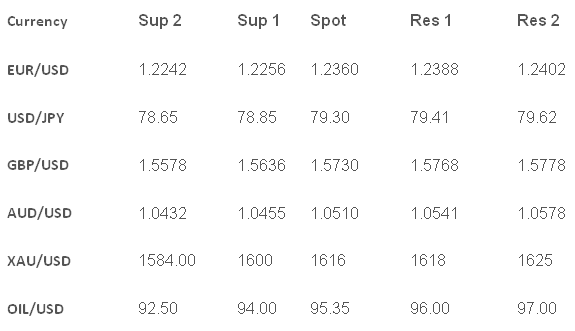

U.S. Dollar Trading (USD) stocks kicked higher again overnight and the safe haven USD weakened against most currencies with the EUR/USD the front runner. US July Housing data was mixed with Housing starts down at 746k vs. 757k forecast but July Building Permits at 812k vs. 770k previously. US Stocks gained on the back of European Banking stocks which soared higher on ECB optimism. Looking ahead, August UoM Consumer Sentiment forecast at 72.4 vs. 72.3 previously.

The Euro (EUR) the EUR/USD popped above 1.2300 and shot to 1.2350 with European banks surging on reports Spain should accept fiscal reforms for heavy ECB intervention in the bond markets. The rally was helped by German Chancellor Markel’s comments she backed ECB Draghi’s pledge to do ‘whatever it takes to save the Eurozone’. The Sterling (GBP) the GBP/USD finally broke 1.5700 decisively and pushed higher to 1.5750 on the back of the stocks and EUR/USD rally. July Retail Sales at 0.3% vs. -0.1% forecast helped underpin the move higher and traders are looking to extend the gains. Looking ahead, July German PPI forecast at 0.4% vs. -0.4% previously.

The Japanese Yen (JPY) Yen weakness continued overnight with USD/JPY pushing higher into the Y79 region after heavy sell orders where worked through and the crosses enjoyed fresh gains. EUR/JPY and GBP/JPY are both rallying higher and beginning uptrends. Continued Yen weakness will require US Data to remain upbeat and US stocks to remain strong. Australian Dollar (AUD) the AUD/USD moved back above 1.0500 but did match the gains of other majors with some slight hesitation to buy Aussie with the recent weakness still fresh in the traders minds. EUR/AUD and GBP/AUD both continued to push higher and could be the cause of the AUD/USD underperformance.

Oil & Gold (XAU) XAU/USD enjoyed the USD weakness to push higher towards $1615. OIL/USD broke $95 in strong trade with the key level now broken traders will look to the $100 a barrel level next.

Pairs to watch

USD/JPY to test Y79.50?

AUD/USD to retest 1.0600 now support found?

TECHNICAL COMMENTARY

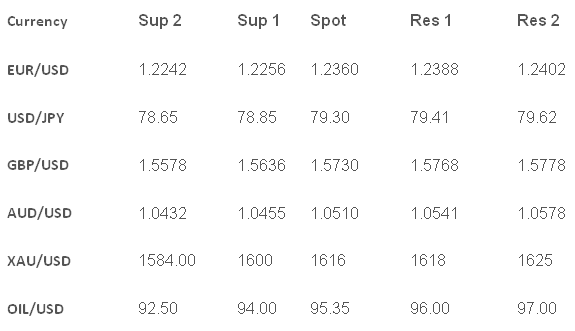

The Euro (EUR) the EUR/USD popped above 1.2300 and shot to 1.2350 with European banks surging on reports Spain should accept fiscal reforms for heavy ECB intervention in the bond markets. The rally was helped by German Chancellor Markel’s comments she backed ECB Draghi’s pledge to do ‘whatever it takes to save the Eurozone’. The Sterling (GBP) the GBP/USD finally broke 1.5700 decisively and pushed higher to 1.5750 on the back of the stocks and EUR/USD rally. July Retail Sales at 0.3% vs. -0.1% forecast helped underpin the move higher and traders are looking to extend the gains. Looking ahead, July German PPI forecast at 0.4% vs. -0.4% previously.

The Japanese Yen (JPY) Yen weakness continued overnight with USD/JPY pushing higher into the Y79 region after heavy sell orders where worked through and the crosses enjoyed fresh gains. EUR/JPY and GBP/JPY are both rallying higher and beginning uptrends. Continued Yen weakness will require US Data to remain upbeat and US stocks to remain strong. Australian Dollar (AUD) the AUD/USD moved back above 1.0500 but did match the gains of other majors with some slight hesitation to buy Aussie with the recent weakness still fresh in the traders minds. EUR/AUD and GBP/AUD both continued to push higher and could be the cause of the AUD/USD underperformance.

Oil & Gold (XAU) XAU/USD enjoyed the USD weakness to push higher towards $1615. OIL/USD broke $95 in strong trade with the key level now broken traders will look to the $100 a barrel level next.

Pairs to watch

USD/JPY to test Y79.50?

AUD/USD to retest 1.0600 now support found?

TECHNICAL COMMENTARY