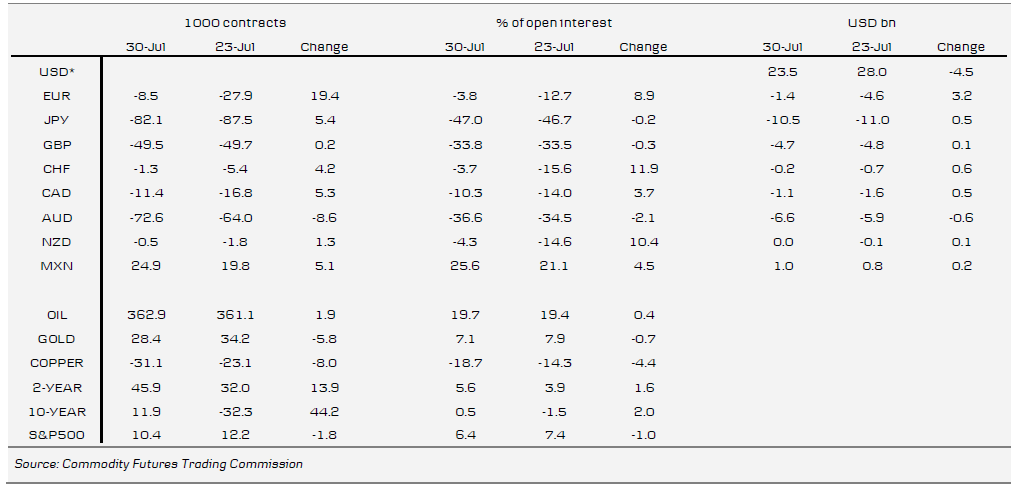

The latest IMM data covers the week from 23 July to 30 July.

Unwinding long dollar positions:

Unwinding long dollar positions:

The rebound in EUR/USD has coincided with an unwind of long dollar positions and by Tuesday last week net short EUR positions had been cut from 13% of open interest to 4%. This in turn should reduce upside risks on EUR/USD from positioning.

Investors remain very short AUD: Net short AUD positions remain near record levels, reflecting very bearish market sentiment and expectations of further easing by the RBA. While fundamentals continue to weigh on the Australian dollar, the current one-sided market sentiment does leave risks of a position squeeze and a temporary spike higher on positive Australian data surprises or a dovish signal by the Fed.

To Read the Entire Report Please Click on the pdf File Below.