Market Brief

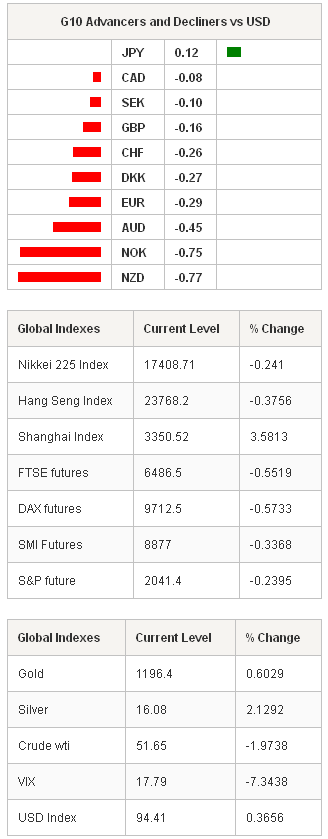

The EUR made a heavy start to the week on worrying news around Greece and hiking speculations that the ECB moves closer to full-blown QE. EUR/USD rallied on stops after breaking 1.20, plunged to 1.1864 – a 9-year low, and rapidly bounced back above 1.1900. German Chancellor Merkel said the Euro-zone can well cope with the Grexit, according to Der Spiegel. The sentiment in EUR remains solidly negative as the EUR/USD steps in oversold territories (RSI at 26%, lower Bollinger Band at 1.1998). A correction is certainly underway, yet the upside should stay limited as traders look to sell the rallies. The aggressive EUR sell-off pulled EUR/JPY to 143.16. The pair trades comfortably within the Ichimoku cloud (141.64/145.11). The daily base and conversion line point deeper downside correction as JPY anxieties cool-off.

USD/JPY and JPY crosses were mixed in Tokyo. USD/JPY remained well bid above 120.00, yet remains ranged at 118.80/121.00 area in the absence of fresh Abenomics-related news. Option bids are still supportive above 120, offers trail below 121.00. The 5-year JGB yields hit record low as the government is preparing to issue 37 trillion yen worth of new bonds in 2015 FY (Yomuiri report). On the other hand, the BoJ’s new guidelines take effect today and should keep the JPY selling contained in the near term. The BoJ’s bond purchase targets are lowered from 220-500 billion yen to 100-300bn for JGBs up to 1-year maturity, from 2.4-3.6 trillion yen to 1.8-3.6trln for 5 to 10 year maturity, from 650bn – 2 trln yen to 1.25 – 2trln yen for more than 10-year maturity.

AUD/USD extends losses to 0.8035 as the steady advance toward our 80-cent target continues. Option related offers abound at 0.8075/0.8100.

Else, the oil sell-off continues with the WTI down to $51.40 in Asia. The heavy CAD-unwind lifts USD/CAD to 1.1844 at the week open, the trend and momentum indicators turn positive as the pair breaks above the 1.1670/75 (December top). Eyes shift to 1.20 psychological levels as downside pressures on oil persist. USD/NOK stands at MACD pivot (7.67). A daily close above this level should open the way for a re-test of 7.8745 (Dec 16th high).

Turkey CB hikes the FX reserve requirement for its banks as the TRY comes under pressure following the broad based USD rally. We remain bearish on TRY and TRY holdings. Decent option relates bids are placed at 2.35/2.40 for today expiry.

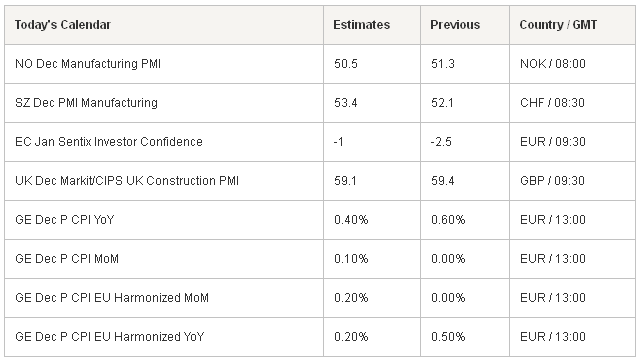

Today, traders watch Norwegian and Swiss December Manufacturing PMI, German December (Prelim) CPI m/m & y/y, UK December Construction PMI.

Currency Tech

EUR/USD

R 2: 1.2110

R 1: 1.2000

CURRENT: 1.1969

S 1: 1.1926

S 2: 1.1864

GBPUSD

R 2: 1.5620

R 1: 1.5485

CURRENT: 1.5306

S 1: 1.5176

S 2: 1.5000

USD/JPY

R 2: 121.85

R 1: 121.00

CURRENT: 120.32

S 1: 119.32

S 2: 118.87

USDCHF

R 2: 1.0278

R 1: 1.0100

CURRENT: 1.0045

S 1: 0.9951

S 2: 0.9845