EUR/USD has moved up on Tuesday, as the pair trades in the high-1.33 range. After a slow start on Monday, the markets will be busy, with major releases from the Eurozone and the US. The day started off well, with positive Eurozone and German ZEW Economic Sentiment releases. The German release was a notch above the estimate, while the Eurozone release beat the forecast. This will be followed by two key releases out of the US – Building Permits and Core CPI. The G8 wraps up a meeting in Northern Ireland, where discussions were held about an EU - US free trade pact.

All eyes will be glued to the US Federal Reserve on Wednesday, as the FOMC releases an highly anticipated policy statement. The markets will be particularly interested in what the Fed has to say with regard to its quantitative easing program. Speculation has been growing that the Fed could scale back QE later in the year, and this has had a very strong impact on stocks, commodities and the US dollar. The Federal Reserve has repeatedly stated that it will stick with the current program until it sees an improvement in the US economy, especially in the employment market. Currently the Fed purchases $85 billion in assets every month. If the Fed does take action or even hint at a move to tighten QE, we can expect the dollar to move higher against the major currencies.

ECB President Mario Draghi said on Tuesday that he is open to “non-standard” monetary tools, and would consider their implementation if needed. Draghi recently said that the ECB could consider a negative deposit rate, and the euro lost ground as a result. Other non-standard measures include long-term lending operations and modifying collateral requirements. Draghi has managed to steer the Eurozone through the worst of the debt crisis, but the zone remains stuck in its longest recession since its creation in 1999. If the ECB does take action and introduces negative rates or other non-standard measures, we could see a sharp reaction from EUR/USD.

G8 summits are often photo-ops with little substance, as confident world leaders reiterate their commitment to take steps to improve the global economy. However, this year’s G8 meeting in Northern Ireland served more than the usual fare, as the G8 leaders used the occasion to announce the start of negotiations on a free trade agreement between the European Union and the United States. The stakes are very high – the EU and US produce 50% of the global output, and a third of world trade. The deal would be the largest bilateral trade deal ever, and could add up to $100 billion to the economies of each partner. Negotiations will get underway in Washington next month, with a deal expected to be signed by the end of 2014. EUR/USD" width="400" height="300">

EUR/USD" width="400" height="300">

EUR/USD June 18 at 10:30 GMT

EUR/USD 1.3326 H: 1.3398 L: 1.3326

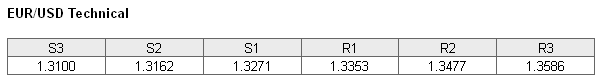

EUR/USD has gained ground in Tuesday trading. On the downside, 1.3271 continues to provide support. There is a stronger support level at 1.3162. On the upside, the pair has tested the 1.3353 line, but this line is holding up for now. This is followed by stronger resistance at 1.3477.

- Current range: 1.3271 to 1.3353

- Below: 1.3271, 1.3162, 1.3100, 1.3050 and 1.3000

- Above: 1.3353, 1.3477, 1.3586 and 1.3690

The EUR/USD ratio is showing slight movement towards short positions. Currently, we are not seeing this movement from the pair, as the euro has moved higher. Short positions enjoy a substantial majority, indicating strong trader bias towards a downwards correction for the pair.

EUR/USD continues to move higher, and is within striking distance of the 1.34 line. There was some good news from the euro as Eurozone and German economic sentiment numbers were positive, and with the US releasing some key events later, we could see more movement from the pair.

EUR/USD Fundamentals

- 6:00 ECB President Mario Draghi Speaks.

- 9:00 German ZEW Economic Sentiment. Estimate 38.2 points. Actual 38.5 points.

- 9:00 Eurozone ZEW Economic Sentiment. Estimate 29.4 points. Actual 30.6 points.

- 12:30 US Building Permits. Estimate 0.98M.

- 12:30 US Core CPI. Estimate 0.2%.

- 12:30 US CPI. Estimate 0.1%.

- 12:30 US Housing Starts. Estimate 0.95M.

- Day 2 of G8 Meetings.