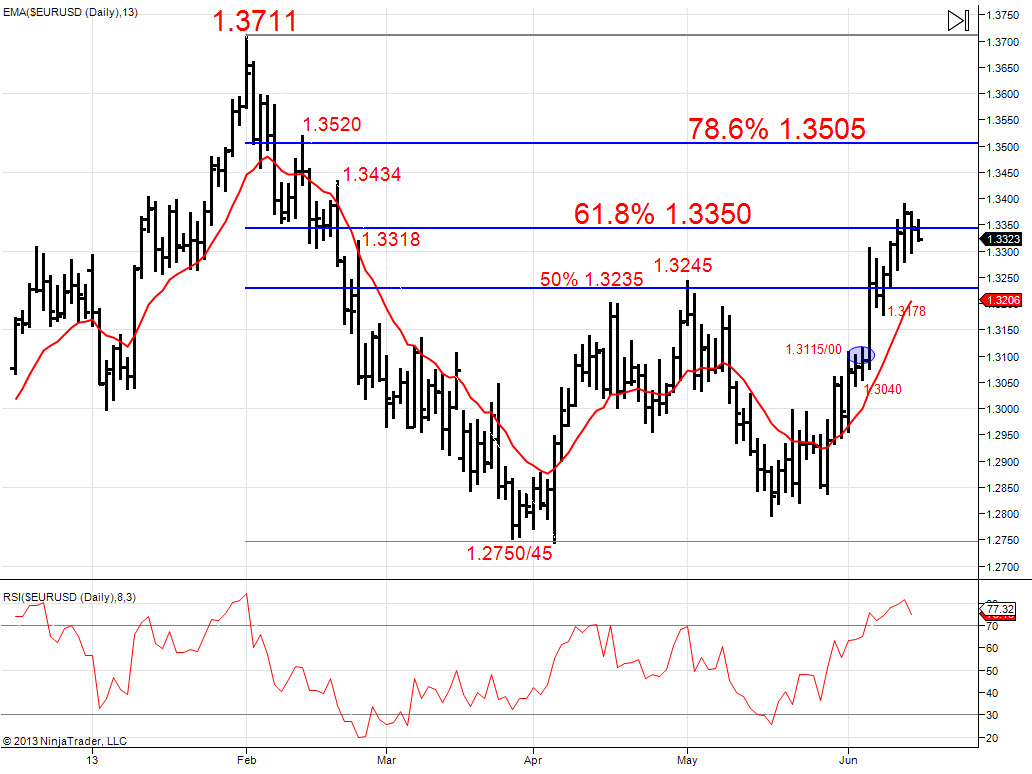

EUR/USD aiming higher this week to 1.3505/20 targets

- A resilient, inside pattern pause Monday after a grind higher through last week as we restate our view “we still see upside risk through mid-month to the area defined by the 78.6% retrace of the Q1 sell off and chart high at 1.3505/20”.

- The re-energizing of bullish pressures last week from modest support at 1.3178/75 through interim chart and retrace resistance factors at 1.3318 and 1.3350 favours further gains this week.

We see a minor target early this week at the 1.3434 failure peak and aim for 1.3505/20 this month.

WHAT CHANGES THIS?

Below 1.3175 eases bull risks; through 1.3040 signals a more neutral tone, only shifting negative below 1.2950/40.

Please download audio-visual analysis here.