It’s been a slow week so far, but that is set to change on Wednesday, as the markets will have plenty of releases to review. All eyes will be on the US Federal Reserve, as we wait for the release of the FOMC minutes and Bernard Bernanke testifies in front of a Congressional committee. As well, the US releases Existing Home Sales, the first major release of the week. In the Eurozone, there was some excellent news as Current Account sparkled, posting its largest surplus in more than six years. Germany will auction off 10-year bonds and the EU holds a summit in Brussels.

The Federal Reserve will be front page and center on Wednesday, as Fed Chairman Bernard Bernanke testifies before a Congressional committee and the Fed releases the minutes of the last FOMC meeting. The $64,000 question is whether the Fed will make any changes to its current round of quantitative easing, which involves the purchase of $85 billion in assets each month. There are signs that the Fed is mulling making a move, despite lukewarm US numbers of late. Last week, John Williams, president of the Federal Reserve Bank of San Francisco, stated that the Fed could begin reducing QE this summer and terminate bond buying late in 2013. As the QE program is dollar negative, any moves by the Fed to wind up QE could have a strong impact on the movement of EUR/USD.

US releases have not looked good lately, and last week’s numbers were, for the most part, disappointing. Inflation and manufacturing numbers fell below expectations, and housing data did not meet the forecast. Unemployment Claims had looked impressive in recent readings, but was well above expectations, pointing to weakness on the job front. There was better news from Building Permits, and the UoM Consumer Sentiment shot up to wrap up the week. Trying to determine the extent of the US recovery continues to be difficult, as the economy has yet to demonstrate sustained growth and produce continuous positive releases.

Germany, the largest economy in the Eurozone and the “locomotive of Europe”, has raised concerns as German economic releases have looked sluggish. Last week, ZEW Economic Sentiment, one of the most important German releases, came in well below the estimate. German CPI and WPI posted declines, indicating weak activity in the economy. GDP posted a slight gain of 0.1%, but this was below the 0.3% forecast. This week hasn’t started any better, as the important PPI indicator declined for the third straight reading. The index fell 0.2%, a sharper drop than the forecast of -0.1%. If the Eurozone is to have any hope of getting back on solid economic footing, it will need Germany to lead the way and post some positive numbers. We’ll see a string of German releases later in the week, highlighted by PMIs and the German Ifo Business Climate. EUR/USD" title="EUR/USD" width="400" height="300">

EUR/USD" title="EUR/USD" width="400" height="300">

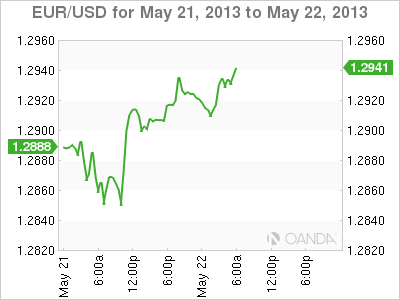

EUR/USD May 22 at 10:05 GMT

EUR/USD 1.2939 H: 1.2945 L: 1.2904 EUR/USD Technical" title="EUR/USD Technical" width="601" height="83">

EUR/USD Technical" title="EUR/USD Technical" width="601" height="83">

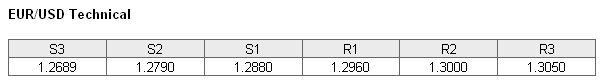

EUR/USD has moved higher, as the pair trades in the mid-1.29 range. The pair is facing resistance at 1.2960. This line could be tested if the euro continues to make gains. There is a stronger resistance at the round number of 1.3000. On the downside, there is support at 1.2880. This line has strengthened as the euro trades at higher levels. This is followed by a support level at 1.2790.

- Current range: 1.2790 to 1.2880

- Below: 1.2790, 1.2689, 1.2589 and 1.2500

- Above: 1.2880, 1.2960, 1.3000, 1.3050, and 1.31

EUR/USD ratio is showing little movement in Wednesday trading. The euro has edged higher, but this has been a modest move. If the pair continues to move higher, we could see some increased activity in the ratio.

EUR/USD continues to post modest gains, as it trades in the mid-129 range. We could see some volatility from the pair during the day, as the US releases key housing data and the Federal Reserve releases minutes of its last policy meeting.

EUR/USD Fundamentals

- 8:00 EU Current Account. Estimate 14.2B. Actual 25.9B

- All Day: EU Economic Summit

- Tentative: German 10-year Bond Auction

- 14:00 US Existing Home Sales. Estimate 4.99M

- 14:00 US Fed Chairman Bernard Bernanke testifies before the Joint Economic Committee

- 14:00 US Treasury Secretary Jack Lew Speaks

- 14:30 US Crude Oil Inventories. Estimate -0.4M

- 18:00 US FOMC Meeting Minutes