EUR/USD" width="1596" height="746">

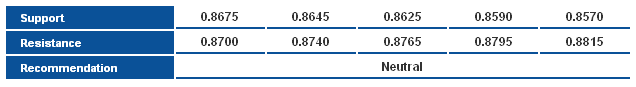

EUR/USD" width="1596" height="746">The pair managed to move to the upside last Friday but is still limited below 1.3315. Despite that the pair failed the intraday downside move, but stability below the referred to level might bring negativity back. Of note, breaching 1.3315 might push the pair to test the previous top at 1.3415 and perhaps further. For now, since the pair is trading below the intraday interval is at 23.6% correction bearishness remains valid.

The trading range for this week is among the key support at 1.3070 and key resistance at 1.3500.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

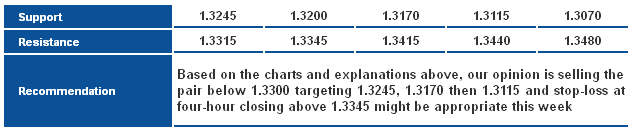

The pair moved sharply to the upside and is stable again above key support level of the upside move, as it failed to stabilize below it and below 1.5170. RSI is stable above 50 and Stochastic is biased to the upside. Therefore, it is possible to see more positivity this week. Stability below 1.5170 again might indicate the failure of the upside move and the beginning of a new downside wave.

The trading range for this week is among key support at 1.5035 and key resistance at 1.5550.

The general trend over short term basis is to the downside as far as areas of 1.5605 remains intact targeting 1.4550.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

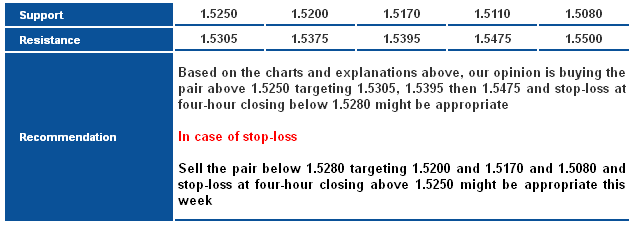

The pair dropped last week after failing to stabilize over daily basis above 99.70, in addition to trading below key resistance level of the downside move starting since the breakout of the ascending channel. Stochastic provided a negative cross over and RSI is trading in a bearish bias below line 50. Therefore, we think that we are in front of a bearish wave this week, which remains valid with stability below 99.95.

The trading range for this week is among key support at 95.45 and key resistance at 100.70.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

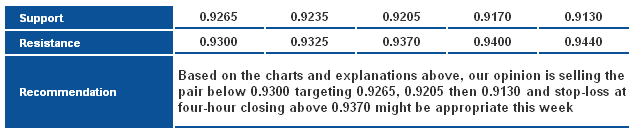

The pair dropped sharply which might prove forming a new descending channel. Stability below 0.9370 will keep the bearish possibility valid this week. We should point out that breaking 0.9265 is significant to support extending the downside move and cancel any oversold signals on Stochastic. Anyhow, Linear Regression Indicators are negative and RSI is moving freely below line 50.

The trading range for this week is among key support at 0.9130 and key resistance at 0.9440.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

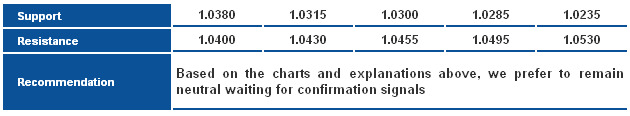

The upside move on Friday pushed the pair to stabilize above 1.0385 but is now hovering around it. We find the pair currently stable below Linear Regression Indicator 55 where we can’t count on stabilizing above 1.0385 to expect positivity especially that Stochastic is reflecting overbought signals. The downside move also requires stability below 1.0385 again with daily closing. From here, we prefer to be neutral in our weekly report waiting for confirmation signals.

The trading range for this week is between the key support at 1.0135 and the key resistance at 1.0530.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1676" height="908">

AUD/CAD" width="1676" height="908">

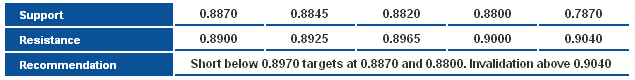

The rally on Friday was short-lived, as price resumed the bearish wave, and AUD/USD extended the downside move. 0.8870-support level managed to halt further decline, where we may see an minor upside bounce supported by the slight bullish divergence on RSI. However, the overall bearish trend remains intact, and the bearish scenario remains favored for the week.

NZD/USD NZD/USD" width="1676" height="908">

NZD/USD" width="1676" height="908">

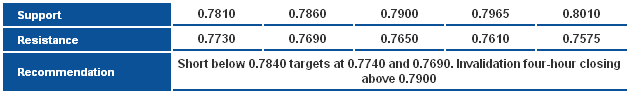

The pair started the week sharply lower, with a strong bearish gap, confirming the bearish view. Further downside is seen this week, following a potential minor upside pullback to fill the gap, targeting 0.7700 support level again.

GBP/JPY GBP/JPY" width="1596" height="762">

GBP/JPY" width="1596" height="762">

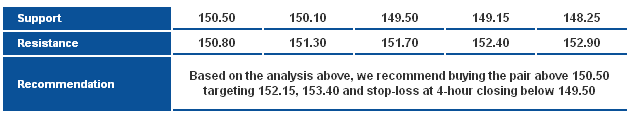

GBP/JPY is slightly biased to the downside, retesting the previous breached resistance –turned into support- at 150.50. Stability above the mentioned 150.50 keeps the positive outlook valid targeting initially 153.45 areas. Momentum indicators are pushing the pair lower and a confirmed breakout below 150.50 will push the pair lower targeting 148.75 and most importantly 147.65.

**Trading range expected this week is between the main support at 148.75 and the main resistance 154.00.

**Short-term trend is upside targeting 163.00 if 147.65 remains intact.

EUR/JPY EUR/JPY" width="1596" height="762">

EUR/JPY" width="1596" height="762">

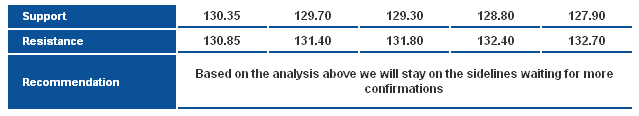

The pair failed to hold long above the main ascending support to turn lower once more breaking 23.6% Fibonacci opening way for extending bearish correction. On the other end, Stochastic is entering oversold areas which might revive positivity and therefore our weekly outlook is neutral for now awaiting more confirmations by observing the daily closings at 130.85 and 131.70.

**Trading range expected this week is between the main support at 129.90 and the main resistance at 133.75.

**Short-term trend is upside, targeting 140.00 if 124.95 remains intact.

EUR/GBP EUR/GBP" width="1676" height="908">

EUR/GBP" width="1676" height="908">

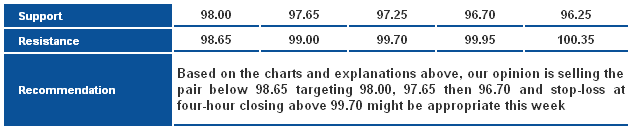

The pair moved sharply lower on Friday, and extends the move towards the key low at 0.8675, a break below this low may extend the downside move further probably towards the ascending support for the latest bullish wave show on chart. We prefer to be neutral awaiting further confirmation of the next potential direction.