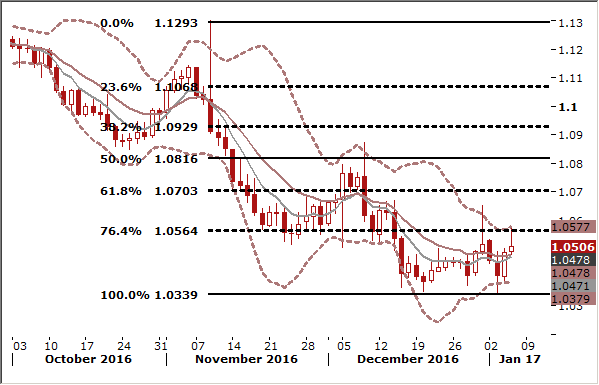

EUR/USD recovered after Eurozone inflation and FOMC minutes, as expected

- Minutes from the central bank's December meeting showed that almost all Federal Reserve policymakers thought the economy could grow more quickly because of fiscal stimulus under the Trump administration and many were eyeing faster interest rate increases.

- Policymakers were clear that the outlook for fiscal easing remained uncertain, but it could, if implemented, stoke higher inflation which would lead the central bank to raise borrowing costs more aggressively.

- "About half of the participants incorporated an assumption of more expansionary fiscal policy in their forecasts," according to the minutes from the December 13-14 meeting, referring to the 17 policymakers who participated. "Almost all also indicated that the upside risks to their forecasts for economic growth had increased," the minutes stated.

- U.S. short-term interest rate futures rose slightly after the release of the minutes but not enough to suggest altered expectations for the central bank's rate hike path this year.

- As we expected, higher-than-expected Eurozone inflation and FOMC minutes spurred profit-taking. The EUR/USD rose in Asia to 1.0575, extending its recovery from a 14-year low of 1.0340 touched on Tuesday. The dollar's retreat came as investors locked in gains from its two-month-old rally after Donald Trump won the U.S. presidential election.

- The near-term outlook is unclear. The key question is where the EUR/USD closes today. A white candle may signal a stronger recovery, but a shooting star will herald a continuation of downward move.

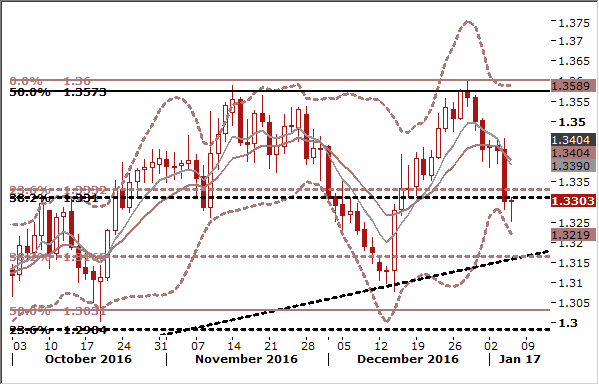

USD/CAD: Loonie benefited from global upswing in growth

- The CAD hit a three-week high against a weaker USD today, helped by upbeat global economic data as investors tempered greenback bets around the release of minutes from the U.S. Federal Reserve's December meeting.

- The loonie rose together with gains for other commodity-linked currencies after a batch of European data showed that French consumer confidence hit a nine-year high, business activity across the euro zone rose at the fastest pace in more than five years and inflation in the euro zone is its highest in over three years. This followed similarly upbeat reports this week on U.S., British, Chinese and Japanese business activity.

- Commodity-linked currencies, such as the CAD, the AUD and the NZD, tend to benefit more than many others from an upswing in growth.

- We stay USD/CAD short with trailing stop-loss lowered to 1.3380. Our long-term EUR/CAD short is also in good shape.

- Canada's trade report for November and employment report for December are due on Friday.