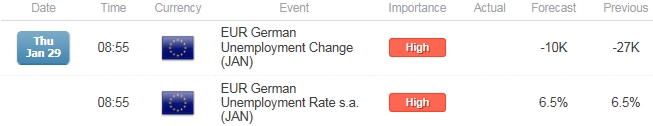

- German Unemployment to Contract for Fourth Consecutive Month in January.

- Jobless Rate to Hold at Record-Low of 6.5% for Second Month.

Trading the News: German Unemployment Change

Another 10K decline in German Unemployment may spur a larger rebound in EUR/USD as it props up the growth outlook for Europe’s largest economy.

What’s Expected:

Why Is This Event Important:

Prospects for a stronger economic recovery may boost the appeal of the single currency as it limits the European Central Bank’s (ECB) scope to further embark on its easing cycle, and the Governing Council may endorse a wait-and-see approach over the near to medium-term as it gauges the impact of their non-standard measures.

Expectations: Bullish Argument/Scenario

|

Release |

Expected |

Actual |

|

IFO Business Climate (JAN) |

106.5 |

106.7 |

|

Producer Price Index (YoY) (DEC) |

-1.4% |

-1.7% |

|

ZEW Survey- Expectations (JAN) |

40.0 |

48.4 |

Improved confidence paired with lower input costs may encourage German firms to further expand their labor force, and a marked decline in unemployment may generate a bullish reaction in EUR/USD as it raises the fundamental outlook for the monetary union.

Risk: Bearish Argument/Scenario

|

Release |

Expected |

Actual |

|

Trade Balance (NOV) |

20.4B |

17.9B |

|

Industrial Production s.a. (MoM) (NOV) |

0.3% |

-0.1% |

|

Factory Orders (MoM) (NOV) |

-0.8% |

-2.4% |

However, slowing demand from home and abroad may drag on hiring, and a dismal labor report may fuel bets for additional monetary support as ECB President Mario Draghi retains a very dovish tone for monetary policy.

How To Trade This Event Risk(Video)

Bullish EUR Trade: Unemployment Contracts 10K or Greater

- Need green, five-minute candle following the print to consider a long EUR/USD trade

- If market reaction favors buying Euro, long EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish EUR Trade: Labor Report Falls Short of Market Expectations

- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same setup as the bullish Euro trade, just in opposite direction

Read More:

CAD/JPY Triangle Forming At Major Support

Scalping the AUD/CAD Reversal- Shorts Favored Below 9928

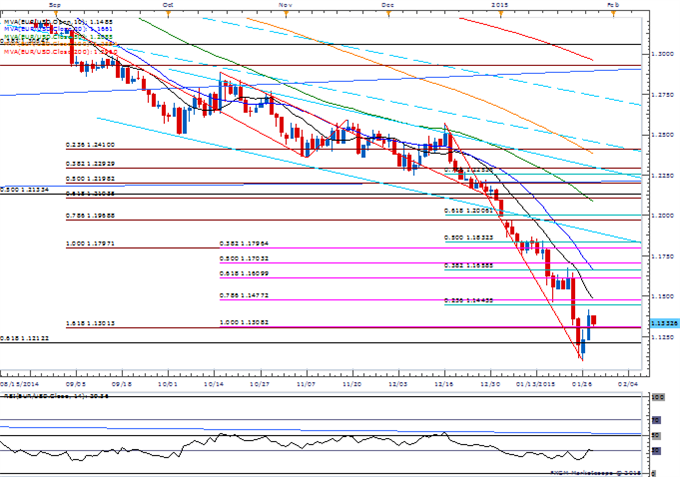

Potential Price Targets For The Release

EUR/USD Daily

Chart - Created Using FXCM Marketscope 2.0

- Waiting and watching the RSI for move back above 30 (oversold territory) to favor a larger rebound in EUR/USD.

- Interim Resistance: 1.1440 (23.6% retracement) to 1.1470 (78.6% expansion)

- Interim Support: 1.1096 (January low) to 1.1100 pivot

Impact that the GermanyUnemployment Change has had on EUR during the last release

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

DEC 2014 |

01/07/2015 08:55 GMT |

-5.0K |

-27.0K |

-2 |

-46 |

December 2014 Germany Unemployment Change

The number of unemployment in Germany slipped another 27K during the month of December, with the jobless rate pushing down to a record-low of 6.5%. Indeed, low inflation along with the robust recovery in the labor market may help to drive private-sector consumption within Europe’s largest economy, but the European Central Bank’s (ECB) may have little choice but to implement additional monetary support as it struggles to achieve its one and only mandate for price stability. Nevertheless, the market reaction to the better-than-expected print was short-lived as EUR/USD slipped back below the 1.1850 region, with the pair ending the day at 1.1822.