The U.S. dollar declined at the beginning of the week as investors traded currencies in anticipation of an upcoming speech by the Chairman of the Federal Reserve. Chairman Ben Bernanke was expected to deliver clues on any possible changes in monetary policy. The President of The Federal Reserve Bank of San Francisco, John Williams, stated that the central bank would probably have to expand the asset-purchasing program into the second half of 2013 in order to lower unemployment.

The dollar remained under pressure after President Barack Obama suggested that the markets may go “haywire” if U.S. lawmakers don’t approve an increase of the debt ceiling. There were no economic news reports out of the U.S., however, data released on Friday confirmed the country’s Trade deficit expanded unexpectedly from 42.1 to 48.7 billion U.S. dollars.

The Canadian dollar declined against its South Pacific peers on comments by China’s Securities regulator who stated that foreign investors might opt for putting their money into Chinese firms. The loonie dipped against the majority of its counterparts after Chinese stocks rallied the most in four weeks.

The euro advanced for a third consecutive day against the U.S. currency, but erased some of its early gains subsequent to a release which showed that Industrial Output declined slightly during the month of November. The lackluster news prompted speculators to sell off the euro despite remarks by the region’s policy makers stating that the worst of the sovereign debt crisis may be over.

The Swiss franc fell on statements which gave the impression the debt crisis in the euro region is over. The British pound traded lower against the greenback amid worries over possible changes that may take place between the U.K. and the European Union. The pound was also weighed down by news that the U.K. is re-negotiating the terms of its membership in the E.U. Sentiment towards the sterling was fragile as the country released a flurry of weak data during the previous days.

In Japan, the yen reached the lowest price against the U.S. dollar since 2010 on speculation Prime Minister Shinzo Abe will name a central bank governor who is ready to implement aggressive monetary easing in order to debase the currency further. The yen reached new lows against the shared currency after Abe urged the Bank of Japan to raise the inflation target from 1 to 2 percent.

Lastly, the South Pacific currencies rose as risk appetite improved in anticipation of the Federal Reserve Chairman’s speech. The New Zealand dollar rallied versus all of its peers following an announcement confirming that Home Prices and Retail Spending on credit increased. Investors were confident that Federal Reserve Chairman Bernanke would provide indications as to whether the central bank was planning to put an early end to the quantitative easing program.

EUR/USD- Worst May Be Behind

The euro gained against the U.S. dollar after the European Central Bank’s governors intimated that the worst may be over. This prompted the shared currency to climb to the highest since the start of 2012. But less than stellar economic news caused the euro to decline.

According to official euro region data, Industrial Production dipped 0.3 percent in November, despite forecasts for a 0.1 percent increase. This started a massive sell-off of the euro as investors were trying to capture their gains. In the previous week, the ECB left the benchmark interest rates unchanged and this strengthened the euro against the greenback.

EUR/USD" title="EUR/USD" width="624" height="332" />

EUR/USD" title="EUR/USD" width="624" height="332" />

GBP/USD- U.K. In Negotiations

Investors grew concerned over the terms of a possible agreement between the E.U. and the U.K. after British Prime Minister David Cameron played down the possibility Britain may leave the E.U. Mr. Cameron indicated he’d like to see it remain a part of the Union.

GBP/USD" title="GBP/USD" width="624" height="330" />

GBP/USD" title="GBP/USD" width="624" height="330" />

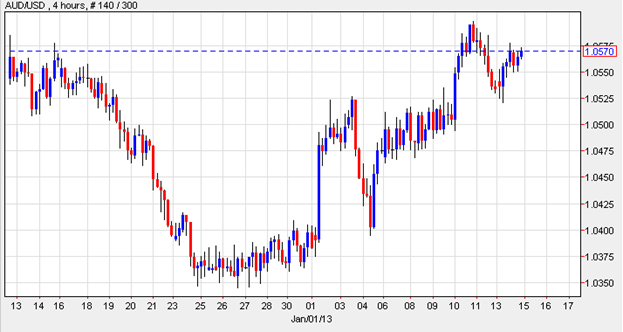

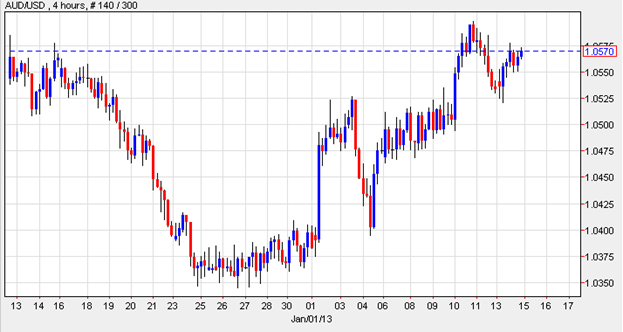

AUD/USD- Aussie Responds To Stock Rally

The Australian dollar advanced against the U.S. currency as a rally in Asian stocks increased demand for high yield assets. The aussie extended gains versus the greenback and the yen following comments by the President of the Federal Reserve Bank of Chicago wherein he indicated that the central bank should leave policy unchanged to bolster growth in the world’s largest economy.

On the data front, reports showed that Job Advertisements declined 3.80 percent at the end of 2012. Other releases revealed that Home Loan Approvals fell. The aussie remained supported in anticipation of the Federal Reserve Chairman’s speech.

AUD/USD" title="AUD/USD" width="623" height="332" />

AUD/USD" title="AUD/USD" width="623" height="332" />

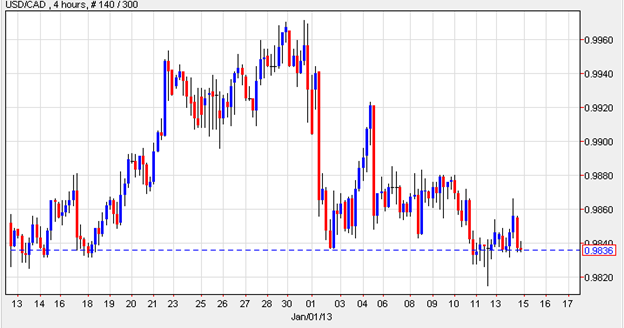

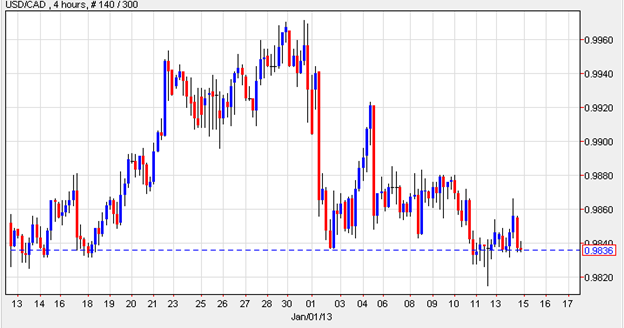

USD/CAD- Loonie Weakens

The Canadian dollar fell against its American counterpart after Chinese stocks gained the most in one month, following a statement by Guo Shuqing, who is the Chairman of the Chinese Securities Regulatory Commission. In his comments, Mr. Shuqing suggested that the country is capable of increasing quotas to let foreign investors purchase stocks and bonds in the nation’s firms. The greenback remained little changed versus the loonie ahead of the Fed Chairman’s speech.

USD/CAD" title="USD/CAD" width="624" height="328" />

USD/CAD" title="USD/CAD" width="624" height="328" />

USD/JPY- Abe Helps Fed Chairman

The yen extended losses against the U.S. dollar on speculation the next governor of the Bank of Japan will implement more aggressive easing measures to bolster growth and debase the currency. Prime Minister Abe announced that Japan will purchase U.S. government bonds in order to weaken the yen.

In his speech, Mr. Abe, stated that he’s considering a 50 trillion yen ($558 billion) fund to purchase foreign securities. This would help the Federal Reserve with its yields. For Mr. Bernanke, the timing is perfect because with the improvements the economy is showing, the yields will probably rise in the next 6 to 12 months.

USD/JPY" title="USD/JPY" width="624" height="331" />

USD/JPY" title="USD/JPY" width="624" height="331" />

Today’s Outlook

Today’s economic calendar shows that the Euro region will release the Trade Balance as well as German, Spanish and Italian CPI. The U.K. will report on CPI and Core CPI, the House Price Index, and PPI Input and Output. The U.S. will announce PPI and Core PPI, Core Retail Sales, and the New York Empire State Manufacturing Index. Australia will issue figures on the Westpac Consumer Sentiment.

The dollar remained under pressure after President Barack Obama suggested that the markets may go “haywire” if U.S. lawmakers don’t approve an increase of the debt ceiling. There were no economic news reports out of the U.S., however, data released on Friday confirmed the country’s Trade deficit expanded unexpectedly from 42.1 to 48.7 billion U.S. dollars.

The Canadian dollar declined against its South Pacific peers on comments by China’s Securities regulator who stated that foreign investors might opt for putting their money into Chinese firms. The loonie dipped against the majority of its counterparts after Chinese stocks rallied the most in four weeks.

The euro advanced for a third consecutive day against the U.S. currency, but erased some of its early gains subsequent to a release which showed that Industrial Output declined slightly during the month of November. The lackluster news prompted speculators to sell off the euro despite remarks by the region’s policy makers stating that the worst of the sovereign debt crisis may be over.

The Swiss franc fell on statements which gave the impression the debt crisis in the euro region is over. The British pound traded lower against the greenback amid worries over possible changes that may take place between the U.K. and the European Union. The pound was also weighed down by news that the U.K. is re-negotiating the terms of its membership in the E.U. Sentiment towards the sterling was fragile as the country released a flurry of weak data during the previous days.

In Japan, the yen reached the lowest price against the U.S. dollar since 2010 on speculation Prime Minister Shinzo Abe will name a central bank governor who is ready to implement aggressive monetary easing in order to debase the currency further. The yen reached new lows against the shared currency after Abe urged the Bank of Japan to raise the inflation target from 1 to 2 percent.

Lastly, the South Pacific currencies rose as risk appetite improved in anticipation of the Federal Reserve Chairman’s speech. The New Zealand dollar rallied versus all of its peers following an announcement confirming that Home Prices and Retail Spending on credit increased. Investors were confident that Federal Reserve Chairman Bernanke would provide indications as to whether the central bank was planning to put an early end to the quantitative easing program.

EUR/USD- Worst May Be Behind

The euro gained against the U.S. dollar after the European Central Bank’s governors intimated that the worst may be over. This prompted the shared currency to climb to the highest since the start of 2012. But less than stellar economic news caused the euro to decline.

According to official euro region data, Industrial Production dipped 0.3 percent in November, despite forecasts for a 0.1 percent increase. This started a massive sell-off of the euro as investors were trying to capture their gains. In the previous week, the ECB left the benchmark interest rates unchanged and this strengthened the euro against the greenback.

EUR/USD" title="EUR/USD" width="624" height="332" />

EUR/USD" title="EUR/USD" width="624" height="332" />GBP/USD- U.K. In Negotiations

Investors grew concerned over the terms of a possible agreement between the E.U. and the U.K. after British Prime Minister David Cameron played down the possibility Britain may leave the E.U. Mr. Cameron indicated he’d like to see it remain a part of the Union.

GBP/USD" title="GBP/USD" width="624" height="330" />

GBP/USD" title="GBP/USD" width="624" height="330" />AUD/USD- Aussie Responds To Stock Rally

The Australian dollar advanced against the U.S. currency as a rally in Asian stocks increased demand for high yield assets. The aussie extended gains versus the greenback and the yen following comments by the President of the Federal Reserve Bank of Chicago wherein he indicated that the central bank should leave policy unchanged to bolster growth in the world’s largest economy.

On the data front, reports showed that Job Advertisements declined 3.80 percent at the end of 2012. Other releases revealed that Home Loan Approvals fell. The aussie remained supported in anticipation of the Federal Reserve Chairman’s speech.

AUD/USD" title="AUD/USD" width="623" height="332" />

AUD/USD" title="AUD/USD" width="623" height="332" />USD/CAD- Loonie Weakens

The Canadian dollar fell against its American counterpart after Chinese stocks gained the most in one month, following a statement by Guo Shuqing, who is the Chairman of the Chinese Securities Regulatory Commission. In his comments, Mr. Shuqing suggested that the country is capable of increasing quotas to let foreign investors purchase stocks and bonds in the nation’s firms. The greenback remained little changed versus the loonie ahead of the Fed Chairman’s speech.

USD/CAD" title="USD/CAD" width="624" height="328" />

USD/CAD" title="USD/CAD" width="624" height="328" />USD/JPY- Abe Helps Fed Chairman

The yen extended losses against the U.S. dollar on speculation the next governor of the Bank of Japan will implement more aggressive easing measures to bolster growth and debase the currency. Prime Minister Abe announced that Japan will purchase U.S. government bonds in order to weaken the yen.

In his speech, Mr. Abe, stated that he’s considering a 50 trillion yen ($558 billion) fund to purchase foreign securities. This would help the Federal Reserve with its yields. For Mr. Bernanke, the timing is perfect because with the improvements the economy is showing, the yields will probably rise in the next 6 to 12 months.

USD/JPY" title="USD/JPY" width="624" height="331" />

USD/JPY" title="USD/JPY" width="624" height="331" />Today’s Outlook

Today’s economic calendar shows that the Euro region will release the Trade Balance as well as German, Spanish and Italian CPI. The U.K. will report on CPI and Core CPI, the House Price Index, and PPI Input and Output. The U.S. will announce PPI and Core PPI, Core Retail Sales, and the New York Empire State Manufacturing Index. Australia will issue figures on the Westpac Consumer Sentiment.