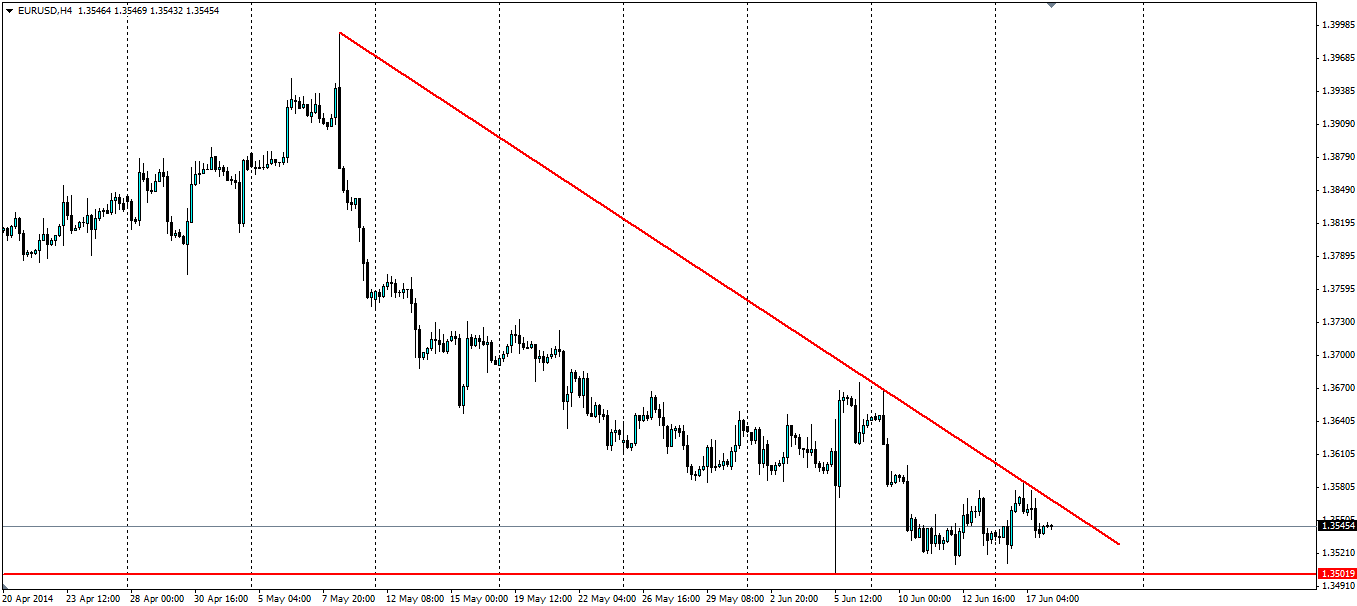

As the FOMC meet today, the triangle that has formed on the EUR/USD H4 chart is coming to a head and could well be breached with any news on tapering and interest rate talk.

The EUR/USD pair has a big day today with the Federal Open Market Committee meeting to discuss the tapering of stimulus. The likelihood is for the FED to continue on as usual and drop the Quantitative Easing programme by another US$10b this month. This has come to be known as tapering and is expected to end the QE programme by September. What the market will be looking for is any clue of an interest rate rise when FED Chairwoman Janet Yellen speaks after the meeting (expected at 18:30 GMT). CPI figures just released show a better than expected 0.3% inflation rate from a month ago. This fuelled the speculation of interest rates sooner rather than later, but we will not know until Yellen’s speech.

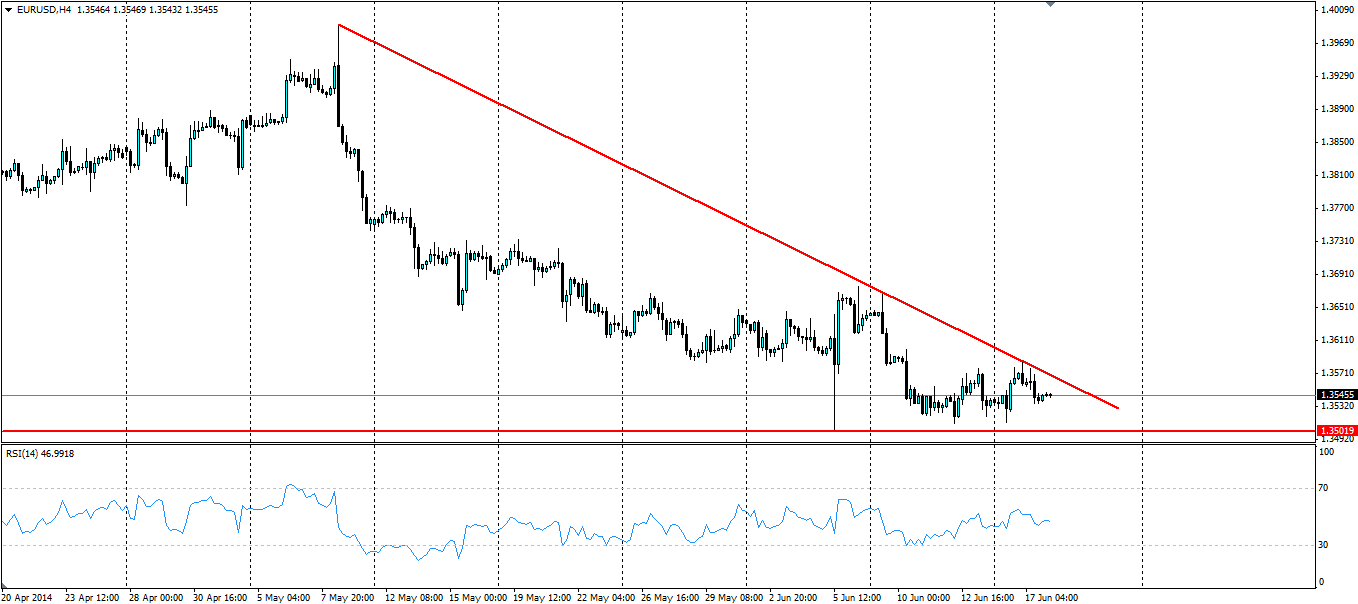

The EUR/USD is where all of the fireworks will be and the downward sloping triangle is just adding to the intrigue. The bearish top line is there for good reason; the market is extremely bearish on the Euro at the moment because the easing policy the ECB has adopted contrasts well with the end of the easing in the US. Support for the pair has been found at 1.3502 but given the impressive amount of positive news out of the US recently, including yesterday’s CPI figure and last week’s non-farm data, we will no doubt see this level tested.

The RSI is showing a fairly neutral level at 46.65, with momentum neither with the bears, nor the bulls. This is fair enough, given the importance of the FOMC meeting coming up. Volatility and no doubt volumes will have dried up as the markets waits for the meeting to provide direction.

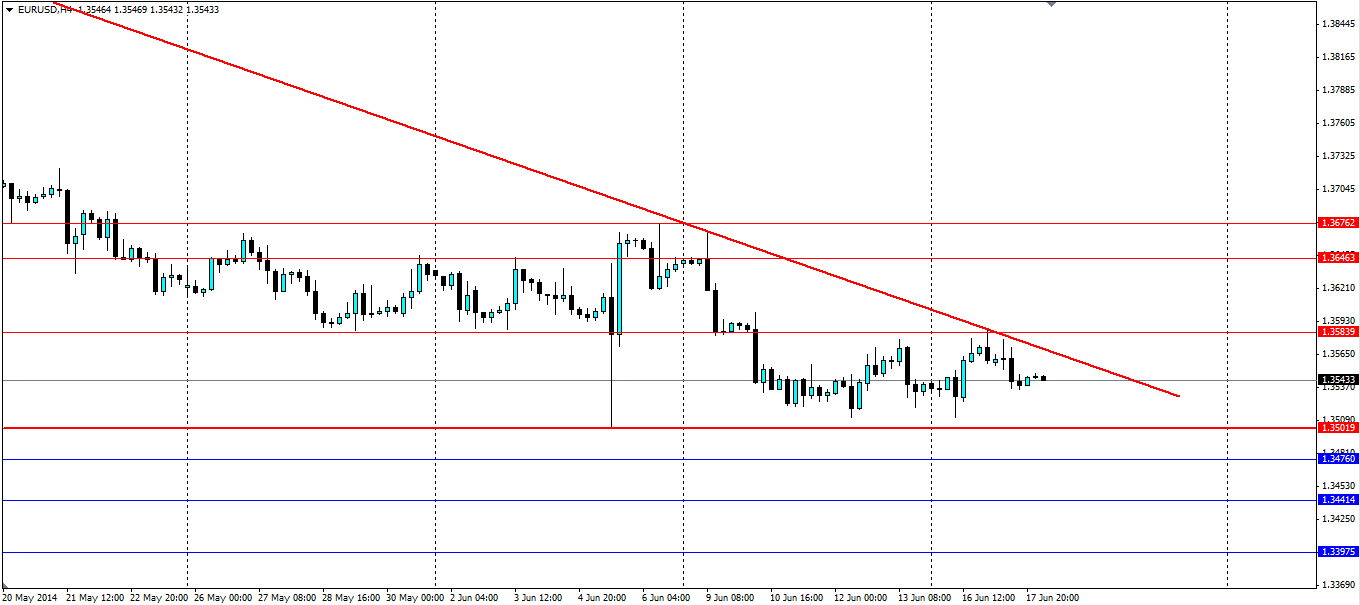

Traders looking to take advantage of strength in the USD should look to set a stop sell just under the support at 1.3502 (and probably under 1.3500 as this will act as psychological resistance). Targeting previous levels of resistance is always a good idea when looking for points of exit. 1.3476, 1.3441 and 1.3397 will all act as support for a movement to the bearish side for the Euro. These levels have not been tested since November last year, but the market does not forget about old levels of support or resistance.

Alternatively, Yellen could talk about the fragility of the recovery (Unemployment Claims rose last week) and the potential threats to global stability and financial markets that the situation in Iraq poses. In which case the reluctance of the FED to raise interest rates would spur the bulls to push the EUR/USD pair through the bearish resistance that forms the triangle. A stop buy outside of the triangle would take advantage of this situation, but it is unlikely given the amount of positive data recently. 1.3584, 1.3646 and 1.3676 would act as resistance for a bullish move higher.

The FED meeting today provides the opportunity to catch a breakout of a downward sloping triangle forming off the EUR/USD charts. The right set ups can take advantage of a bullish or bearish breakout, but the bearish one is looking more likely at this stage.