick wall of support, and even though it failed a couple of weeks ago leading to the new lows, it has since been called upon again to offer support over the last couple of weeks. Throughout May and most of June the Euro surged higher to a four month high above 1.34. Before that in the first half of May, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the Euro has moved very strongly in both directions. Throughout February and March the Euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the Euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

Germany could overtake the United States to become the world’s second-biggest exporter this year, but its share of global trade is likely to dip as its exports lag global expansion, German chambers of commerce said on Thursday. Europe’s biggest economy, currently the world’s third-biggest exporter after China and the United States, has seen its share of world trade fall to 7.5 percent by last year, from a post-German unification peak of 11 percent in 1991-92, according to DIHK Chambers of Commerce. DIHK sees Germany’s share slipping to 7 percent this year and in 2014. The German economy is rebounding after a slow patch. Data on Wednesday showed it grew 0.7 percent in the second quarter, its fastest quarterly expansion in more than a year and helping pull the euro zone out of an 18-month recession. The second-quarter expansion, however, was mainly driven by domestic private and public consumption.

EUR/USD August 15 at 22:30 GMT 1.3348 H: 1.3363 L: 1.3205

During the early hours of the Asian trading session on Friday, the Euro is consolidating right around 1.3350 after having surged higher in the last 12 hours through the 1.33 resistance level. Since the middle of June, the Euro has generally fallen sharply from new highs above 1.34, and has been looking to return back to the significant lows around 1.2800, however in the last month or so it has recovered well and moved back to above 1.34 again. Current range: trading right around 1.3350.

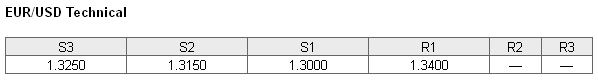

Further levels in both directions:

• Below: 1.3250, 1.3150 and 1.3000.

• Above: 1.3400.

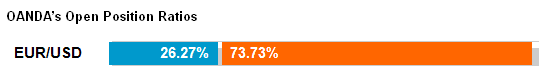

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has fallen sharply back to below 30% as the Euro has surged through 1.33. The trader sentiment remains strongly in favour of short positions.

Economic Releases

- 08:00 EU Current Account (Jun)

- 09:00 EU HICP (Final) (Jul)

- 09:00 EU Trade Balance (Jun)

- 12:30 CA Manufacturing sales (Jun)

- 12:30 US Building Permits (Jul)

- 12:30 US Housing Starts (Jul)

- 12:30 US Non Farm Productivity (Prelim.) (Q2)

- 12:30 US Unit Labour Costs (Prelim.) (Q2)

- 13:55 US Univ of Mich Sent. (Prelim.) (Aug)