EUR/USD has edged higher on Monday, as the pair pushed above the 1.30 level in the Asian session. The new trading week started on a positive note, as Eurozone Manufacturing PMIs beat their estimates. The US will try to rebound after some disappointing major releases last week. Monday’s highlight is ISM Manufacturing PMI.

The markets were treated to some good news to start the week, as Eurozone Manufacturing PMIs all moved higher. Italian Manufacturing PMI hit a four-month high, climbing to 47.3 points. Eurozone Final Manufacturing PMI improved to 48.3 points, its highest level since March 2012. Spanish Manufacturing PMI kept pace with a sharp rise, jumping from 44.7 points to 48.1 points. Despite the good news, traders should keep in mind that all three PMIs remain below the 50-point level, indicative of continuing contraction in these manufacturing sectors. The upward movement is certainly a welcome development, but if the European manufacturing industry is to recover, PMIs will need to continue to improve and cross above the 50 level.

In the US, we continue to see mixed numbers from economic releases. Any hopes for a string of positive US releases evaporated on Thursday, with three key releases missing their estimates. Preliminary GDP improved to 2.4%, but missed the estimate of 2.5% Unemployment Claims shot up to 350 thousand, well above the estimate of 342 thousand. Pending Home Sales gained just 0.3%, well below the forecast of a 1.3% gain. These numbers point to weakness in the US economy, and raises questions about the extent of the US recovery. The US dollar was broadly lower courtesy of the bad news, and the euro joined the parade and posted sharp gains.

Will the Federal Reserve scale back quantitative easing? Fed policymakers, including Fed Chair Bernanke, continue to hint that QE could be wound up in the next few months. However, with the US continuing to alternate between good and bad economic releases, the Fed is unlikely to act before it is convinced that the US economy is improving. Much of the volatility we are seeing from EUR/USD can be attributed to market uncertainty about what action the Fed will take, and further hints from the Fed about scaling back QE will continue to impact on the currency markets.

In the Eurozone, the markets are eagerly awaiting the ECB policy meeting later this week. EUR/USD has gone on wild rides after recent meetings, even though interest rates did not budge, and we could see some volatility after this meeting as well. There has been more talk of negative interest rates, and Mario Draghi and other policy makers have hinted that they are open to the idea. The ECB’s deposit rate is currently at zero, and if the ECB goes any lower, it would be the first central bank to introduce negative interest rates. Such a move would hurt the euro, as investors would likely look outside the Eurozone to get more attractive rates for their funds. If Draghi repeats his openness to the concept when the ECB meets, we could see EUR/USD push higher.

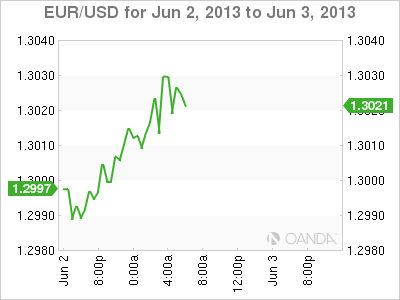

EUR/USD June 3 at 10:00 GMT

EUR/USD 1.3023 H: 1.3043 L: 1.2988 EUR/USD Technical" title="EUR/USD Technical" width="600" height="80">

EUR/USD Technical" title="EUR/USD Technical" width="600" height="80">

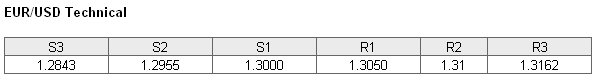

EUR/USD has edged higher as we begin the new week. The proximate resistance and support lines (R1 and S1 above) remain in place. On the downside, 1.3000 continues to provide support. However, this is a weak line, and could face more activity during the day. The next line of support is at 1.2955. On the upside, 1.3050 is providing resistance. There is stronger resistance at the round number of 1.31.

- Current range: 1.3000 to 1.3050

Further levels in both directions:

- Below: 1.3000, 1.2955, 1.2843, 1.2753, 1.2689 and 1.2589

- Above: 1.3050, 1.3100, 1.3162 and 1.3271

EUR/USD ratio is pointing to movement towards long positions in the Monday session. This is reflective of the pair’s current movement, as the euro has pushed above the 1.30 line and posted modest gains against the dollar.

The euro is again above the 1.30 line, but has had trouble staying above this line. Will it be able to continue Monday’s upward momentum. The currency has benefited from solid Eurozone numbers earlier, and we could see more movement as the US releases a key PMI later today.

EUR/USD Fundamentals

- 1:50 US FOMC Member Janet Yellen Speaks.

- 7:15 Spanish Manufacturing PMI. Estimate 45.5 points. Actual 48.1 points.

- 7:45 Italian Manufacturing PMI. Estimate 46.2 points. Actual 47.3 points.

- 8:00 Eurozone Final Manufacturing PMI. Estimate 47.8 points. Actual 48.3 points.

- 13:00 US Final Manufacturing PMI. Estimate 52.0 points.

- 14:00 US ISM Manufacturing PMI. Estimate 50.6 points.

- 14:00 US Construction Spending. Estimate 1.1%.

- 14:00 US ISM Manufacturing Prices. Estimate 49.6 points.

- All Day: US Total Vehicle Sales. Estimate 15.2M.