The market sold the USD into the weekend as the EUR/USD recovery extended higher. With little data out the market reacted to news flow from the eurozone and in particular the increases to IMF funding pledged from G20 which amounted to 400bn. Looking ahead, no US data to start the week.

EUR

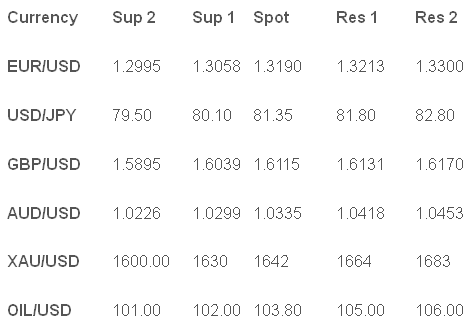

The EUR/USD broke above 1.3150 and we moved to 1.3220 as the IMF news combined with the better-than-expected German IFO to push higher. April German IFO increased to 109.9 vs. 109.5 forecast. EUR/JPY kicked to Y108 and is enjoying the upside in recent days.

GBP

The GBP/USD rally extended on Friday kicking above 1.6100 and opens up 1.6500 this week with many seeing the downside over and all the GBP crosses moving technically higher. GBP/AUD moved above 1.5500. The EUR/GBP remained offered and closed under 0.8200 and is targeting the 0.8000 level going forward. Looking ahead, April German Manufacturing PMI forecast at 49 vs. 48.4 previously. Also ahead, eurozone Manufacturing PMI forecast at 48 vs. 47.7 previously.

JPY

USD/JPY held in a tight range above Y81.50 but is of risk of once again falling back as USD weakness usually moves across onto the USD/JPY if sustained. Crosses are supported for the time being but need sustained risk appetite to move higher.

AUD

The AUD/USD was supported by the move higher in the EUR/USD but the market was hesitant at 1.0380 and we saw the Aussie fall behind. The GBP/AUD and EUR/AUD took advantage of the lagging Major to push higher with week highs on both and more gains expected. Looking ahead, April HSBC China PMI forecast at 49 vs. 48.4 previously.

XAU

Gold spent the whole day in a $5 dollar range above $1640 and is waiting for further inspiration. OIL/USD rallied with stocks and the euro up above $104 and near $105 before easing into the weekend. The $105 level is a big resistance and could prove the pivot in coming days.

Pairs To Watch

EUR/USD more upside once consolidation over?

GBP/USD on to 1.6300 now?

Technical Commentary

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD Breaks Higher, China PMI: April 23, 2012

Published 04/23/2012, 02:14 AM

Updated 03/09/2019, 08:30 AM

EUR/USD Breaks Higher, China PMI: April 23, 2012

USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.