After an uneventful start to the trading week, EUR/USD swung into action on Tuesday, as EUR/USD posted sharp losses. The pair dropped close to one cent after a superb consumer confidence release out of the US. The euro has partially recovered these losses, as the pair is trading close to the 1.29 line during Wednesday’s European session.

In economic news, today’ highlight is the change in German Unemployment. The key indicator surprised the markets with a very weak reading, as unemployment claims jumped to their highest level in four years. It is a quiet day in the US, with the only release a speech by FOMC Member Eric Rosengren.

There is a lot of truth to the motto “as goes Germany, so goes Europe”, but the question the markets are now asking is “where goes Germany?” After some lukewarm PMI data out of Germany last week, there was better news on Friday, as German consumer and business confidence looked sharp. On Tuesday, German Unemployment Change was a bust, as the key indicator shot up to 21,000 new claims, much higher than the forecast of 4,000 that was expected. The weak employment numbers will again raise questions about the health of the German economy, and could hurt the struggling euro.

Will the ECB implement negative interest rates? Recently, ECB President Mario Draghi and other policymakers have expressed a willingness to consider the idea. At present, the ECB’s deposit rate stands at zero. On Monday, ECB Executive Board member Joerg Asmussen said that the ECB will continue it expansive monetary policy in order to boost the Eurozone economy, but urged caution on the question of negative rates. Asmussen warned that the ECB can’t simply fix uncompetitive economies by changing its monetary policy, such as adopting negative interest rates. A move in this direction would likely hurt the euro, as investors would move funds out of the eurozone in search of better rates of return.

The markets are accustomed to ups and downs in US numbers, which has typified US releases in 2013. Last week saw mixed housing numbers, as Existing Home Sales missed the estimate, but New Home Sales looked very sharp. Unemployment Claims bounce back with a strong release, and the week ended with a rise in Core Durable Goods Orders. This week started off with a bang, as CB Consumer Confidence jumped from 68.1 points to 76.2 points, its best showing since June 2009. As well, the S&P/CS Composite-20 HPI rose by 10.9%, beating the estimate of 10.2%. This points to more activity in the US housing market. If this week’s US indicators follow suit and point upward, the US dollar could jump on for the ride and post gains against the euro.

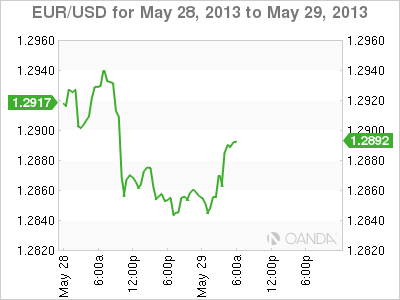

EUR/USD May 29 at 10:20 GMT

EUR/USD 1.2888 H: 1.2896 L: 1.2837

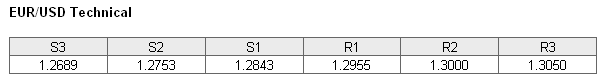

EUR/USD has gained ground on Wednesday, after the sharp losses it sustained on Tuesday. The proximate resistance and support lines remain in place (R1 and S1 above). The pair continues to receive support at 1.2843. The next support level is at 1.2753. On the upside, the pair is facing strong resistance at 1.2955.

- Current range: 1.2843 to 1.2955

- Below: 1.2843, 1.2753, 1.2689, 1.2589 and 1.2500

- Above: 1.2955, 1.3000, 1.3050, and 1.31

EUR/USD ratio is pointing to movement towards long positions in Wednesday trading. This is reflected in the current movement of the pair, as the euro has posted some gains following Tuesday’s sharp losses. The ratio remains close to an even split between short and long positions, indicating a split in trader sentiment as what to expect from EUR/USD.

EUR/USD is showing some volatility after a slow start to the week. The pair dropped sharply on Tuesday, but has since recovered much of these losses. With no key releases out of the Eurozone or the US on Wednesday, we could see the pair settle down and continue to trade close to the 1.29 line.

EUR/USD Fundamentals

- All Day: German Preliminary CPI. Estimate 0.2%.

- 7:55 German Unemployment Change. Estimate 4K. Actual 21K.

- 8:00 Eurozone M3 Money Supply. Estimate 2.9%. Actual 3.2%.

- 8:02 Eurozone Private Loans. Estimate -0.4%. Actual -0.9%.

- 17:00 US FOMC Eric Rosengren Speaks.