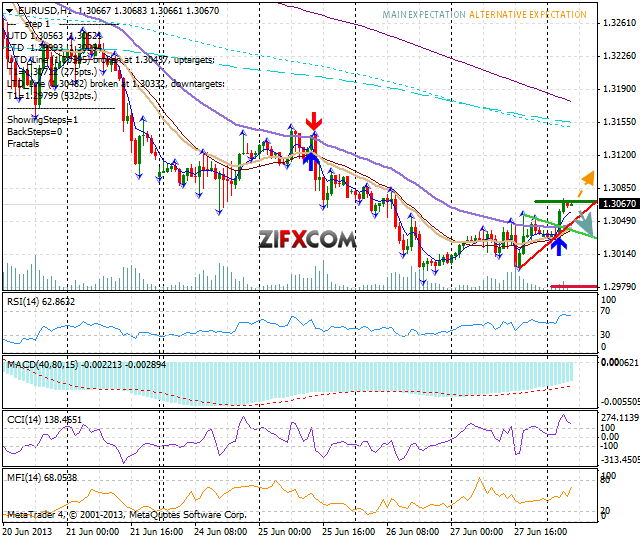

On Thursday Euro/Dollar traded within 55 pip range. The European currency appreciated from 1.2999 to 1.3057 yesterday, not matching the negative money flow sentiment at almost -16%, closing the day at 1.3033. This morning the Euro lifted slightly further, reaching 1.3075.

On the 1 hour chart new downward channel has formed, while on the 3 hour chart quotes are moving within wide trading range. Break above the nearest resistance and today's top at 1.3075 may trigger further strengthening of the Euro. Going below yesterday's bottom and first support at 1.2999, however, would confirm continuation of the bearish trend, towards next objective downwards 1.2884.

Today's focus is on Germany Retail sales, France Consumer spending and PPI, Italy PPI and CPI, Germany CPI and HICP, and U.S. Chicago PMI and Consumer sentiment index, at 6, 6:45, 8, 9, 12, 13:45, and 13:55 GMT respectively.

Quotes are moving above the close 20 and 50 EMA on the 1 hour chart, indicating bullish pressure. The value of the RSI indicator is positive and calm, MACD is negative and quiet, while CCI has crossed up the 100 line on the 1 hour chart, giving over all light long signals.

Technical resistance levels: 1.3075 1.3190 1.3314

Technical support levels: 1.2999 1.2884 1.2760

Yesterday we made +15 pips profit/loss on EUR/USD from the following sent to clients only signal:

5:15 GMT+1 Sell EUR/USD at 1.3031 SL 1.3057 TP 1.2981, exit sent at 8:22 GMT+1.

Total yesterday +175, as shown at our web site. EUR/USD Chart" title="EUR/USD Chart">

EUR/USD Chart" title="EUR/USD Chart">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD Eases On Fed Muffle 'Taper' Discussion

Published 06/28/2013, 12:37 AM

Updated 01/01/2017, 02:20 AM

EUR/USD Eases On Fed Muffle 'Taper' Discussion

EUR/USD Open 1.3032 High 1.3075 Low 1.2999 Close 1.3033

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.