EUR/USD is under pressure, as the pair trades in the high-1.28 range in Thursday’s European session. The euro lost ground on Wednesday following weak GDP numbers out of the Eurozone. US inflation and manufacturing data also disappointed. There was better news on Thursday, as Eurozone inflation numbers matched the forecast. In the US, it’s a very busy day with four key releases – Building Permits, Core CPI, Unemployment Claims and the Philly Fed Manufacturing Index.

The markets were treated to some poor releases out of the Eurozone on Wednesday, as a host of GDP numbers pointed downwards. French and Eurozone GDPs fell by 0.2% while Italian GDP declined 0.5%. German GDP managed a weak gain of 0.1%, but this missed the estimate of 0.3%. These weak numbers point to contraction in the major economies of the Eurozone, which continue to struggle. The euro lost ground as a result. There was better news on Thursday, as Eurozone inflation numbers were positive. CPI posted a 1.2% gain, and Core CPI rose 1.0%. Both readings matched their estimates.

There has been a lot of volatility from EUR/USD recently, and one of the reasons has been statements from the ECB regarding negative deposit rates. Essentially, this means that depositors would be charged a fee for cash deposits held in European banks. ECB head Mario Draghi broached the idea earlier this month, and the euro dropped almost immediately. The reason? Negative deposit rates would lead to the flow of funds out of the Eurozone, as deposit holders seek better returns on their money. Earlier in the week, ECB member Ignazio Visco said that the ECB was open to the idea of negative deposits. Proponents of the idea argue that it would increase lending to businesses and help boost economic activity in the sluggish Eurozone. The ECB would be the first major central bank to adopt negative deposit rates, and if the ECB does take steps to adopt this measure, we can expect the euro to react.

The dollar has shown some broad strength against the major currencies, in part due to speculation that the Federal Reserve might terminate its current round of quantitative easing, thanks to an improving employment picture in the US. The Fed has not given any clues that it might scale back QE, which involves asset purchases of $85 billion every month. However, if the US recovery shows stronger signs of recovery, pressure will increase on the Fed to ease up on the QE, which would be dollar-positive. Any statements from the Fed regarding QE will likely have an impact on the movement of EUR/USD.

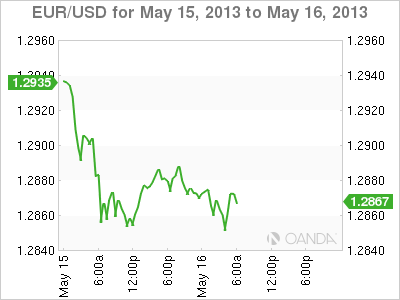

EUR/USD May 16 at 10:40 GMT

EUR/USD 1.2862 H: 1.2890 L: 1.2847 EUR/USD Technical" title="EUR/USD Technical" width="600" height="81">

EUR/USD Technical" title="EUR/USD Technical" width="600" height="81">

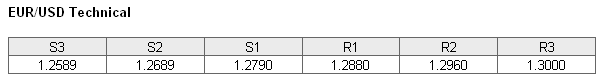

EUR/USD is under pressure, and has dropped to the mid-1.28 range. The pair is receiving support at 1.2790. The next support level is at 1.2689. On the upside, the pair faces weak resistance at 12880. This line could see more activity during the day. The next line of resistance is at 1.2960. This line has strengthened as the pair trades at lower levels.

- Current range: 1.2880 to 1.2960

- Below: 1.2790, 1.2689, 1.2589 and 1.2500

- Above: 1.2880, 1.2960, 1.3000, 1.3050, and 1.31

EUR/USD ratio currently has a slight majority of long positions, thanks to some recent sharp losses by the pair. The ratio is not showing much movement, but this could change if the pair continues to be active.

EUR/USD is struggling, and has dropped below the 1.29 line for the first time since early April. With four major releases out of the US later in the day, we could see some volatility from the pair.

EUR/USD Fundamentals

- 6:45 French Preliminary Non-Farm Payrolls. Estimate -0.3%. Actual: -0.1%.

- 8:00 Italian Trade Balance. Estimate 1.72B. Actual 3.24B.

- 9:00 Eurozone CPI. Estimate 1.2%. Actual 1.2%.

- 9:00 Eurozone Core CPI. Estimate 1.0%. Actual 1.0%.

- 9:00 Eurozone Trade Balance: Estimate 11.8B. Actual 18.7B.

- 11:45 US FOMC Member Eric Rosengren Speaks.

- 12:30 US Building Permits. Estimate 0.94M.

- 12:30 US Core CPI. Estimate 0.2%.

- 12:30 US Unemployment Claims. Estimate 332K.

- 12:30 US CPI. Estimate -0.3%.

- 12:30 US Housing Starts. Estimate 0.98M.

- 14:00 US Philly Fed Manufacturing Index. Estimate 2.5 points.

- 14:30 US Natural Gas Storage. Estimate 96B.

- 16:30 US FOMC Member Sarah Bloom Rosengren Speaks.