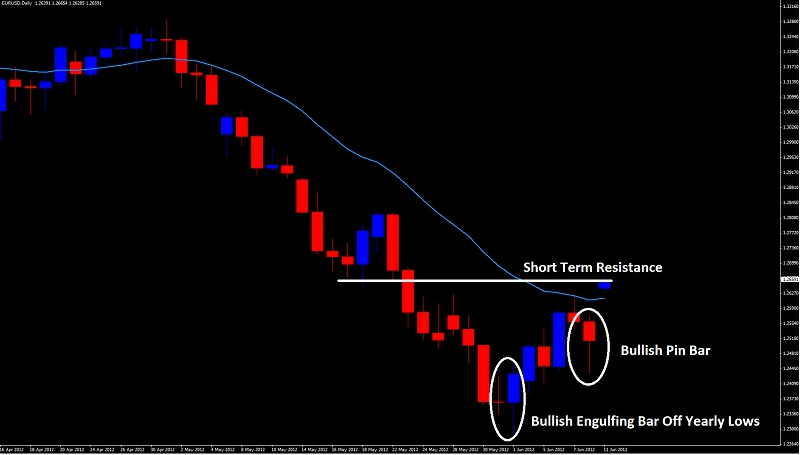

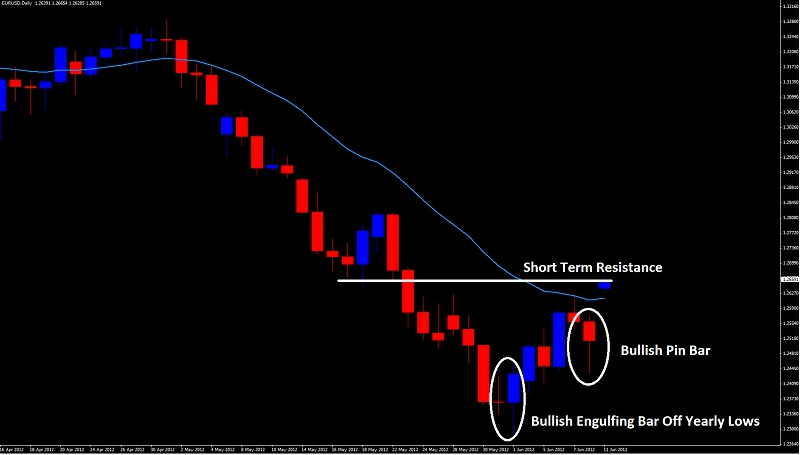

EUR/USD

As we wrote last week in our forex market commentary, wer expected price to go higher from the bullish engulfing bar setup off the yearly lows and higher the pair went. Aided by a Spanish bank bailout announcement over the weekend, and the pair has gapped higher following a bullish pin bar setup from Friday. The pair has cleared a major hurdle in the 1.2625 level and the daily 20ema, so short-term, we expect it to run higher. Keep in mind, this pair is so politically driven that any news out of Europe can somehow make people forget how bad things really are there. Case in point, originally Spain only needed about €40M to help out their banks, and yet €100M is the official number…for now. But regardless, they needed more, and they got it so short-term bullish, but we expect this to fade come later this week or next when more comes out of the closet.

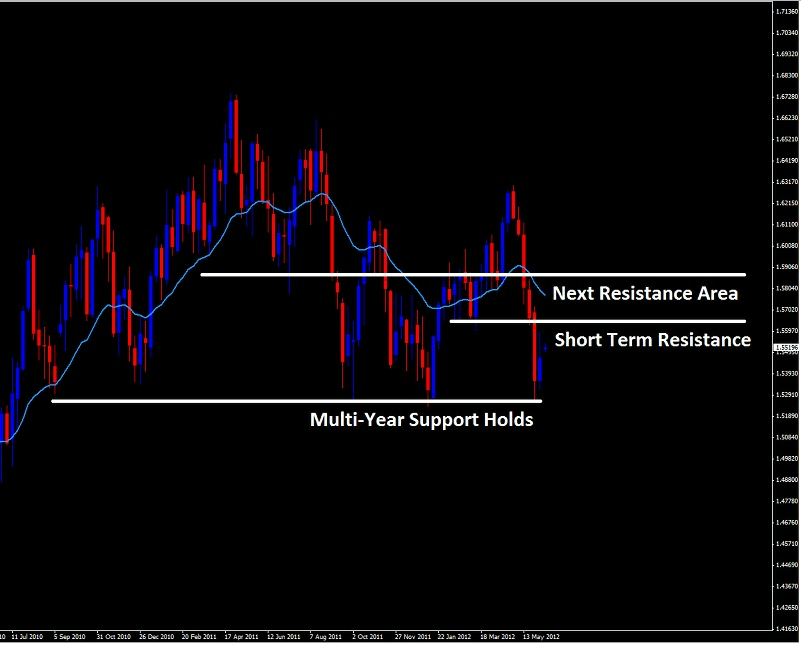

GBP/USD

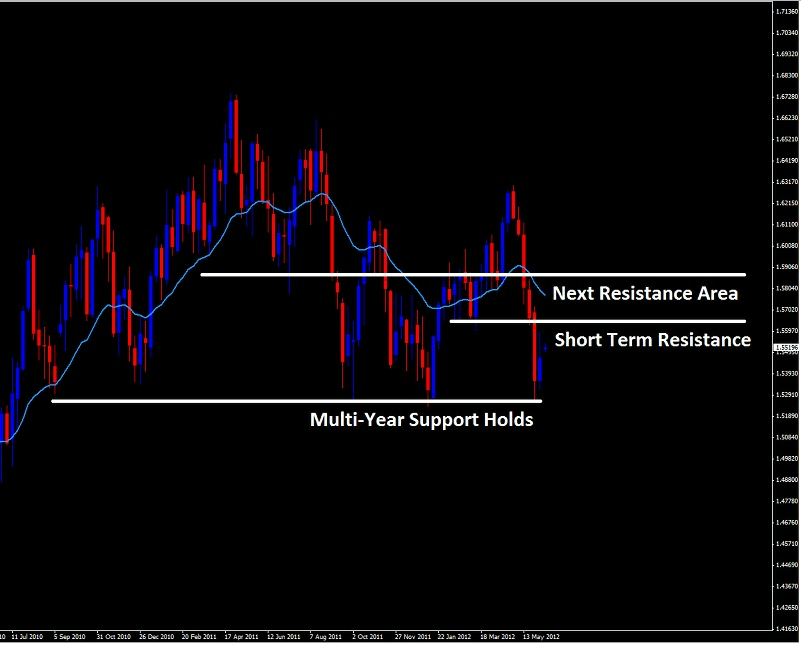

Last week we commented on how the cable had sold off for 5 consecutive weeks and when looked at historically and quantitatively, this was quite extreme, thus suggesting a bounce. Bounce the pair did, holding the multi-year lows at 1.5260 and ending just shy of 1.5500. But the weekend gap has produced a decent gain which we expect to close by Monday’s London session. Upside looks worse for cable than it does for euro short-term, as the weekly high will have to be cleared which is 1.5600. We prefer selling rallies at 1.56452 or 1.5821 for a move back down to 1.5300 as we feel the pair has just been washing off the oversold status last week, and will resume the downtrend shortly.

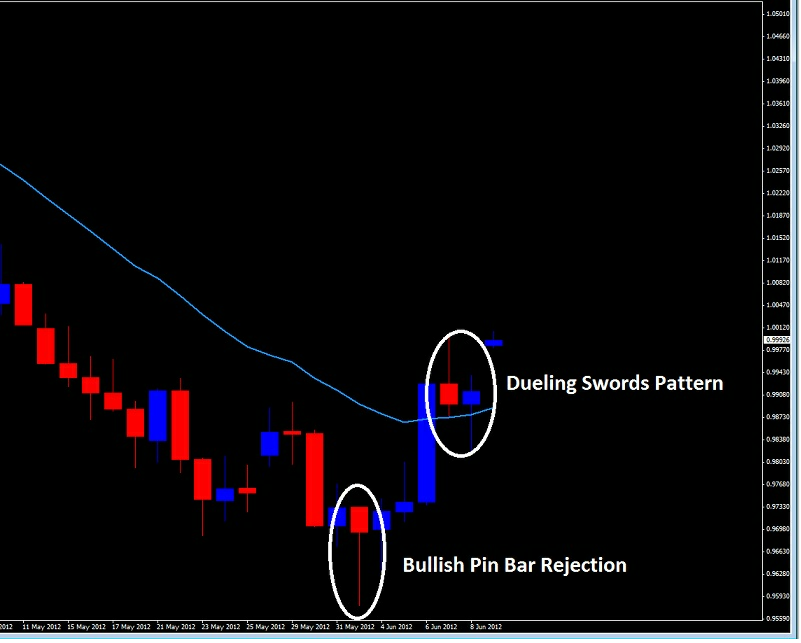

AUD/USD

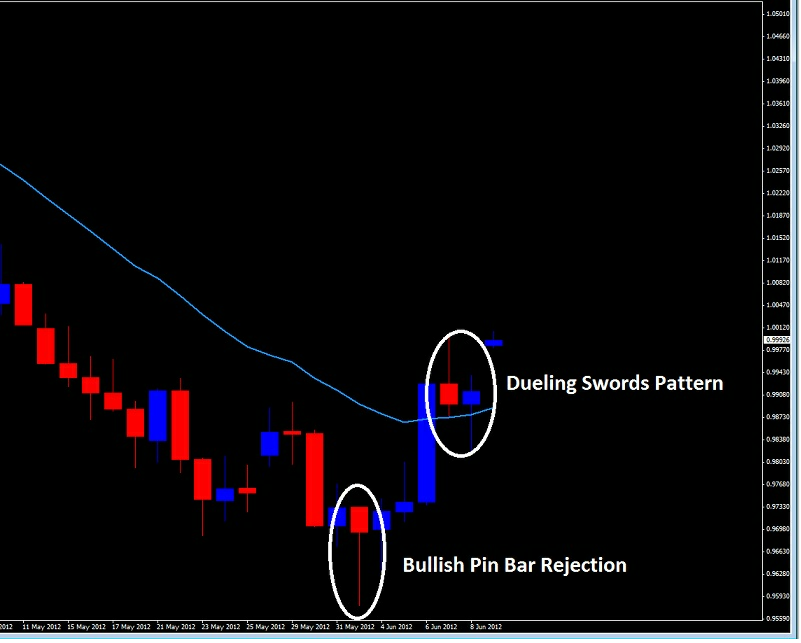

The bullish pin bar strategy we talked about last week came off nicely producing a +300pip bounce off the then yearly lows which many of our price action traders took advantage of as it was discussed in detail. The pair has since then formed a dueling swords pattern which has already completed itself. Short-term, the pair needs to clear last week's highs before bringing in new buyers, and if it fails here, we suspect a short-term move towards .9890 where it may find support. Intra-day bulls can take longs here while bears can wait for a move up 1.0050 to fade any rallies looking for price action triggers here.

Gold

The precious metal of choice appears to be underpinned with continual buying interest in the $1530-1560 region as it has formed several pin bars off the lows along with some really strong rejections communicating the strong buying interest at these prices. Last weeks sell-off was clearly event driven as Bernanke announced he would not hit the CTRL + P button, which was obviously bad for gold. The precious metal though rebounded forming a higher low suggesting buyers are happy to take the higher prices as they feel confident of its value there. There is some sticky resistance levels above at $1628-$1641 so watch for possible selling here, but if the pair continues to be underpinned like this, we suspect the bulls will win out and start another bull run in the weeks to come. Bulls can take longs from $1530-1560 while short-term bears can sell at the aforementioned levels.

As we wrote last week in our forex market commentary, wer expected price to go higher from the bullish engulfing bar setup off the yearly lows and higher the pair went. Aided by a Spanish bank bailout announcement over the weekend, and the pair has gapped higher following a bullish pin bar setup from Friday. The pair has cleared a major hurdle in the 1.2625 level and the daily 20ema, so short-term, we expect it to run higher. Keep in mind, this pair is so politically driven that any news out of Europe can somehow make people forget how bad things really are there. Case in point, originally Spain only needed about €40M to help out their banks, and yet €100M is the official number…for now. But regardless, they needed more, and they got it so short-term bullish, but we expect this to fade come later this week or next when more comes out of the closet.

GBP/USD

Last week we commented on how the cable had sold off for 5 consecutive weeks and when looked at historically and quantitatively, this was quite extreme, thus suggesting a bounce. Bounce the pair did, holding the multi-year lows at 1.5260 and ending just shy of 1.5500. But the weekend gap has produced a decent gain which we expect to close by Monday’s London session. Upside looks worse for cable than it does for euro short-term, as the weekly high will have to be cleared which is 1.5600. We prefer selling rallies at 1.56452 or 1.5821 for a move back down to 1.5300 as we feel the pair has just been washing off the oversold status last week, and will resume the downtrend shortly.

AUD/USD

The bullish pin bar strategy we talked about last week came off nicely producing a +300pip bounce off the then yearly lows which many of our price action traders took advantage of as it was discussed in detail. The pair has since then formed a dueling swords pattern which has already completed itself. Short-term, the pair needs to clear last week's highs before bringing in new buyers, and if it fails here, we suspect a short-term move towards .9890 where it may find support. Intra-day bulls can take longs here while bears can wait for a move up 1.0050 to fade any rallies looking for price action triggers here.

Gold

The precious metal of choice appears to be underpinned with continual buying interest in the $1530-1560 region as it has formed several pin bars off the lows along with some really strong rejections communicating the strong buying interest at these prices. Last weeks sell-off was clearly event driven as Bernanke announced he would not hit the CTRL + P button, which was obviously bad for gold. The precious metal though rebounded forming a higher low suggesting buyers are happy to take the higher prices as they feel confident of its value there. There is some sticky resistance levels above at $1628-$1641 so watch for possible selling here, but if the pair continues to be underpinned like this, we suspect the bulls will win out and start another bull run in the weeks to come. Bulls can take longs from $1530-1560 while short-term bears can sell at the aforementioned levels.