Investing.com’s stocks of the week

The EUR/USD pair little advanced and regained $1.2550 level as traders are covering short trades ahead of the major events of the week; the European Central Bank interest rate decision on Thursday and U.S Nonfarm payrolls October report on Friday. However the pair remains under selling pressure as divergence between the two central banks is becoming more obvious. Today, traders must keep an eye on eurozone October Markit Composite PMI and September Retail Sales (MoM) reports and ADP Nonfarm Employment Change for October and ISM Non-Manufacturing PMI data releases in U.S.

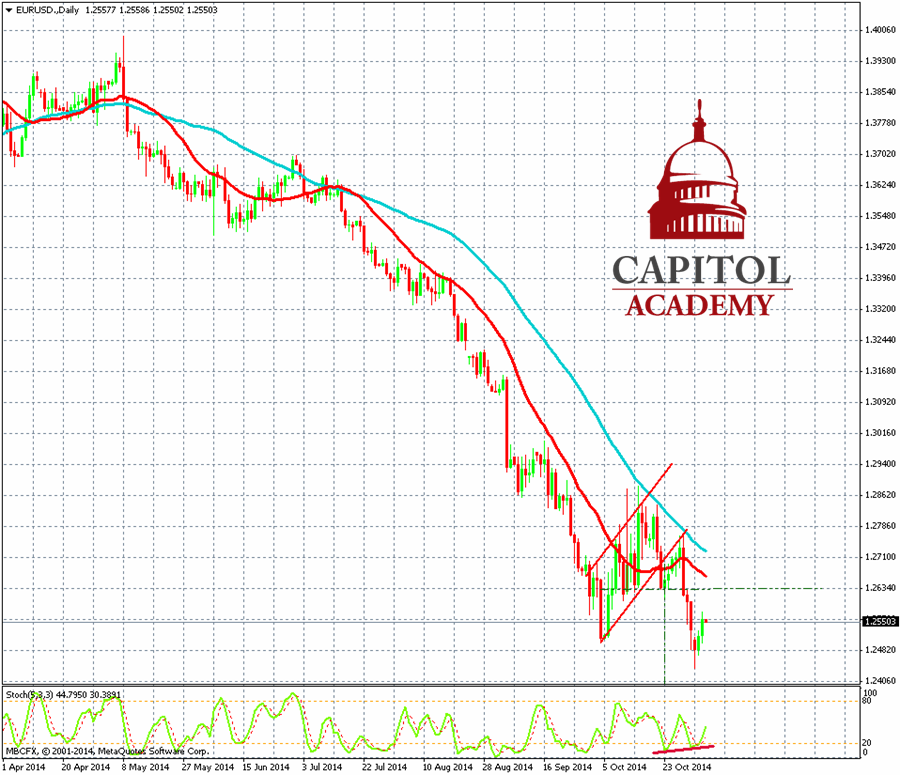

As we have expected the pair EUR/USD advanced to regain $1.2550-level after supported by the divergence observed on the stochastic. The divergence target is not reached yet, so further correction to the upside toward resistance area at $1.2634-- $1.2664 could not be excluded.

Though, the main outlook of the EUR/USD remains bearish, so any rally provides“Short” opportunities of the pair. The bearish flag settings remain valid, and any decline could reach $1.2228 potential flag target area. (Learn How trade Divergences and Flags patterns with Capitol Academy).