EUR/USD Chart: Bearish Candlestick Patterns on Trending Channel’s Highs" title="EUR/USD Chart: Bearish Candlestick Patterns on Trending Channel’s Highs" width="1166" height="593">

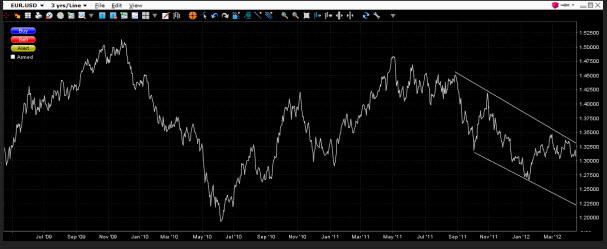

EUR/USD Chart: Bearish Candlestick Patterns on Trending Channel’s Highs" title="EUR/USD Chart: Bearish Candlestick Patterns on Trending Channel’s Highs" width="1166" height="593">2012 EUR/USD consolidation range seems to be between 1.30 and 1.35 but Friday’s candlestick completed a bearish pattern that may ignite a resume of the downtrend, which began 8 months ago, and push the popular forex pair all the way down to 1.22! If you trust technical analysis signals, you can’t neglect the downwards trending channel, the last weeks’ falling triangle and the bearish candlestick patterns. Will Euro lose more value against the US dollar over the next months due to the European debt crisis, or would 1.30 be the support level that will eventually put an end to the cable’s downtrend?

EUR/USD is nowadays trading right in the middle of 5-year high at 1.51 and low at 1.19. Yet the currency pair is certainly trending towards lower prices, according to the well-defined channel. One of the channel’s highs has been the announcement’s day of the Greek referendum, which was also accompanied by a very strong bearish candlestick pattern. In the meantime, the 1.30 support level in conjunction with the falling trend line forms an almost perfect downwards triangle during the past month. Moreover Friday’s lower close of EUR/USD, when sellers quite obviously controlled the forex market, is considered a fine signal for a short-selling entry point. ATR indicator at the same time seems ready to develop a new uptrend, meaning a EUR/USD trend is about to evolve. For the time being, there are not that many signals, which point to an uptrend of the popular forex pair.

EUR/USD Chart: Bearish Candlestick Patterns on Trending Channel’s Highs" title="EUR/USD Chart: Bearish Candlestick Patterns on Trending Channel’s Highs" width="1166" height="593">

EUR/USD Chart: Bearish Candlestick Patterns on Trending Channel’s Highs" title="EUR/USD Chart: Bearish Candlestick Patterns on Trending Channel’s Highs" width="1166" height="593">The trending channel can be used for setting stop loss orders if forex traders are not willing to apply tight stop losses, while profit targets can be set at the latest downtrend’s resistance at 1.2625 and also at the projected lower band of the channel at 1.22. Would you trust that crucial channel or are you not a technical analysis’ fan?