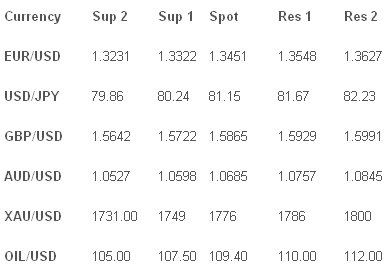

U.S. Dollar Trading (USD) stocks were slow but currencies volatile with large moves seen in both the USD/JPY and the EUR/USD. The US consumer confidence provided positive news improving from to 75.3 vs. 72.5 previously. Over the weekend we saw the G20 meet and release a statement that was largely expected giving commitments to increase IMF funding in the future and support the Eurozone but with little firm action taken. The Euro (EUR) the EUR/USD continued to push higher after breaking out on Thursday last week above 1.3300. The 1.3500 level should also slow the ascent with some concerns remaining about Eurozone bailouts which go to the vote in Germany and other EU countries in coming weeks. Looking ahead, January M3 Money Growth forecast at 1.8% vs. 1.6% previously. Also ahead January Home Sales forecast at 1% vs. -3.5% previously.

The Japanese Yen (JPY) the USD/JPY pushed higher into the Y80 region confirming the new uptrend with support coming from heavy EUR/JPY buying now to Y109 after trading below Y100 last month. The Yen has gone quickly from the strongest to weakest currency in the market with the outlook improving for the Europe and concerns Japans deflation problem will remain for the foreseeable future. The Sterling (GBP) The GBP/USD tested 1.5900 on Friday closely tracking the Euro’s move up and on the front foot against the Yen and other risk currencies. GBP/AUD has been in a long downtrend and is beginning to unwind in recent sessions. Australian Dollar (AUD) the Aussie is getting the jitters and the bulls are nervous with everyone expecting a move higher in recent weeks disappointed and we finished lower even as the EUR/USD soared. Stronger Support is seen towards 1.0500 but the selling is mild with AUD/JPY buyers supporting.

Oil & Gold (XAU) Gold was very stable in $10 range around near $1780 unable to gather strength to test $1800. OIL/USD is not having any issues gathering strength and broke to fresh year highs near $110 a barrel.

Pairs to watch

OIL/USD Overbought signals going to stop OIL/USD rally?

XAU/USD Time for $1800oz test?

TECHNICAL COMMENTARY

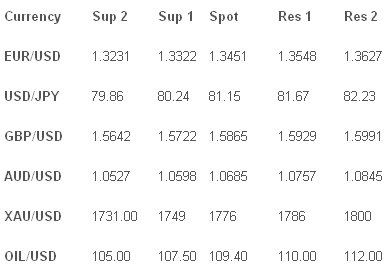

The Japanese Yen (JPY) the USD/JPY pushed higher into the Y80 region confirming the new uptrend with support coming from heavy EUR/JPY buying now to Y109 after trading below Y100 last month. The Yen has gone quickly from the strongest to weakest currency in the market with the outlook improving for the Europe and concerns Japans deflation problem will remain for the foreseeable future. The Sterling (GBP) The GBP/USD tested 1.5900 on Friday closely tracking the Euro’s move up and on the front foot against the Yen and other risk currencies. GBP/AUD has been in a long downtrend and is beginning to unwind in recent sessions. Australian Dollar (AUD) the Aussie is getting the jitters and the bulls are nervous with everyone expecting a move higher in recent weeks disappointed and we finished lower even as the EUR/USD soared. Stronger Support is seen towards 1.0500 but the selling is mild with AUD/JPY buyers supporting.

Oil & Gold (XAU) Gold was very stable in $10 range around near $1780 unable to gather strength to test $1800. OIL/USD is not having any issues gathering strength and broke to fresh year highs near $110 a barrel.

Pairs to watch

OIL/USD Overbought signals going to stop OIL/USD rally?

XAU/USD Time for $1800oz test?

TECHNICAL COMMENTARY