The U.S. dollar traded lower against the euro and British pound after U.S. retail sales and CPI data fell short of estimates. Following Friday's softer reports, the odds for a Federal Reserve rate increase next month have fallen to about 70 percent, even though data was still good enough to bolster the case for tightening in June.

EUR/USD

The euro rose towards its 1.0950-resistance after re-testing the current support zone ranging from 1.0855 to 1.0820. We will now pay close attention to a renewed break above 1.0950 which could result in a climb towards 1.1050.

Despite the low-volatile market environment there might be a catalyst for some swings throughout this week. The German ZEW Survey is due for release on Tuesday, followed by the Eurozone Consumer Price Report which is due on Wednesday and a speech of ECB President Draghi on Thursday.

GBP/USD

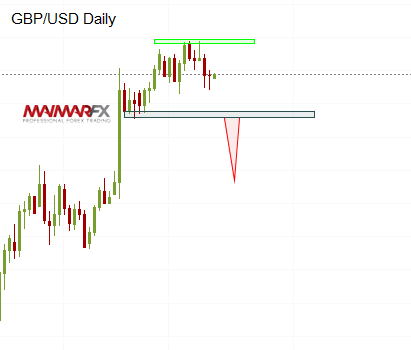

The pound sterling remained range-bound between 1.2990 and 1.2845 and traders still wait for, at least, a test of 1.30. It could be an interesting week for sterling traders with U.K. Consumer Prices (Tuesday), Employment data (Wednesday) and Retail Sales (Thursday) scheduled for release. Most of these reports are expected to surprise to the upside, so we may see a run for 1.30 and possibly even a test of 1.3050.

A bearish break below 1.2750, however, could increase bearish momentum towards lower targets around 1.26.

Here are our daily signal alerts:

EUR/USD

Long at 1.0960 SL 25 TP 40, 90

Short at 1.0890 SL 25 TP 18, 40

GBP/USD

Long at 1.2915 SL 25 TP 20, 40

Short at 1.2870 SL 25 TP 20, 50

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.