EUR/USD for Thursday, September 26, 2013

Over the last week or so the euro has slowly but surely drifted lower moving back down below the 1.35 level, however in the last 12 hours it has reversed strongly and moved back above. For some time now, the 1.34 level had been causing the Euro headaches however last week it surged higher and moved through there to its highest level since February just shy of 1.3570. It finished the week slightly lower just below 1.3530 and in the first few days this week, it slowly but surely eased a little lower to just under 1.35. Several weeks ago the Euro fell strongly away from the resistance level at 1.34 back to below the support level at 1.32 and in doing so traded to its lowest level in seven weeks very close to 1.31. Despite a couple of rallies back above 1.32 a few weeks ago, it continued to drift lower and fall below 1.3150. For about a week or so a few weeks ago the Euro was placing upward pressure on the 1.34 level however it stood firm just like it has done so for the last few months. About a month ago the Euro made a run at the 1.34 level only to be turned away yet again and ease back under – this was the story for several weeks. Several weeks ago it retreated heavily from above 1.34 after having reached a six month high around 1.3450.

The surge higher in the few days last week is significant as despite its persistent attempts to push through the 1.34 level on many occasions, it had only been consistently repelled with ample supply. Looking at the bigger picture the Euro has spent most of the last six weeks or so trading within a range between 1.32 and 1.34. Back in early July the Euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there. It has been some time since the Euro has experienced a 24 hour period with as much range as the period earlier in July when it surged higher from from below 1.28 up to above 1.32. Prior to that jump, the Euro had been in a very solid medium term down trend after succumbing to the resistance at 1.29 and moving down below the key long term level of 1.28. This resulted in it trading at a multi-year low near 1.2750.

Throughout May and most of June the Euro surged higher to a four month high above 1.34. Before that in the first half of May, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the Euro has moved very strongly in both directions. Throughout February and March the Euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the Euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

A closely watched index of German business confidence rose for the fifth month in a row in September, reflecting the improved prospects for Europe’s largest economy and the 17-country euro currency union. The Ifo institute’s index, released Tuesday, edged up to 107.7 points from 107.6 in August. Market analysts had expected it to rise slightly more, to 108.0. The index is based on a survey of 7,000 companies about how they think the situation is now, and how they see things going in the coming months. Economist Carsten Brzeski at ING said the results showed the economy was “stabilizing at a high level.” Germany’s economy expanded 0.7 percent in the second quarter, helping the eurozone return to growth after six quarters of shrinking output. But recent figures for German industrial production and retail sales have been disappointing, raising concerns that the third quarter may not be as strong.

EUR/USD September 25 at 22:20 GMT 1.3522 H: 1.3537 L: 1.3464

During the early hours of the Asian trading session on Thursday, the Euro is just easing back towards 1.3520 after having surged higher to near 1.3540 over the last 12 hours. Since the middle of June, the Euro has generally fallen sharply from new highs above 1.34, and has been looking to return back to the significant lows around 1.2800, however in the last month or so it has recovered well and moved back to above 1.34 again in the middle of August. Current range: right around 1.3520.

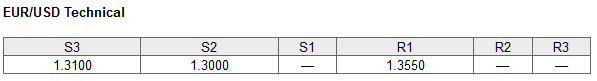

Further levels in both directions:

• Below: 1.3100 and 1.3000.

• Above: 1.3550.

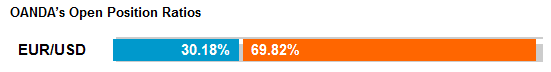

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has moved back above 30% as the Euro has crept below 1.35. The trader sentiment remains strongly in favour of short positions.

Economic Releases

- 08:00 EU M3 Money Supply (Aug)

- 08:30 UK Current Account (Q2)

- 08:30 UK GDP (3rd Est.) (Q2)

- 12:30 US Core PCE Price Index (Final) (Q2)

- 12:30 US GDP Annualised (Final) (Q2)

- 12:30 US GDP Price Index (Final) (Q2)

- 12:30 US Initial Claims (20/09/2013)

- 14:00 US Pending Home Sales (Aug)