In the short term the euro has found some much needed support right around 1.2850 which has held it up recently and just for the moment, stopped the strong falls it is presently experiencing. It has ever so slightly traded below 1.2850 and these levels represent the lowest levels it has traded to since early April. It has also become evident over the last few days, especially on the 4 hourly chart below, that the 1.30 level is now providing some resistance and placing pressure on price. The Euro finished last week moving back down through the long term key level of 1.30. It did spend the last couple of weeks trading right around the 1.31 level and finding support and resistance at 1.30 and 1.32 respectively, however the former level has now been broken. In finishing last week below 1.30, it moved to levels not seen in over a month. Over the last month the 1.32 level has become quite significant and has been an obstacle to the Euro moving higher (evident in the right half of the daily chart below). During this time, it has had some periods of little movement followed by sharp bursts.

A couple of weeks ago, the Euro exhibited a classic pin bar reversal candlestick pattern which was indicating the significant selling pressure it experienced at any price above the 1.32 level and likely lower prices to follow. This reinforced the significance of the 1.32 level and how it was going to take considerable effort to move through there. On this pin bar, it moved to near 1.325 and to its highest level in more than two months, since the end of February when it was falling heavily from up near 1.34. Just as quickly, it has fallen away and now moved down to the one month low below 1.30. Prior to that, it was quiet and spent the most part of two weeks ago trading within a narrow range between 1.30 and 1.31, which reinforced how significant this two cent range was. In the middle of April the Euro surged up towards 1.32 and ran into a wall of resistance at that level, to then be followed by a sharp fall back towards the then support level at 1.30.

Over the last month the Euro has done well to weather the storm through February and March which saw it fall sharply from around 1.37, although its decline over the last week or so may be reversing this good fortune. Despite its strong rally in the first half of April, it was only a few weeks ago that the Euro dropped to its lowest level since the middle of November around 1.2750, so it did very well of late to move back strongly above 1.30, despite its recent lapse. The Euro has spent the best part of the last month consolidating above the key 1.30 and 1.29 levels after its decline throughout February. Over the last couple of weeks, the 1.30 level has been called upon again to prop up price, although it may have reversed roles now as it is providing some resistance to movement higher. Sentiment has completely changed with the Euro and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards levels not seen in over 12 months above 1.37 before falling very sharply to below 1.28 and setting a 14 week low a month ago.

This week French and Eurozone GDPs fell by 0.2% while Italian GDP declined 0.5%. German GDP managed a weak gain of 0.1%, but this missed the estimate of 0.3%. These weak numbers point to contraction in the major economies of the Eurozone, which continue to struggle. There was better news on Thursday, as Eurozone inflation numbers were positive. CPI posted a 1.2% gain, and Core CPI rose 1.0%. Both readings matched their estimates. There has been a lot of volatility from EUR/USD recently, and one of the reasons has been statements from the ECB regarding negative deposit rates. Essentially, this means that depositors would be charged a fee for cash deposits held in European banks. ECB head Mario Draghi broached the idea earlier this month, and the euro dropped almost immediately. The reason? Negative deposit rates would lead to the flow of funds out of the Eurozone, as deposit holders seek better returns on their money. Earlier in the week, ECB member Ignazio Visco said that the ECB was open to the idea of negative deposits. Proponents of the idea argue that it would increase lending to businesses and help boost economic activity in the sluggish Eurozone. The ECB would be the first major central bank to adopt negative deposit rates, and if the ECB does take steps to adopt this measure, we can expect the euro to react.

EUR/USD May 17 at 00:10 GMT 1.2885 H: 1.2929 L: 1.2846 EUR/USD Technical" title="EUR/USD Technical" width="600" height="79">

EUR/USD Technical" title="EUR/USD Technical" width="600" height="79">

During the early hours of the Asian trading session on Friday, the Euro is trying to rally back towards 1.29 after a sudden drop back to 1.2870. Since the start of February, it has fallen sharply from new highs above 1.37, although it has experienced some strong rallies in that time trying to claw back lost ground. Current range: trading right around 1.2890.

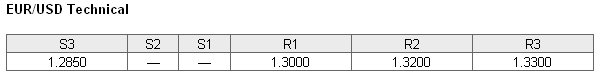

Further levels in both directions:

• Below: 1.2850.

• Above: 1.3000, 1.32000 and 1.3300.

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has risen sharply in the last couple of days as the Euro has fallen back down below 1.29. The trader sentiment has shifted and is now in favour of long positions.

Economic Releases

- 12:30 CA CPI (Apr)

- 12:30 CA Wholesale Sales (Mar)

- 13:55 US Univ of Mich Sent. (Prelim.) (May)

- 14:00 US Leading Indicator (Apr)