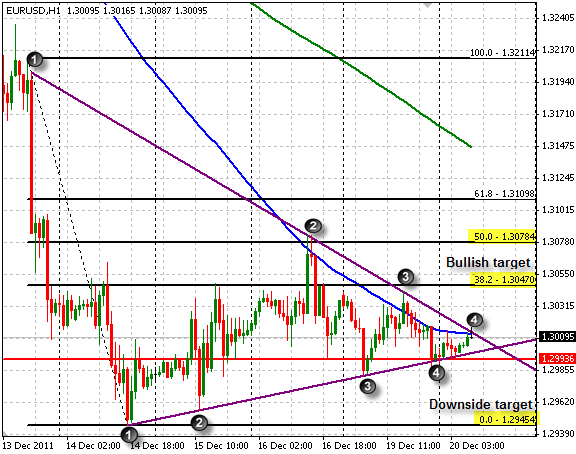

Since the exit of Asia from the market, things have been pretty quiet. The Nikkei closed up 0.50% and the Hang Seng is currently also up 0.50% with the Dow futures up 50 points. In Europe, the FTSE looks to open down around -0.2% and the DAX -0.3%. A look at the EUR/USD from an hourly perspective seems like the pair, from a technical stand point, may choose direction. At this point in the wedge we look for a close below support, or higher above the line of resistance. Also note that current trading is in the area of the 100 hour moving average (1.3012). If equities in Europe open lower, we may see the Euro trade in the same direction…. we’ll have to wait and see.

EUR/USD Makes a Break Higher

The Euro broke through the trend line resistance we made reference to earlier and is testing the 1.3047 target. The initial move came after Riksbank lowered interest rates 25 basis points (as expected) which propelled EUR/SEK higher and appears to have also put upward pressure on some of the Euro crosses. The rest of the move came after German business climate came in better than expected. If resistance is found at the 38.2% line we look back to the 100 hour moving average as the target; 1.30784 topside target.

Euro Firmer After 3-6 Month t-bill Auction goes Better than Expected…

EUR/USD re-tests previous high of 1.3084 following the release.

USD Weaker in Recent Trade

Risk appetite is higher in recent trade with the USD losing ground against all of the majors. The USD/CHF was finding support around .9350 until recently making a session low of .9350; a level not seen since December 12th. Continued selling in the USD could see the pair continue towards .9288, but in the case of a rebound we look back to .9350.