Greek and German finance ministers “didn’t even agree to disagree” The long-awaited meeting between German finance minister Schäuble and Greek finance minister Varoufakis turned out more or less as expected. Schauble reiterated Germany’s “tough love” position that Greece needs to continue its reforms to improve its competitiveness and should continue to work with troika as per prior agreements. Debt cut for Greece was not even on the table. The meeting following ECB's decision on Wednesday to stop accepting Greek bonds to finance Greek banks, puts pressure on the new-elected government to come up with an agreement and continue to work with troika to avoid a possible “Grexit”.

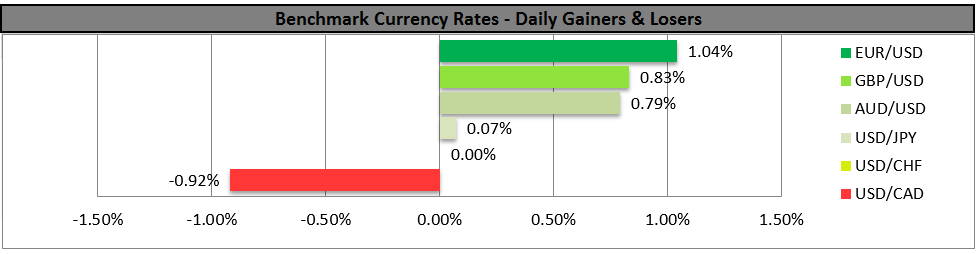

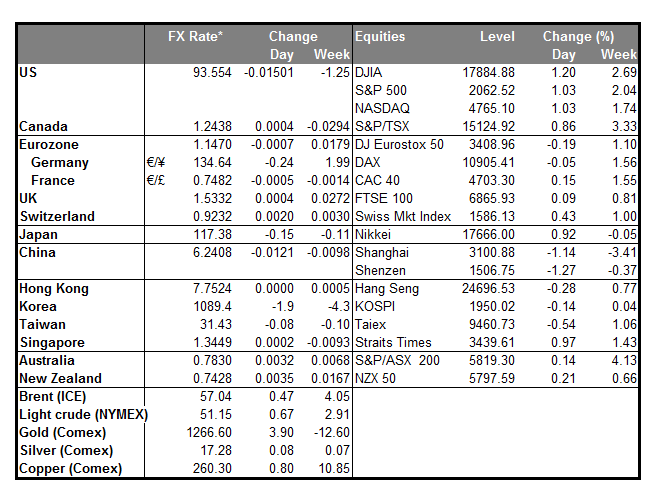

The Reserve Bank of Australia (RBA) released its quarterly statement of monetary policy, which includes updated economic growth and inflation forecasts. The statement, which was less dovish than expected, showed that the Bank revised down its outlook for inflation and growth rate for the first half of 2015. The Australian dollar gained however, as they kept the annual outlook for inflation within the Bank’s target range of 2%-3% and they expect the annual growth rate to pick up later this year. RBA cut its benchmark interest rate by 25 bps earlier this week, and given their assessment in this quarterly statement the reduction was appropriate to support demand and sustain growth and inflation outcomes consistent with their target. AUD/USD has recovered all of its losses following Tuesday’s rate cut, and given the optimistic statement it could extend its gains towards the key psychological level of 0.8000 in the near future.

The highlight of the day will be the US non-farm payrolls for January. The market consensus is for an increase in payrolls of 230k, down from 252k in December. The strong ADP report on Wednesday, suggested that nonfarm payroll figure may come in over 200k again, consistent with a firming labor market (although there is a lot of variation between the ADP and the NFP reports). In such a case, it will show that the US economy has added at least 200k jobs for 12 consecutive months. At the same time the unemployment rate is forecast to remain unchanged at 5.6%, while average hourly earnings are expected to accelerate a bit on a yoy basis. Such figures would be consistent with the FOMC’s more confident view about the employment market. In the statement following last week’s meeting, the Committee referred to “strong job gains” and a “solid pace” of growth, thereby another strong reading could support the dollar. However, unless it is accompanied by a solid wage growth, the decline in the unemployment rate and a figure above 200k are unlikely to convince the market for an early rate hike.

During the European day, Norway’s industrial production for December is forecast to fall at a slower pace than in November. This is likely to support the Norwegian krone.

Canada’s unemployment rate for January is expected to have remained unchanged at 6.7%, while the net change in employment is expected to show a rise after December’s decline. Nevertheless, following the strong downward employment report revisions in January, the market may remain skeptical about the figure and push USD/CAD higher, perhaps on concerns for further revisions in a later stage.

As for the speakers, Atlanta Fed President Dennis Lockhart speaks during the US session.

The Market

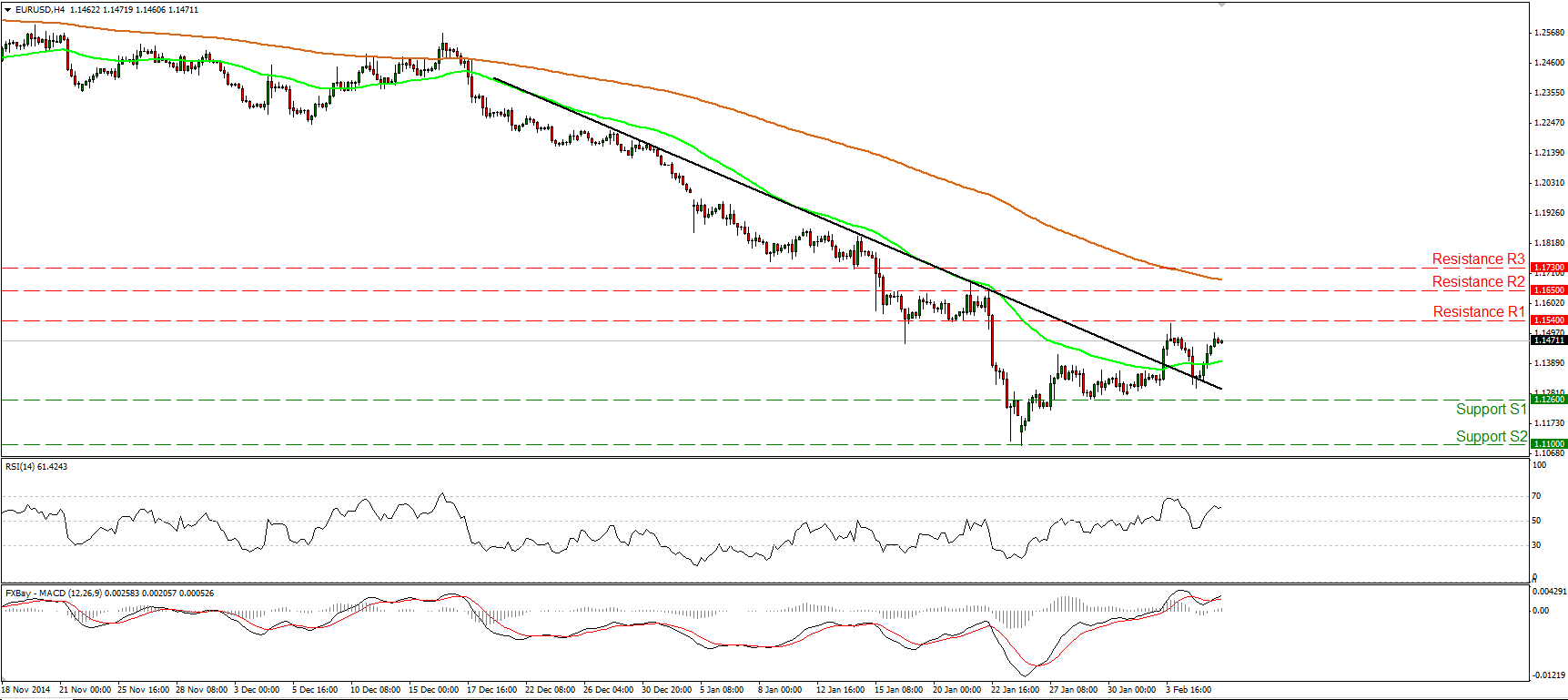

EUR/USD rebounds from the downtrend line

EUR/USD rebounded from near the near-term downtrend line, but the advance paused slightly below the 1.1540 (R1) resistance area. A clear move above that area is likely to confirm a forthcoming higher high on the 4-hour chart and perhaps challenge the 1.1650 (R2) obstacle. Our daily momentum studies support further upside extensions. The 14-day RSI moved higher after exiting its oversold territory and is now approaching its 50 line, while the daily MACD edged higher after crossing above its trigger line. As far as the broader trend is concerned, the price structure still suggests a longer-term downtrend. EUR/USD is printing lower peaks and lower troughs below both the 50- and the 200-day moving averages. Therefore, I would treat any possible upside extensions of yesterday’s rebound as a corrective phase before sellers pull the trigger again.

• Support: 1.1260 (S1), 1.1100 (S2), 1.1020 (S3).

• Resistance: 1.1540 (R1), 1.1650 (R2), 1.1730 (R3).

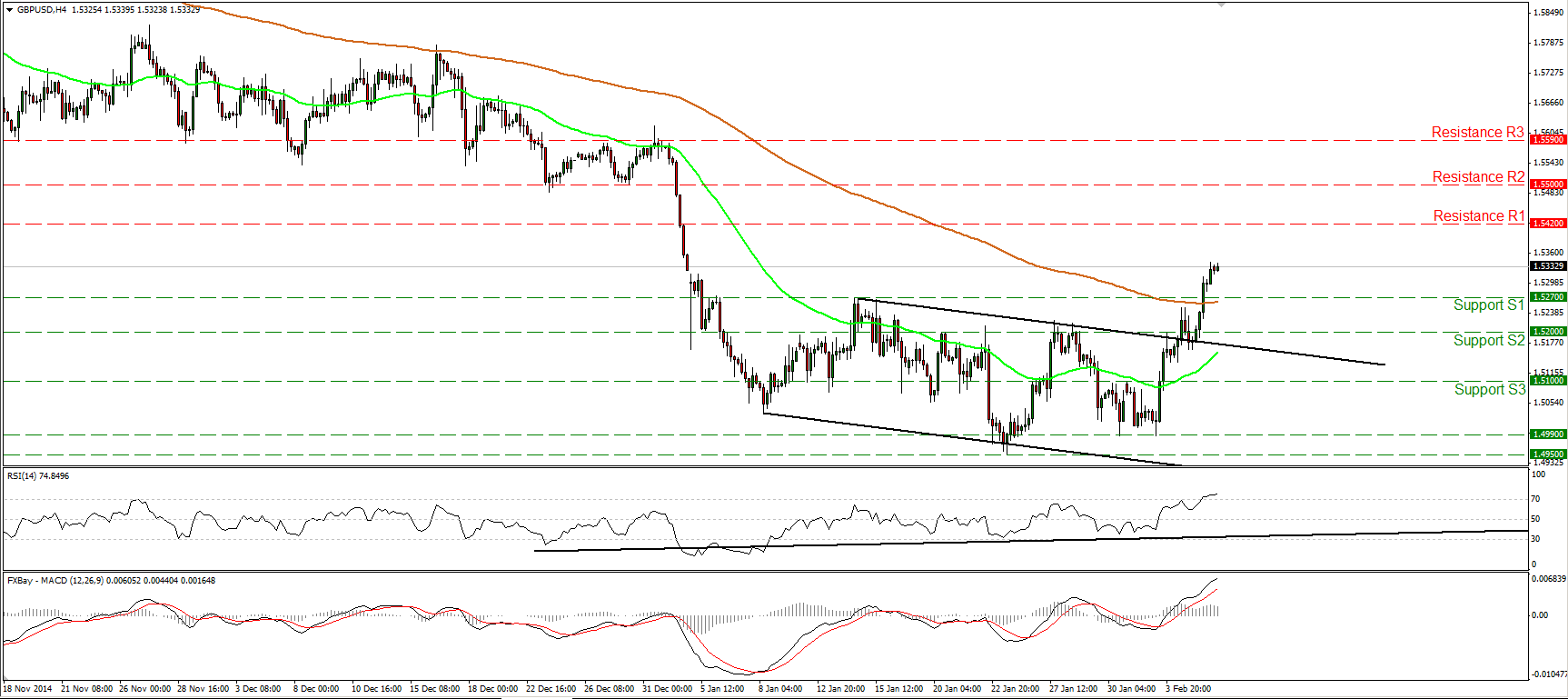

GBP/USD continues climbing

GBP/USD continued its surge, breaking above the resistance (turned into support) barrier of 1.5270 (S1). I would expect that break to extend the bullish wave towards the 1.5420 (R1) obstacle, defined by the lows of the 14th and the 28th of August 2013. Our daily momentum studies support the notion. The 14-day RSI edged higher and crossed above its 50 line, while the daily MACD, although negative, stands above its trigger and is pointing north. As for the broader trend, as long as Cable is trading below the 80-day exponential moving average, I would consider the overall downtrend to be intact, and I would see the recent advance or any extensions of it as a retracement, at least for now.

• Support: 1.5270 (S1), 1.5200 (S2), 1.5100 (S3).

• Resistance: 1.5420 (R1), 1.5500 (R2), 1.5590 (R3).

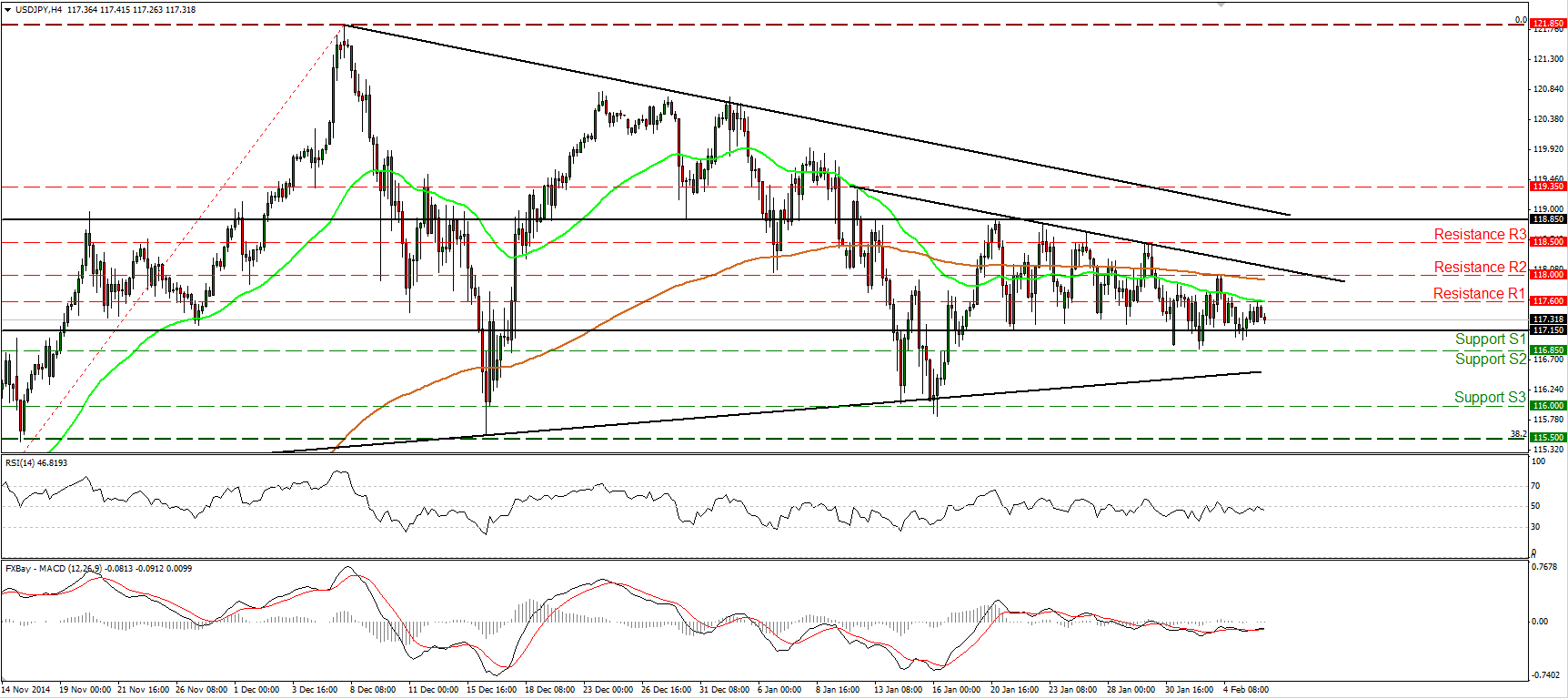

USD/JPY continues trendless

USD/JPY moved in a consolidative manner on Thursday, staying between the key support line of 117.15 (S1) and the resistance of 117.60 (R1). Bearing in mind that the rate is still in a sideways mode, I would maintain my flat stance as far as the near-term picture is concerned. Our oscillators continue to gyrate around their neutral levels, corroborating my view. On the daily chart, the rate is still trading above both the 50- and the 200-day moving averages, but it’s been also trading within a possible triangle formation. As a result, I would wait for an escape out of the pattern before making any assumptions about the continuation or the end of the longer-term uptrend.

• Support: 117.15 (S1), 116.85 (S2), 116.00 (S3).

• Resistance: 117.60 (R1), 118.00 (R2), 118.50 (R3).

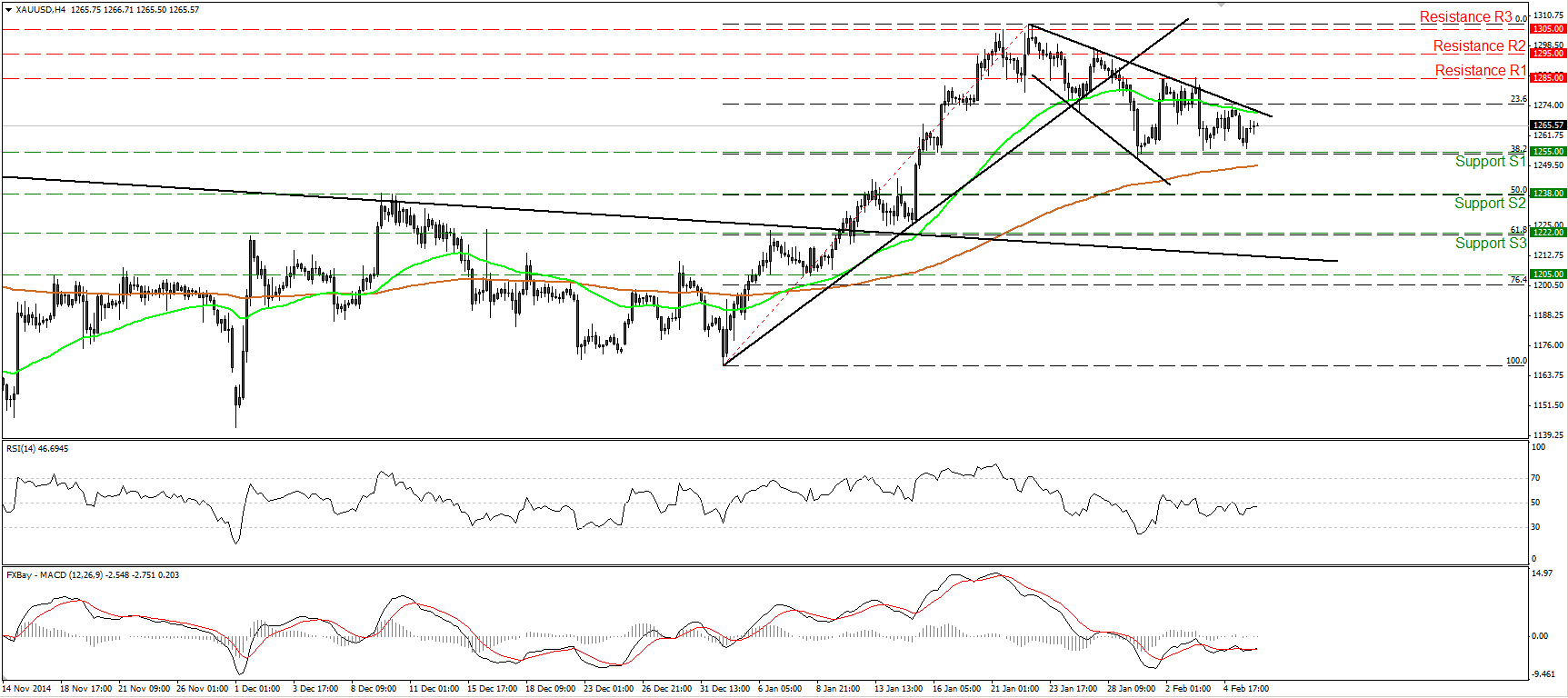

Gold hits again support near 1255

Gold slid somewhat on Thursday to find once again support marginally above the 1255 (S1) support barrier, which happens to be the 38.2% retracement level of the 2nd - 22nd of January advance. Nevertheless, the metal is still trading below the downside resistance line taken from the high of the 22nd of January, thus I would prefer to continue standing on the side-lines. As for the overall path, after the completion of an inverted head and shoulders formation on the 12th of January, on the daily chart, the price structure is still suggesting an uptrend in my view. The possibility for a lower high still exist and thus I would treat the current down wave as a corrective phase.

• Support: 1255 (S1), 1238 (S2), 1222 (S3).

• Resistance: 1285 (R1), 1295 (R2), 1305 (R3).

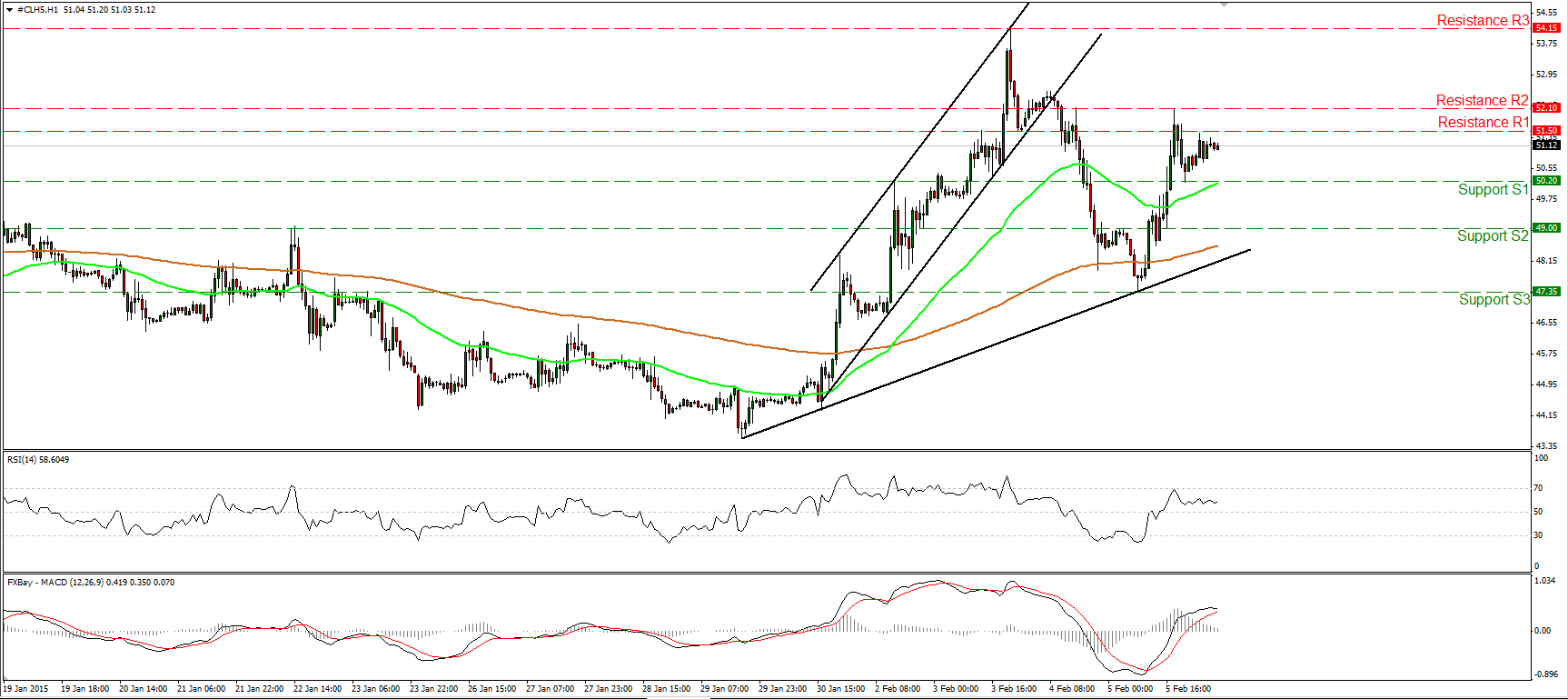

WTI rebounds from 47.35

WTI shoot up yesterday after finding support near the black uptrend line taken from the low of the 29th of January. The rally hit resistance at 52.10 (R2) and retreated to settle slightly below the 51.50 (R1) barrier. If the bulls are willing to continue yesterday’s momentum and drive the battle above 52.10 (R2), I would expect them to pull the trigger for another test near the 54.15 (R3) line. On the daily chart, WTI is still trading below both the 50- and the 200-day moving averages, but given the positive divergence between the daily oscillators and the price action, I would prefer to remain neutral as far as the overall picture is concerned.

• Support: 50.20 (S1), 49.00 (S2), 47.35 (S3).

• Resistance: 51.50 (R1) 52.10 (R2), 54.15 (R3).