The Euro did very well towards the end of last week as it used the solid support at 1.28 and surged higher not only through 1.29 but also the significant level of 1.30, before just easing back to close out the week. Over the last couple of weeks it has made several attempts to move through the 1.30 level only to be turned away by stiff resistance. At the same time the 1.28 level has provided solid support. A few weeks ago , the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level has been called upon over the last couple of weeks to provide additional support. A couple of weeks ago the Euro traded ever so slightly below 1.2800 and this level represented the lowest levels it had traded to since early April.

It is significant that it has moved so strongly through 1.30 as evidence was mounting that the 1.30 level was providing resistance and placing downward pressure on price. Over the last month the 1.32 level has become quite significant and has been an obstacle to the Euro moving higher (evident in the middle of the daily chart below). During this time, it has had some periods of little movement followed by sharp bursts. At the beginning of May the Euro exhibited a classic pin bar reversal candlestick pattern which was indicating the significant selling pressure it experienced at any price above the 1.32 level and likely lower prices to follow. This reinforced the significance of the 1.32 level and how it was going to take considerable effort to move through there. On this pin bar, it moved to near 1.325 and to its highest level in more than two months, since the end of February when it was falling heavily from up near 1.34. Just as quickly, it fell away and moved down to the six week low below 1.28. Prior to that, it was quiet and spent the most part of two weeks ago trading within a narrow range between 1.30 and 1.31, which reinforced how significant this two cent range was.

Over the last month the Euro has done well to weather the storm through February and March which saw it fall sharply from around 1.37, although its decline in the middle of May may be reversing this good fortune. Despite its strong rally in the first half of April, it was only a few weeks ago that the Euro dropped to its lowest level since the middle of November around 1.2750, so it did very well of late to move back strongly above 1.30, despite its recent lapse. The Euro has spent the best part of the last month consolidating above the key 1.30 and 1.29 levels after its decline throughout February. Sentiment has completely changed with the Euro and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards levels not seen in over 12 months above 1.37 before falling very sharply to below 1.28 and setting a 14 week low a month ago.

Germany has been having its problems, as economic releases continue to disappoint the markets. This is leading to rising concern about the health of the German economy. There was mixed news on Wednesday as Unemployment Change was awful. The key indicator shot up to 21 thousand, blowing past the estimate of 4 thousand. This was the indicator’s worst reading since June 2008. There was better news on the inflation front, as Preliminary CPI rebounded nicely and posted a 0.4% gain, beating the forecast of 0.2%. The week ended on a sour note as Retail Sales slumped, declining 0.4%. This was well below the estimate of 0.1%, and marked a four-month low. Where is the German economy headed? The Eurozone will find it more than difficult to get back on track if the German locomotive is not steaming in the right direction. Meanwhile, the employment picture in the Eurozone is going from bad to worse, with the Eurozone Unemployment Rate hitting 1.22%, while the quarterly Italian Unemployment Rate jumped to 11.9%.

EUR/USD June 2 at 23:55 GMT 1.2992 H: 1.2998 L: 1.2984 EUR/USD Technical" title="EUR/USD Technical" width="597" height="81">

EUR/USD Technical" title="EUR/USD Technical" width="597" height="81">

During the early hours of the Asian trading session on Monday, the Euro is trading just under the 1.30 level and is looking to place upward pressure and break through again. Since the start of February, it has fallen sharply from new highs above 1.37, although it has experienced some strong rallies in that time trying to claw back lost ground. Current range: trading right around 1.2990.

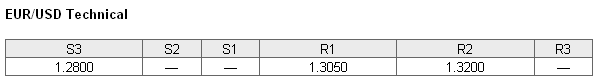

Further levels in both directions:

• Below: 1.2800.

• Above: 1.3050, and 1.3200

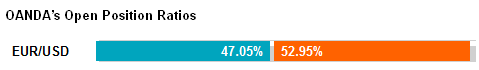

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has moved lower as the Euro has rallied to back over 1.30. The trader sentiment remains in favour of short positions.

Economic Releases

- 01:30 AU Inventories (Q1)

- 01:30 AU Retail trade (Apr)

- 05:00 JP Vehicle Sales (May)

- 07:00 UK Halifax House Price Index (3rd-7th) (May)

- 07:58 EU Manufacturing PMI (May)

- 08:28 UK CIPS/Markit Manufacturing PMI (May)

- 12:58 US Manufacturing PMI (May)

- 14:00 US Construction Spending (Apr)

- 14:00 US ISM Manufacturing (May)

- 21:00 US Vehicle Sales (May)