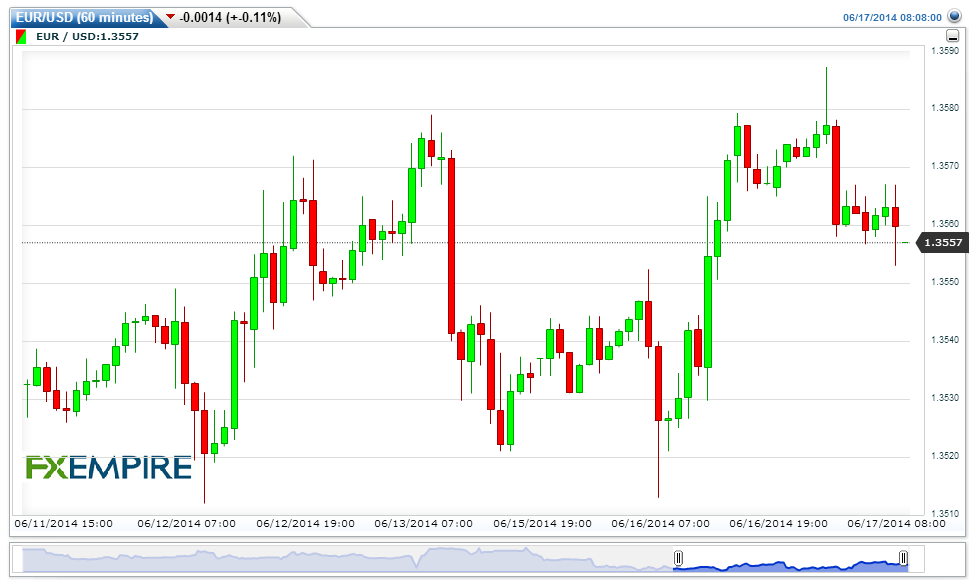

The EUR/USD eased by 7 points on surprising data from Germany. The pair traded at 1.3566 after German ZEW economic sentiment tumbled showing concerns after the ECB added its big guns a few weeks ago. The dollar edged higher, but was kept to a narrow range by caution ahead of this week’s U.S. Federal Reserve meeting and concern about escalating violence in Iraq.

US Industrial Production beat forecasts of 0.5% yesterday, instead rising by 0.6% as robust automotive output, mining output and machinery production boosted the factory orders figure. The upbeat reading helped to support the view that the US economy will register a sturdy GDP expansion in the second quarter as the world’s largest economy recovers from the polar vortex in Q1.

The U.S. central bank is expected to announce a further reduction in its monthly bond purchasing program, but most market participants do not expect an interest rate hike until mid-2015. The International Monetary Fund cut its forecast for U.S. growth on Monday and predicted the economy would not reach full employment until the end of 2017, which would suggest interest rates might be held near zero for longer than financial markets expect. The European Central Bank said on Tuesday that it and other major central banks will continue to offer one-week US dollar funding beyond the end of July, continuing action to help the banking system. The ECB governing council, “in cooperation with the Bank of England, the Bank of Japan and the Swiss National Bank, has decided to continue to offer one-week US dollar liquidity-providing operations after July 31, 2014 until further notice,” it said in a statement.

The dollar facilities were introduced during the financial crisis to enable banks to borrow US dollars from their central bank when access to the funds dried up.

FxEmpire provides in-depth analysis for each currency and commodity we review. Fundamental analysis is provided in three components. We provide a detailed monthly analysis and forecast at the beginning of each month. Then we provide more up to the data analysis and information in our weekly reports.