It’s a very quiet start to the new trading week, as the EUR/USD trades in the mid-128 range in Monday trading. The French and German markets are closed today for a holiday, so trading will be thin. In economic news, the US releases ended last week on a positive note, as UoM Consumer Sentiment climbed to a six-month high. Today’s sole release is from the US, as FOMC member Charles Evans delivers a speech in Chicago.

The markets were treated to a host of US releases last week, and for the most part, they didn’t like what they saw. US Inflation and manufacturing numbers fell below expectations, and housing numbers were also weak. Unemployment Claims, one of the most important releases and often a market-mover, had looked impressive in recent readings. However, the key indicator couldn’t keep pace last week, as the number of new claims jumped to 360 thousand, much higher than the estimate of 332 thousand. There was some good news from Building Permits, which were up nicely. On Friday, there was some relief from UoM Consumer Sentiment which jumped from 72.3 points to 83.7 points. This was well above the estimate of 77.9 points, and points to a sharp increase in consumer confidence. However, the host of weak US numbers we saw last week will again bring into question the extent of the US recovery, which has not been able to demonstrate sustained growth and continuous positive releases.

Meanwhile, the Eurozone continues to struggle, with many of the major economies suffering from recession. Germany, considered the locomotive of the Eurozone train, is also having a tough time of it, as underscored by last week’s disappointing data. ZEW Economic Sentiment, one of the most important German releases, came in well below the estimate. German CPI and WPI posted declines, indicating weak activity in the economy. GDP posted a slight gain of 0.1%, but this was below the 0.3% forecast. If the Eurozone is to have any hope of getting back on solid economic footing, it will need Germany to lead the way. Will we see a rebound from German numbers this week?

The Federal Reserve has not been in the spotlight recently, but that could change if the Fed modifies its current round of quantitative easing, which involves the purchase of $85 billion in assets each month. The Fed will be tempted to act if it feels that the US recovery has gained more traction, giving it some room to ease up on QE. On Thursday, John Williams, president of the Federal Reserve Bank of San Francisco, stated that the Fed could begin reducing QE this summer and terminate bond buying late in 2013. After every solid US release, (which have been heavily outnumbered by weak data), speculation rises that the Fed could take action. As the QE program is dollar negative, any moves by the Fed to wind up QE would be bullish for the dollar at the expense of the euro. So traders can expect any new developments (real or rumor) regarding QE to impact on the currency markets.

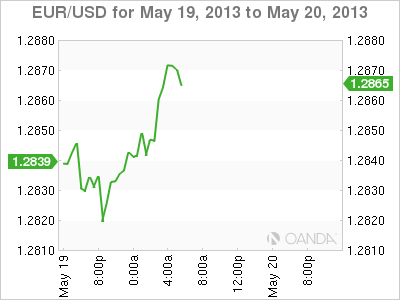

EUR/USD May 20 at 9:50 GMT

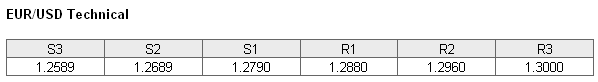

EUR/USD 1.2864 H: 1.2878 L: 1.2819 EUR/USD Technical" title="EUR/USD Technical" width="598" height="82">

EUR/USD Technical" title="EUR/USD Technical" width="598" height="82">

EUR/USD is not making much noise, as the pair continues to trade in the high-1.28 range. The pair is facing weak resistance at 1.2880. This line could break if the euro posts moves higher. There is a stronger support level at 1.2960. On the downside, there is support at 1.2790. This is followed by a support level at 1.2689.

- Current range: 1.2790 to 1.2880

- Below: 1.2790, 1.2689, 1.2589 and 1.2500

- Above: 1.2880,1.2960, 1.3000, 1.3050, and 1.31

EUR/USD ratio is pointing to slight movement towards short positions, as we begin the new trading week. Currently, this is not reflected in the pair, which has edged higher. The ratio has a slight majority of short positions, indicating a weak bias towards the US dollar posting more gains against the euro.

EUR/USD is steady, and remains under the 1.29 line. With no numbers being released out of Europe or the US, and a holiday shutting down the German and French markets, we can expect more of the same in thin trading on Monday.

EUR/USD Fundamentals

- 17:00 Federal Reserve Bank of Chicago President Charles Evans speaks