EUR/USD has started the new trading week in quiet mode. The pair has shown little movement since the middle of last week, as it continues to trade in the mid-1.33 range. Taking a look at Monday’s releases, it’s a quiet start to the week. Both Italian and Eurozone Trade Balances posted surpluses, but missed their estimates. In the US, today’s highlight is the Empire State Manufacturing Index. The index looked very weak in May, but the markets are expecting better news, with an estimate of 0.4 points.

There was good news last Thursday from US releases, as all three key events beat expectations. Retail Sales jumped from 0.1% to 0.6%, surpassing the estimate of 0.4%. Core Retail Sales also climbed nicely, from -0.1% to 0.3%. This matched the market forecast. Unemployment Claims fell to 334 thousand, crushing the estimate of 354 thousand.

On Friday, the news was mixed, as PPI gained 05%, beating the estimate of 0.2%. However, UoM Consumer Sentiment dropped from 3.1 to -1.4 points. On Friday, the Eurozone and the US released inflation data. In Europe, inflation numbers have not impressive, pointing to weak economic activity. Weak inflation was a factor in the recent ECB reduction cut, so as to encourage more spending and give helping hand to the Eurozone economy. This time Eurozone inflation numbers matched the forecast, as Eurozone CPI came in at 1.4%, and Core CPI gained 1.2%. Both readings showed improvement. In the US, PPI rebounded nicely after two releases in negative territory, with a strong gain of 0.5%. This easily beat the estimate of 0.2%

In the eurozone, there was an interesting legal matchup last week, with the ECB versus the Bundesbank. The two powerful central banks faced off as Germany’s Federal Constitutional Court concluded its review of the constitutionality of the ECB’s OMT (Outright Monetary Transactions) program.

Under OMT, the ECB can purchases bonds from members whose economies are in trouble. ECB head Mario Draghi strongly supports OMT, and said that the program has improved stability in the European and global markets and is a key monetary policy measure.

Draghi’s optimistic view lies in sharp contrast to that of Bundesbank President Jens Weidmann, who voted against OMT and is asking the court to reject the scheme. In previous cases involving the legality of ECB rescue mechanisms, the German court has given its approval, but has sometimes added provisos. So we can expect the court to rule that OMT is legal, perhaps with strings attached.

It should be noted that the ECB has yet to make use of the OMT program, and has not bought a single bond from distressed eurozone members. A ruling from the court is not expected until September, after German elections. EUR/USD" width="400" height="300">

EUR/USD" width="400" height="300">

EUR/USD June 17 at 9:50 GMT

EUR/USD 1.3349 H: 1.3355 L: 1.3318

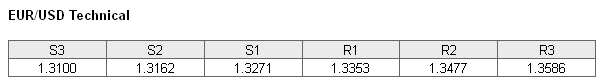

EUR/USD is steady as we begin the week. The pair has continued where it left off last week, trading quietly in the mid-1.33 range. On the downside, 1.3271 continues to provide support. There is a stronger support level at 1.3162. On the upside, the pair is testing the 1.3353 line. This is followed by stronger resistance at 1.3477.

- Current range: 1.3271 to 1.3353

- Below: 1.3271, 1.3162, 1.3100, 1.3050 and 1.3000

- Above: 1.3353, 1.3477, 1.3586 and 1.3690

The EUR/USD ratio is showing little movement in Monday trading. This is consistent with what we are seeing from the pair, which is trading quietly. Short positions enjoy a substantial majority, indicating strong trader bias towards the US dollar making gains at the expense of the euro.

EUR/USD continues to trade quietly in the mid-1.33 range. The pair shrugged off a host of key US releases late last week. Although these were mostly positive, notably Unemployment Claims, the pair has shown limited movement. Today’s highlight is the Empire State Manufacturing Index, and we could see EUR/USD break out if the release is not in line with market expectations.

EUR/USD Fundamentals

- 8:00 Italian Trade Balance. Estimate 2.48B. Actual 191B.

- 9:00 Eurozone Trade Balance. Estimate 21.2B. Actual 16.1B.

- 12:30 US Empire State Manufacturing Index. Estimate 0.4 points.

- 14:00 US NAHB Housing Market Index. Estimate 45 points.

- Day 1 of G8 Meetings.

- 15:10 German Buba President Jens Weidmann Speaks.