Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The EUR/USD pair remained steady on the recovery path and is expected to regain once more.

The EUR/USD pair stood below 10-DMA support, followed by another higher attempt, in a bid to recoup 5-DMA barrier positioned at 1.0449.

The pair currently traded lower by -0.10% to 1.0444, which recovered from earlier session lows at 1.0433. It seemed that the bulls have fought back control, allowing a significant bounce in the pair in response to a fresh US dollar selling.

Meanwhile, the US dollar hit fresh offers against a basket of major rivals after the US treasury yields surrendered a part of intraday gains amid session. However, it is still seen in a spot where the pair can maintain the recovery and break through above resistance 1.0460 ahead of the scheduled US data release later today.

Given heightened anticipation on the pair, it is expected that the major will get affected by the broader market sentiment and USD price-action amid low volumes and minimal volatility.

EUR/USD Tests Parity on Q1

The eurozone economy is anticipated to stagnate an economic growth in a moderate level in the coming year, undershooting the European Central Bank’s (ECB) objective. Hearing this, the central bank will likely maintain a dovish tone, in which the monetary policy is expected to remain on hold through the entire 2017.

Additionally, the deposit rate was left unchanged at -0.40 percent, while he repo rate at zero percent.

Analysts are expecting the pair to hit parity by the end of the first quarter and changed hands at 0.90 by the end of 2017, before declining to its session low of 0.82 towards the first half of 2018.

Subsequently, Donald Trump’s fiscal spending appeal has sent a heavy sell-off pressure in euro, which is anticipated to be financed from government borrowing and not because of the U.S. economic growth.

Therefore, if Trump’s proposed fiscal plan is successful, it is expected that consumer inflation will rise, which will add an optimism for the Federal Reserve to raise interest rates and increase the cost of borrowing as the Fed fund rate will also rally.

After the Presidential election result, EUR had seen an immense selling against the U.S. dollar, which sent the euro to drop by about 9 percent and stood at 1.0938 in a short period of time.

EUR/USD Gets Squeezed In

From a technical perspective, the euro currency was squeezed against the US dollar. However, from a fundamental analysts’ overview, it is likely that the volatility has not returned as it is the second day of Christmas, citing it can hardly return until next year.

Current Stance of EUR/USD Pair

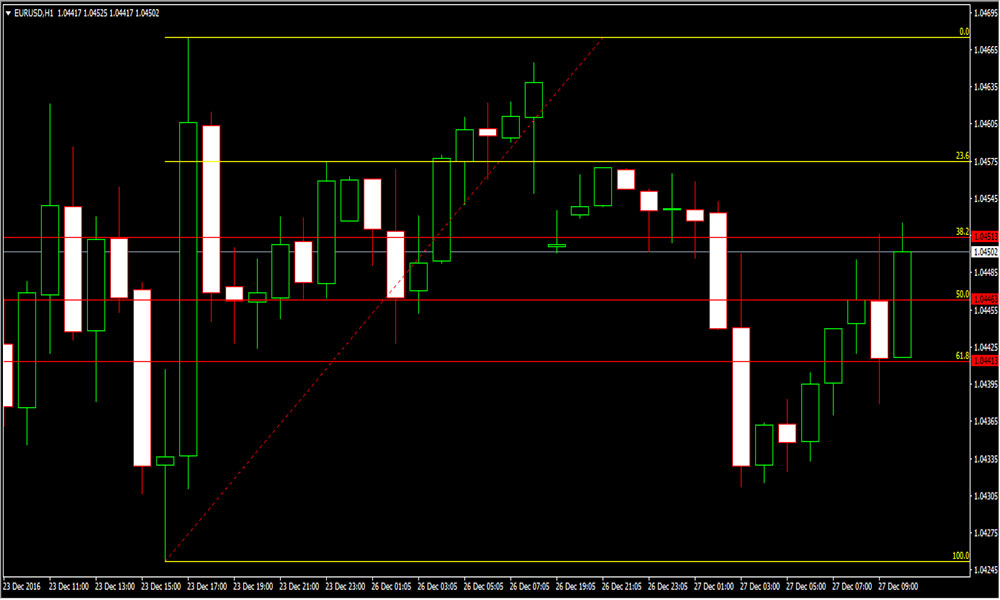

The chart below illustrates EUR/USD price movement amid Trump’s proposed fiscal spending appeal, sending the euro in a sell-off pressure. Given a rebound tone of the pair, market participants have begun selling riskier currencies as Trump’s fiscal spending appeal will give a huge impact on both currencies.

Further, the pair is currently showing signs of recovery, which last traded in a heavy trading volume near resistance 1.04513.

Conclusion

As the illustrative chart above shows rebound on the pair, market participants are recommended to still wait on the sidelines as there aren’t any supporting candle present as of writing.