An ugly little squeeze higher this morning caught the EUR/USD sellers off guard before the pair pushed lower again after dissapointing German PMI data. Where the EUR/USD settles today vis-à-vis 1.3000 and on the other side of tomorrow morning’s IFO survey result will likely set the tone for the next week or more.

The JPY was stronger overnight, and commodity dollars depreciated after a weaker than expected HSBC flash China Manufacturing PMI for April. Europe came in and plowed into equities and risk-on trades, selling the JPY before the German survey data put a halt to those developments. This morning, in less than an hour, the EUR/JPY went from 128.55 to 129.35 and back to 128.40. The strong JPY came despite Standard and Poor’s indicating that it saw a one in three chance of downgrading Japan’s sovereign debt ratings due to uncertainty over Japanese policy. There was commotion yesterday concerning Japanese life insurers wanting to buy foreign bonds if long Japanese yields remained as low as they have lately.

France released slightly less awful than expected preliminary April manufacturing and services PMI survey data. We have to remember that these surveys compare conditions with recent months (diffusion indices), so eventually, as long as an economy stabilizes, the surveys should edge back toward 50. As long as they are below that level, it means that things are continuing to get worse. The difference between the survey moving up to 44.1 vs. 41.3 the previous month, as we have seen with the French services PMI reading this morning, is a question of things getting worse at a slower pace than they were previously. The worsening does need to decelerate before outright improvement can be seen, but we can’t say that “things are getting better” per se until these surveys go above 50.

The German survey data came in quite weak, with the preliminary April Services PMI dipping back below 50 and the Manufacturing survey showing the worst reading in four months at 47.9, as we look towards a likely rate cut at next week’s ECB meeting.

The Swedish unemployment rate jumped to 8.8% vs. an unchanged reading at 8.5% expected. This has shot the EUR/SEK to new local highs and has the USD/SEK challenging above its 200-day moving average at the time of writing.

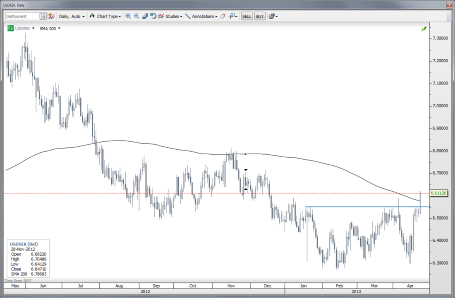

Chart: USD/SEK

This is oneI’ve had my eye on for a while now. The krona has taken a real beating lately, and the USD/SEK could have a good deal more wood to chop to the upside now that this 6.55 level appears fully taken out and the descending trendline has been more decisively broken. If the EUR/USD confirms the 1.3000 break, we may have a look at 6.75+ here.

USD/SEK" title="USD/SEK" width="455" height="298" />

USD/SEK" title="USD/SEK" width="455" height="298" />

Looking ahead

The EUR/USD is certainly playing with our heads today. I had penned a long paragraph on the risks of a throwback to 1.3200 if 1.3125 gave way after that nasty little squeeze this morning above 1.3080. But I erased it upon the challenge of 1.3000 after the German survey data, which would seem to eliminate that entire tactical upside scenario if the big 1.3000 round figure gives way properly today. The EUR/JPY could prove the more volatilite cross, as we seem to be back in the old familiar mode of USD strong and JPY even stronger when risk aversion hits the market.

Remember that the Bank of Japan is up on Friday and will likely announce nothing of note other than an attempt to show confidence in the measures it has announced thus far. It will take months for the possible effects to begin to filter through into the data. JPY crosses seem to be behaving very much like risk-on/risk-off instruments, something that may continue unless we get some change in behaviour in the bond market (risk off with bond selling or a Japanese bond market move that is divergent from the rest of the major government bond markets).

Look out for the RBNZ an hour after the U.S. market closes. There’s still a small chance of a rate hike priced in for the twelve months forward – but after the recent aggravated rally in NZD, I would be surprised to see anything but neutral rhetoric from Governor Wheeler on the rate path. There’s been some relief on the weather front as New Zealand has been suffering from drought conditions (important for its milk exports), but the drought declaration has not been called off just yet. Looking at key NZD crosses, the AUD/NZD is certainly at a critical crossroads in this 1.2150/1.2200 area, having staged a strong rally from the lows overnight. Any hint of dovishness could drive a short term squeeze higher there.

Stay careful out there – the market is nervy.

Economic Data Highlights

The JPY was stronger overnight, and commodity dollars depreciated after a weaker than expected HSBC flash China Manufacturing PMI for April. Europe came in and plowed into equities and risk-on trades, selling the JPY before the German survey data put a halt to those developments. This morning, in less than an hour, the EUR/JPY went from 128.55 to 129.35 and back to 128.40. The strong JPY came despite Standard and Poor’s indicating that it saw a one in three chance of downgrading Japan’s sovereign debt ratings due to uncertainty over Japanese policy. There was commotion yesterday concerning Japanese life insurers wanting to buy foreign bonds if long Japanese yields remained as low as they have lately.

France released slightly less awful than expected preliminary April manufacturing and services PMI survey data. We have to remember that these surveys compare conditions with recent months (diffusion indices), so eventually, as long as an economy stabilizes, the surveys should edge back toward 50. As long as they are below that level, it means that things are continuing to get worse. The difference between the survey moving up to 44.1 vs. 41.3 the previous month, as we have seen with the French services PMI reading this morning, is a question of things getting worse at a slower pace than they were previously. The worsening does need to decelerate before outright improvement can be seen, but we can’t say that “things are getting better” per se until these surveys go above 50.

The German survey data came in quite weak, with the preliminary April Services PMI dipping back below 50 and the Manufacturing survey showing the worst reading in four months at 47.9, as we look towards a likely rate cut at next week’s ECB meeting.

The Swedish unemployment rate jumped to 8.8% vs. an unchanged reading at 8.5% expected. This has shot the EUR/SEK to new local highs and has the USD/SEK challenging above its 200-day moving average at the time of writing.

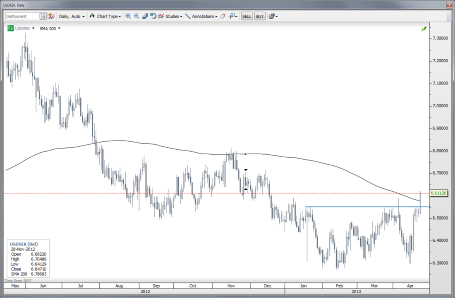

Chart: USD/SEK

This is oneI’ve had my eye on for a while now. The krona has taken a real beating lately, and the USD/SEK could have a good deal more wood to chop to the upside now that this 6.55 level appears fully taken out and the descending trendline has been more decisively broken. If the EUR/USD confirms the 1.3000 break, we may have a look at 6.75+ here.

USD/SEK" title="USD/SEK" width="455" height="298" />

USD/SEK" title="USD/SEK" width="455" height="298" />Looking ahead

The EUR/USD is certainly playing with our heads today. I had penned a long paragraph on the risks of a throwback to 1.3200 if 1.3125 gave way after that nasty little squeeze this morning above 1.3080. But I erased it upon the challenge of 1.3000 after the German survey data, which would seem to eliminate that entire tactical upside scenario if the big 1.3000 round figure gives way properly today. The EUR/JPY could prove the more volatilite cross, as we seem to be back in the old familiar mode of USD strong and JPY even stronger when risk aversion hits the market.

Remember that the Bank of Japan is up on Friday and will likely announce nothing of note other than an attempt to show confidence in the measures it has announced thus far. It will take months for the possible effects to begin to filter through into the data. JPY crosses seem to be behaving very much like risk-on/risk-off instruments, something that may continue unless we get some change in behaviour in the bond market (risk off with bond selling or a Japanese bond market move that is divergent from the rest of the major government bond markets).

Look out for the RBNZ an hour after the U.S. market closes. There’s still a small chance of a rate hike priced in for the twelve months forward – but after the recent aggravated rally in NZD, I would be surprised to see anything but neutral rhetoric from Governor Wheeler on the rate path. There’s been some relief on the weather front as New Zealand has been suffering from drought conditions (important for its milk exports), but the drought declaration has not been called off just yet. Looking at key NZD crosses, the AUD/NZD is certainly at a critical crossroads in this 1.2150/1.2200 area, having staged a strong rally from the lows overnight. Any hint of dovishness could drive a short term squeeze higher there.

Stay careful out there – the market is nervy.

Economic Data Highlights

- China Apr. HSBC Flash Manufacturing PMI out at 50.5 vs. 51.5 expected and 51.6 in Mar.

- Japan Apr. Small Business Confidence out at 49.4 vs. 49.7 in Mar.

- Switzerland Mar. Trade Balance out at +1.9B vs. +1.8B expected and +2.0B in Feb.

- France Preliminary Apr. Manufacturing PMI out at 44.4 vs. 44.1 expected and 44.0 in Mar.

- France Preliminary Apr. Services PMI out at 44.1 vs. 42.0 expected and 41.3 in March.

- Sweden Mar. Unemployment Rate out at 8.8% vs. 8.5% expected and 8.5% in Feb.

- Germany Preliminary Apr. Manufacturing PMI out at 47.9 vs. 49.0 expected and 49.0 in Mar.

- Germany Preliminary Apr. Services PMI out at 49.2 vs. 51.0 expected and 50.9 in Mar.

- Euro Zone Preliminary Apr. Manufacturing PMI out at 46.5 vs. 46.7 expected and 46.8 in Mar.

- Euro Zone Preliminary Apr. Services PMI out at 46.6 vs. 46.5 expected and 46.4 in Mar.

- UK Apr. CBI Total Orders, Selling Prices, and Business Optimism (1000)

- UK BoE’s McCafferty to Speak (1100)

- Canada Feb. Retail Sales (1230)

- US Apr. Richmond Fed Manufacturing Index (1400)

- US Mar. New Home Sales (1400)

- US Weekly API Crude Oil and Product Inventories (2030)

- New Zealand RBNZ Official Cash Rate (2100)

- Japan Mar. Corporate Service Price Index (2350)

- Australia Q1 Consumer Prices (0130)

- Australia RBA’s Lowe to Speak (0440)